Yen Weakening Continues, Concerns over Middle East Tensions Widespread but Not Extreme Risk Aversion

In the Tokyo market at the beginning of the week, not only the dollar-yen but also the cross-yen pairs are being bought, leading to an overall weakening of the yen. However, tensions persist in the Middle East situation, and the stock market is generally subdued. Within this context, it has been indicated that Iran's attack on Israel was a one-time event, and the key going forward seems to be Israel's response. The US has taken a stance urging restraint from Israel and has expressed no intention to get involved in retaliating against Iran. The stock market is gradually seeing buybacks. US stock futures are trading in positive territory, partially due to the rebound from the significant decline at the end of last week. The Nikkei average has halved its losses.

Regarding the weakening yen, the lack of actual intervention by the government and the Bank of Japan, amidst the retreat of risk aversion, seems to have a significant impact. It is reported that overseas investors are mainly driving the selling of yen. On the other hand, Japanese individual investors are said to be increasing their yen-buying positions. If the yen continues to weaken, there is a risk of increased intervention alertness, as well as the potential for short-term yen-buying positions to accumulate. In any case, if the yen weakens to 153 yen, 154 yen, or 155 yen, the market may show even more volatile movements, so caution is advised.

In the upcoming overseas market, economic indicators such as the New York Fed Manufacturing Index (April), US Retail Sales (March), US Business Inventories (February), US NAHB Housing Market Index (April), Canadian Manufacturing Sales (February), and Canadian Wholesale Sales (February) will be released. The consensus forecast for the much-anticipated US Retail Sales is an increase of +0.4% month-on-month and +0.5% month-on-month excluding autos, both expecting a second consecutive month of rise.

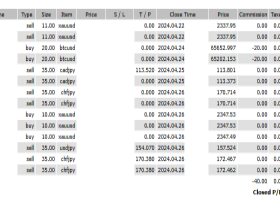

As of now, there have been no further retaliations from Israel, and it is expected to settle. Given the recent selling pressure on cryptocurrencies due to risk aversion, I'm currently entering a buy position on Bitcoin, aiming to capitalize on this rebound. Assuming this situation will be resolved, I plan to continue trading accordingly.