MagZag Beta

- Indicatori

- Conor Mcnamara

- Versione: 1.1

- Aggiornato: 11 maggio 2025

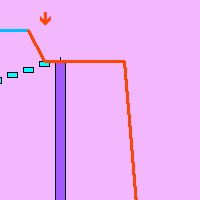

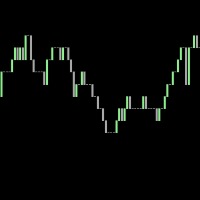

MagZag (Beta) — A Trend-Based Reinvention of the ZigZag

MagZag is a complete remodel of the traditional ZigZag indicator, built on trend-based logic instead of reactive price confirmation.

Unlike a traditional ZigZag that works off of price action and relies on future bars to confirm a swing, MagZag calculates new legs immediately — with no forward correction, no lag, and no repainting. Once a leg is drawn, it's final.

MagZag includes parameters for deviation and backstep, but it does not wait for price action to validate a turning point. It leverages a quantitative trend model based on the slope of a moving average to anticipate direction changes before they happen. This allows new legs to be drawn precisely at the moment a trend change is confirmed — enabling faster and more reliable visualization of market structure.

Key features:

-

No forward correction — all legs are fixed in real time (false signals always still possible with abnormal BoS or news impact)

-

Trend-based logic using moving average slope

-

Forward-stable plotting

-

Deviation and backstep parameters for fine-tuning of local highs and local lows

-

Designed for responsiveness and algorithmic clarity

What makes MagZag different?

-

Zero delay: Legs are drawn in real-time — no waiting for confirmation bars.

-

No repainting in the underlying logic: Once a leg is drawn, it stays.

-

Trend-first logic: The indicator evaluates the moving average slope in advance, so every new bar is prepared to start a new leg immediately if needed.

-

No arbitrary depth settings: Since price action doesn't drive confirmation, there's no need to tweak visual sensitivity parameters.

-

Quantitative over qualitative: Instead of visual swing highs/lows, MagZag focuses on the actual strength and direction of the underlying trend.

Please note: As with any model-driven approach, there are trade-offs. When the moving average period is set too high, the trend may veer away from true local extremums.

Due to the absence of price confirmation, true peaks and bottoms may not always align perfectly with what a traditional zigzag would detect. These are expected and inherent characteristics of a forward-fixed, quantitative design. The idea of no repainting in this indicator is that it does not forward correct like what happens with legs in a traditional zigzag, but false signals can occur on rare occasion, and this results in another kind of repaint.

This is a free beta version for you to test and provide feedback on. Your insights will help shape possible future development. Thank you for your cooperation.

Very accurate indicator.