![📉 [Dollar Weakness Pauses – But Is the Trend Still Intact?] Bitcoin Maintains Bullish Momentum – Break Above $110,000 C 📉 [Dollar Weakness Pauses – But Is the Trend Still Intact?] Bitcoin Maintains Bullish Momentum – Break Above $110,000 C](https://c.mql5.com/6/971/splash-762538.png)

📉 [Dollar Weakness Pauses – But Is the Trend Still Intact?] Bitcoin Maintains Bullish Momentum – Break Above $110,000 C

📉 [Dollar Weakness Pauses – But Is the Trend Still Intact?]

Bitcoin Maintains Bullish Momentum – Break Above $110,000 Could Accelerate Long-Term Trend

✅ Market Overview | Dollar Weakness Paused by Temporary Rebound, But Softness Resumes

-

USD/JPY fell from the low 144s back to the low 143s.

→ Dollar buying briefly picked up in early Asia after reports that the U.S.–Japan finance meeting made no direct mention of FX levels.

→ However, falling U.S. yields and continued equity weakness revived USD selling. -

Weak demand in the U.S. 20-year bond auction remains a drag on sentiment, fueling persistent “U.S. selling” concerns.

→ U.S. equity futures saw a slight bounce but remain sluggish, keeping the broader risk tone cautious. -

EUR/USD rose as high as 1.1360 before entering a corrective phase, now stable in the low 1.13s.

→ Attention turns to today's Eurozone PMI, where any improvement from the previous release may support the euro. -

EUR/JPY dropped from the 163s to the low 162s, reversing the earlier yen selling triggered by the U.S.–Japan meeting.

-

GBP/USD is holding in the low 1.34s and may firm further alongside EUR strength.

→ A strong UK PMI could pave the way for another test of 1.3450.

📅 Key Economic Indicators & Events (Today)

| Region | Indicator/Event | Notes |

|---|---|---|

| 🇪🇺 Eurozone, Germany, France, UK | Flash PMIs | Focus on both manufacturing and services |

| 🇺🇸 U.S. | Flash Manufacturing & Services PMI (May) | Today’s key event – may bring renewed USD trend momentum |

→ With both European and U.S. PMIs due, markets could see sharp directional movement. Watch for USD-driven trend shifts.

📈 Strategy Points | Thursday, May 22, 2025

| Asset | Strategy | Comment |

|---|---|---|

| USD/JPY | Continue selling rallies | Heavy option barriers at 143.00 (expiring on May 23, 26, 28); key level to watch for a breakdown |

| EUR/USD | Buy on dips | If PMI beats, a move toward 1.14 is possible; market may shift to EUR-led direction |

| GBP/USD | Upside potential | UK PMI surprise could trigger a move to 1.3450; could also follow euro strength |

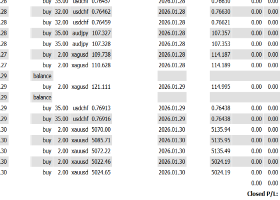

| BTC/USD | Stay long | Breakout above $110,000 marks a new record; buying remains dominant with minimal selling pressure |

| GOLD | Firm tone | USD weakness, Middle East tension, and bond market instability all support demand for safe-haven assets |

📌 Summary

Today is PMI day and a potential turning point for the U.S. dollar trend.

USD/JPY remains heavy above 144 – selling rallies remains effective.

Bitcoin continues its bullish breakout – surpassing $110,000 could mark a major acceleration in its long-term trend.

EUR and GBP could see the next leg higher, depending on today's European data.