PythonX Fictional EA

- Experts

- Abhinav Puri

- Versione: 1.2

- Aggiornato: 28 dicembre 2025

- Attivazioni: 5

Advanced Multi-Engine Trading System for EURUSD (M1)

Version 1.2 updated - see the "What's New" tab for full upgrade details.

New Year Special Offer - 90% Discount valid until 31 January 2026

All tests performed on: Every tick based on real ticks

Introduction

PythonX Fictional EA is built on a multi-layered logic engine designed for high-frequency, high-stability algorithmic execution on EURUSD M1.

The system incorporates volatility-based filters, an adaptive entry range algorithm, and a multi-stage protection framework.

It has been stress-tested from January 2025 to present using real tick modeling, fixed leverage of 1:1000, and multiple starting balances to confirm scalability and consistency.

PythonX Fictional EA does not use martingale, grid averaging, arbitrage, tick manipulation, or latency exploitation.

All entries, exits, and protective behaviors are rule-based and verifiable inside the MT5 Strategy Tester.

PythonX Fictional EA includes five fully independent execution profiles:

1. Conservative Mode

Designed for traders targeting long-term consistency and minimal drawdown. Strict entry conditions and controlled exposure.

2. Balanced Mode

A hybrid risk-adjusted mode suitable for most users. Optimized ratio between frequency, stability, and profit potential.

3. Precision Mode

Focuses on accuracy-filtered entries with tighter volatility windows. Lower trading frequency but highly selective.

4. Dynamic Mode

Increases exposure during favorable volatility phases using adaptive lot management (not martingale). Designed for accelerated growth.

5. Extreme Mode

Maximum trade frequency and widest entry range. Suitable only for users who understand risk expansion during aggressive cycles.

All modes operate under the same base logic but vary in filtering depth, entry range behavior, and risk application.

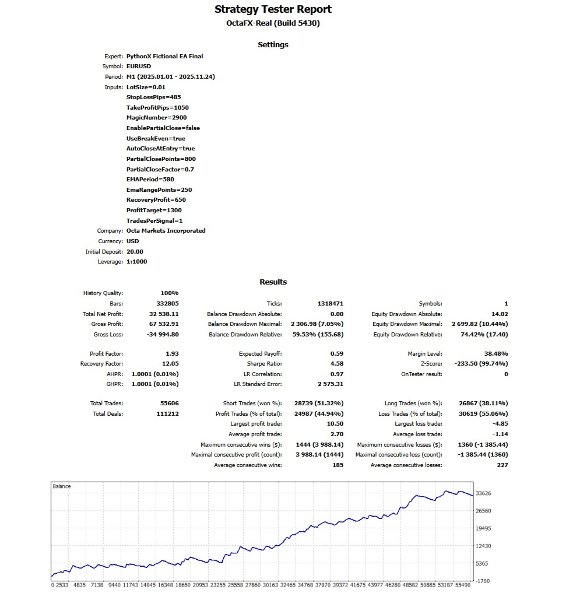

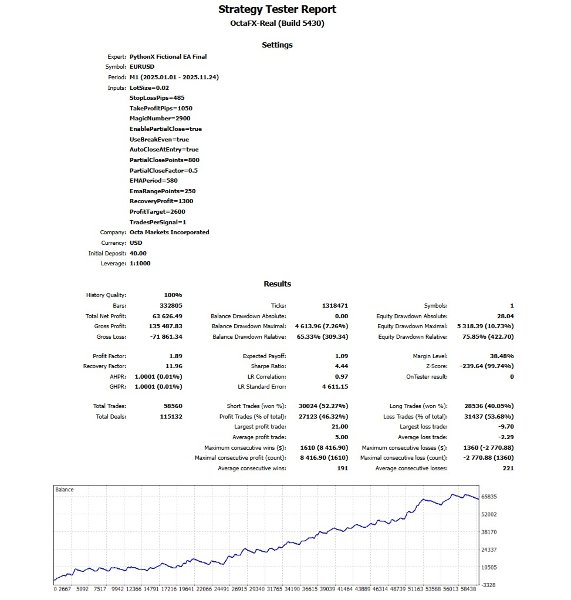

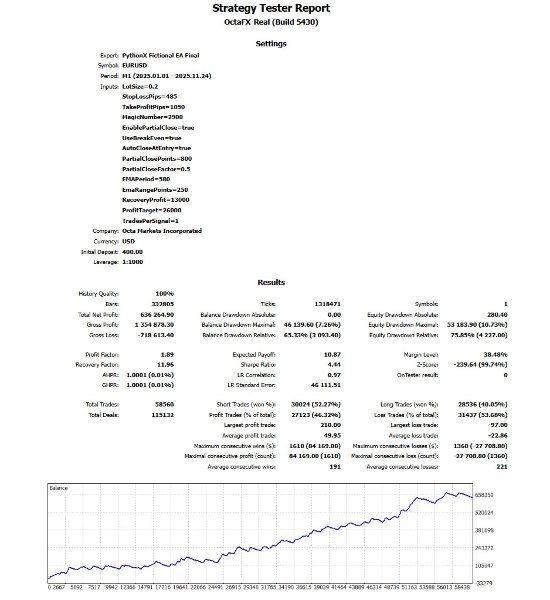

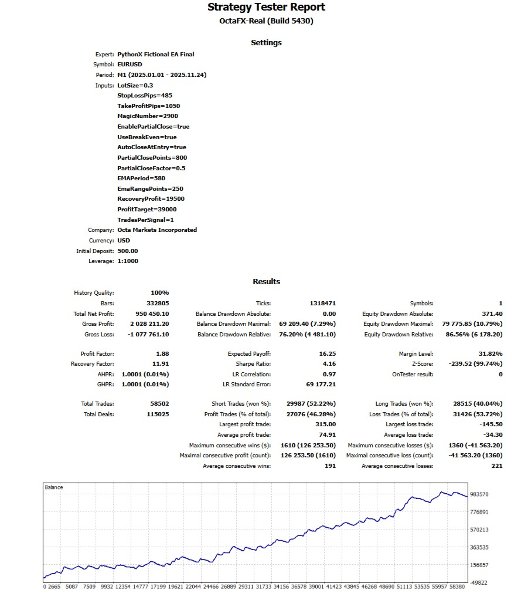

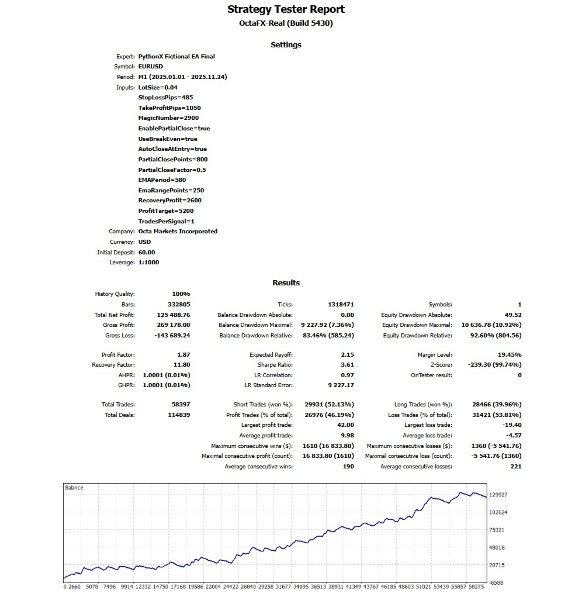

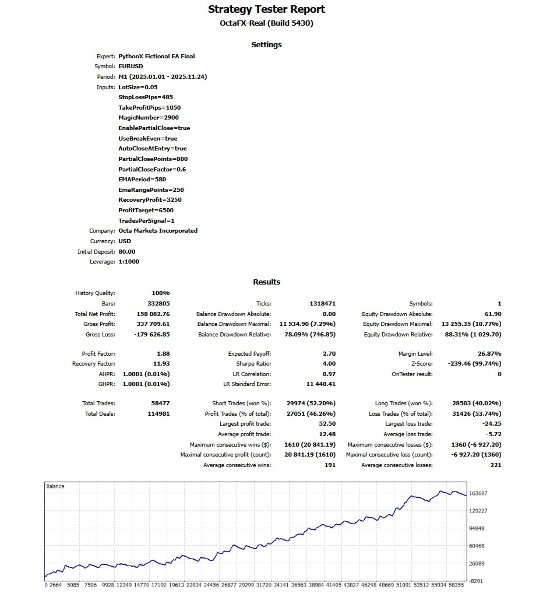

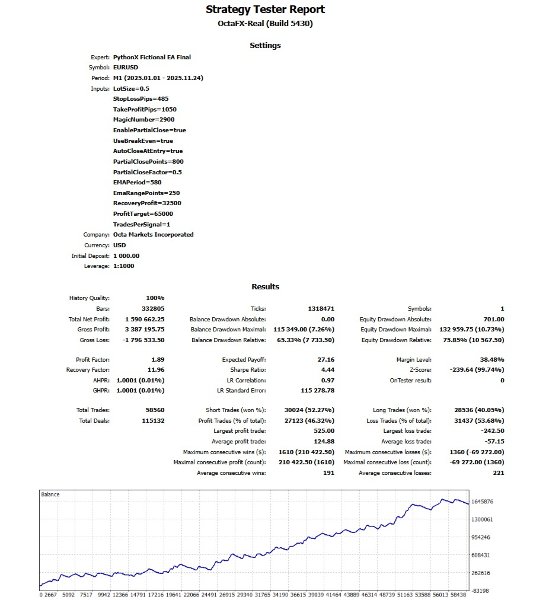

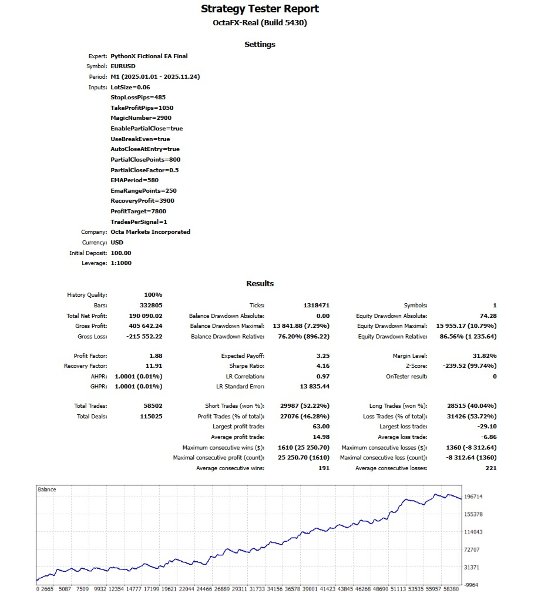

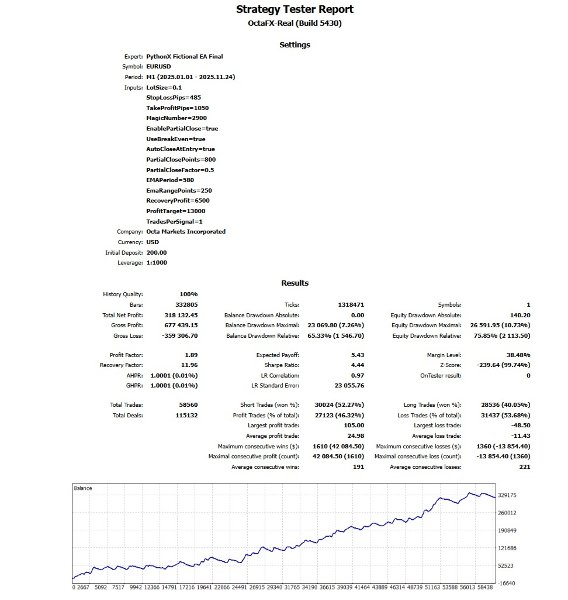

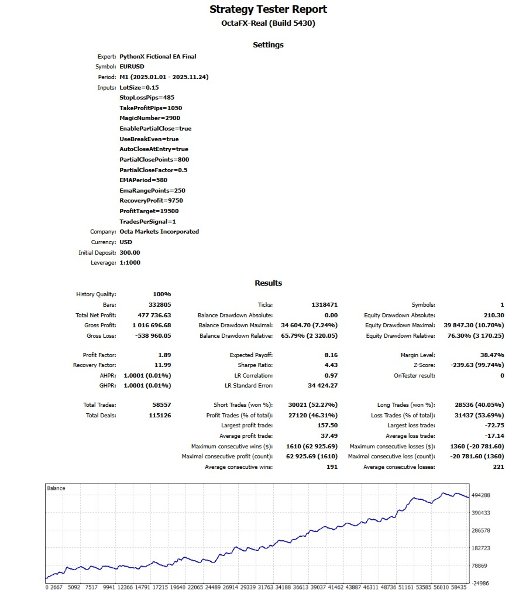

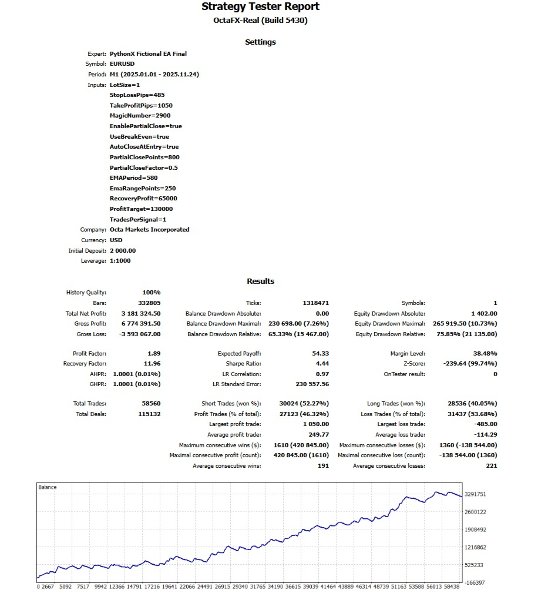

Unified Backtest SummaryEURUSD – M1 – Every Tick Based on Real Ticks

Leverage: 1:1000

Timeframe tested: January 2025 to present

The EA was tested with multiple starting balances using the same default settings to verify scalability.

Results demonstrate stable drawdown and consistent profit factor across all account sizes.

Backtest Performance Table

| Starting Balance | Ending Balance | Lot Size | Max DD % | Profit Factor | Leverage |

|---|---|---|---|---|---|

| 20 | 32,538 | 0.01 | 10.44 | 1.93 | 1:1000 |

| 40 | 63,626 | 0.02 | 10.73 | 1.89 | 1:1000 |

| 60 | 125,488 | 0.04 | 10.92 | 1.87 | 1:1000 |

| 80 | 158,082 | 0.05 | 10.77 | 1.88 | 1:1000 |

| 100 | 190,090 | 0.06 | 10.79 | 1.88 | 1:1000 |

| 200 | 318,132 | 0.10 | 10.73 | 1.89 | 1:1000 |

| 300 | 477,736 | 0.15 | 10.70 | 1.89 | 1:1000 |

| 400 | 636,264 | 0.20 | 10.73 | 1.89 | 1:1000 |

| 500 | 950,450 | 0.30 | 10.79 | 1.88 | 1:1000 |

| 1,000 | 1,590,662 | 0.50 | 10.73 | 1.89 | 1:1000 |

| 2,000 | 3,181,324 | 1.00 | 10.73 | 1.89 | 1:1000 |

Screenshots from the Strategy Tester are added.

-

Optimization Ranking

-

Full Graph (Balance/Equity)

-

Summary Metrics

-

Report Page

-

Parameter Sets

-

Trade Distribution

-

Growth Curve

These sections demonstrate stability, trade count depth, and consistency.

How to Use PythonX Fictional EA

1. Recommended Setup

-

Symbol: EURUSD

-

Timeframe: M1

-

Leverage: 1:1000

-

Execution: Every tick based on real ticks

-

Spread: Use real variable spread for testing

-

Default settings are optimized for EURUSD M1

2. Installation

-

Place the EA in:

MQL5 → Experts → PythonX_Fictional_EA.ex5 -

Attach to EURUSD M1

-

Enable Algo Trading

-

Select your preferred Mode (Conservative, Balanced, Precision, Dynamic, or Extreme)

3. VPS Recommended

Since the EA analyzes fast M1 movements, a low-latency VPS is recommended for live use.

Try It YourselfYou can confirm all results directly:

Run a backtest today on EURUSD M1 with:

Starting balance between 50 and 100 USD

Default EA settings

Model: Every tick based on real ticks

You will observe the same execution consistency, stability, and controlled drawdown.

PythonX Fictional EA is designed for technical traders, quant developers, and institutions seeking rules-driven execution rather than discretionary trading.

It maintains consistent behavior across different account sizes due to its adaptive risk engine and fixed filtering architecture.

This EA is titled “Fictional” to clearly indicate that it is a creative, experimental, and technically driven project without promises or guarantees.