+$142,300 in a week. Decreased Likelihood of BoJ Intervention and Focus on April U.S. CPI Release! Latest Trends in USD/

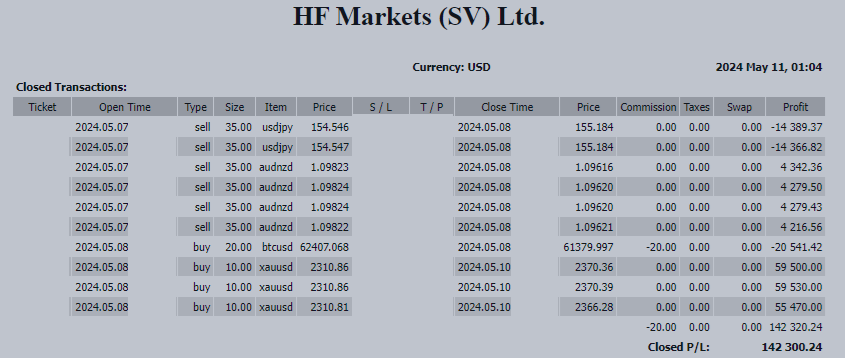

From May 6th to May 10th, my trading resulted in a total gain of +$142,300.

As planned, I went short on USD/JPY, but contrary to the previous week, it unfolded with low volatility and a soft trend, leading to a stop loss.

Treasury Secretary Janet Yellen’s comment that "intervention should be a rare event, limited to cases of excessive volatility and expected to be pre-discussed" stirred the market. This led to speculation that it might become more difficult for the government and the Bank of Japan to intervene than before, triggering renewed selling of the Japanese yen.

However, there remains a cautious sentiment that if the yen rises too much, intervention could still occur, leading to a stagnant state without significant upward movement.

On a brighter note, my position in gold paid off as it reached a technically favorable risk-reward position, allowing me to capitalize effectively.

Looking ahead, the focus is on the U.S. Consumer Price Index (CPI) for April, set to be announced on the 15th. The market's attention may shift more towards the USD movements rather than the yen, especially with the upcoming U.S. economic indicators.

Key points of focus for the future include:

- Focus on U.S. CPI The mood in the market has shifted towards a potential rate cut following last week's U.S. April employment statistics. Whether this expectation will persist is uncertain. Next week, particularly on the 15th, the U.S. April CPI will be closely watched by the market, which could significantly influence the direction of the USD. Also on the 15th, U.S. April retail sales will be announced, and on the 14th, the U.S. April Producer Price Index (PPI) will be released (Source: Reuters). These results could swing the USD in either direction, making it a critical period to follow.

- Surge in Canadian Dollar, Strong Employment Stats The Canadian dollar has surged following stronger-than-expected April employment statistics. The unemployment rate remained stable at 6.1%, below the market expectation of 6.2%. The number of employed increased by 90,400, far exceeding the expected 20,000. The labor participation rate increased from 65.3% to 65.4%. Full-time employment increased by 40,100, and part-time employment also rose by 50,300 (Source: Reuters). The significant deviation between forecasts and results for Canadian employment statistics is notable. I plan to continue with a bullish perspective on the Canadian dollar.