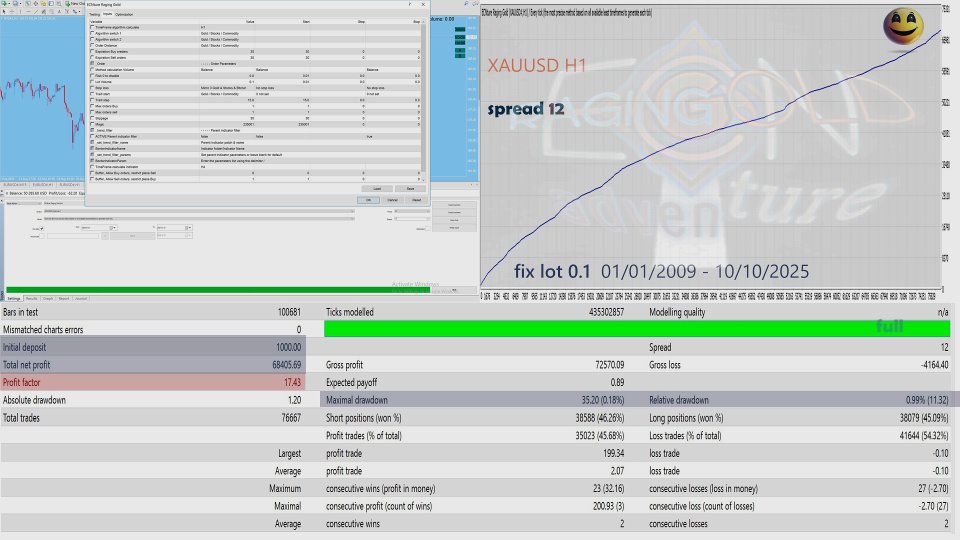

ECNture Raging Gold

- Experts

- Dimitri Nepomniachtchi

- Version: 1.20

- Mise à jour: 21 octobre 2025

- Activations: 10

Gold is a popular trading instrument for traders. It offers accessible conditions for long-term trading and scalping for quick profits.

Read it, don't look between the lines, only then will you understand what kind of monster this is, this is the word I screamed when my keys opened the lock to the world of trade, which shook me up completely and opened many more doors, both in trade and in my career.

The stars of fate led me to create a trading robot for gold. Specifically, gold. It's not just constant testing, research, calculations, and lengthy development. This is a model that has come close to the ideals of stable gold trading over time, relying more on back testing than just a simple back test. The algorithm plays a key role here, proving its effectiveness on: Currencies – EURUSD GBPUSD Stocks – Apple, AMD, Amazon, Boeing, Broadcom, Chevron, Citigroup, Google, Home Depot, IBM, JP Morgan, Nike, NVDA, QUALCOMM, Starbucks, Tesla, U.S. Health (approximately 80% of those tested). Many of these have an average spread lower than the one used for testing.

Bitcoin – Stable, eternal upward growth.

Algorithm calculations for currencies. They were developed about five years ago. Back then, I created a EURUSD trading robot that was backtested from 2009 to 2019, with consistent upward gains but sometimes long stops with a flat balance. I didn't trade it, but I tried it, but didn't continue because I had no patience. Ultimately, my bot remained in the archives while I continued searching for and creating the best I could. Today, the same backtest is being conducted during my absence, the 5-6 years I barely touched it. With an affordable spread and the same parameters. If I had deposited a thousand dollars with a suitable broker back then, I could now be seeing good profits.

I won't bore you with long details; I'd be happy to tell you over a cup of coffee at a seaside café. A good deal always benefits from a face-to-face meeting rather than a digital settlement.

Let's get to the point. What it can do. I'll lay it out in order:

- Stock. The stock strategy tester tests are going well, using real spreads from popular brokers. However, I noticed early on that during the visual test, stop orders were triggered during gaps, when stock trading is closed. Before abandoning stocks, I googled "24/7 stock trading" and found two brokers that offer this option, not 24/7, but 22 hours a day or 24 hours a day, including weekends. These are brokers that support MT4. I haven't yet set up such trading myself. With this bot, you'll have the opportunity to test it yourself, try demo trading, and perhaps even find your own luck trading stocks. The bot can also generate entry and exit signals for stocks, which is very popular among stock trading enthusiasts who don't understand the subject themselves.

- Currency. My new parameters pass the EURUSD/GBPUSD test with good growth, again proving the algorithm's versatility, but a spread of 2x without commissions is unrealistic. I'm keeping my old EURUSD settings in the bot, which were tested about 5-6 years ago (since 2009), along with several new modifications. However, according to tests, there may be a lull in growth. Risk trading is unlikely to wipe out the deposit, but you should be prepared to wait. Ideally, start the account and leave it for two years or more. By the way, even with gold, a long test can see a drawdown of about a month from the last peak of growth, but the lower the commissions and spreads, the less losses and faster the growth.

- Coffee. Good growth, but the spread won't allow it. If you have a spread of up to 10, please let me know.

- Cryptocurrencies. I'm almost disappointed that the tests aren't suitable for Bitcoin. After just one hour away from the beautiful tests, I multiplied the gold parameters by 100. The algorithm, pending order, and profit were slightly higher. Stop loss was set to the minimum, and with a spread of 1500, the profit line shot up (in the strategy tester). With a spread of 3000, losses begin to increase, but the return is still astounding. There's a broker on the market with a spread of 1500-1650 that occasionally goes higher, but it requires a very large deposit to get started. It might work, it might not.

- Gold. Impressive tests. Taking into account the broker's real-world conditions. Since he's already actively trading on demo, my previous reasoning is no longer relevant. I can't wait to test it on a real account; it requires a fairly large deposit. It clearly matches the strategy tester results. I ran it on two demos. On the first, with standard conditions, there was growth, but it's clear how profits are being swallowed up by large commissions. With a better broker, there are no such obstacles; there's rapid and confident upward growth. I almost forgot. It works on GOLD or XAUUSD instruments with two decimal places. For three-digit accounts, I'll add a setting with a ratio of 1 to 10 later. If you need it urgently, please contact me.

Common to all

Micro trades are processed here and closed almost instantly. A stop order can wait for a full day. But no, we're not the kind of bot that opens dozens of micro trades that could freeze the terminal. Personally, I sometimes experience freezes, as I have about ten terminals running at once. When a freeze occurs, it's best not to click anything in the trading terminal; order processing occurs in the background and will eventually return to normal operation.

Saving on swaps. Probably 97%+ of orders won't be carried over to the next day. At least for gold.

Drawdown, according to tests, very good results remain with a drawdown of about 10-20%.

A general calculation algorithm that can be used for a whole group of trading instruments using the same parameters.

Monitoring >>>

>> Demo account With high success right from the start. From a real, large, regulated broker. The demo emulates a real trading account for large traders. Price changes are identical between the demo and real accounts. I haven't launched it on a real account yet. Active gold trading with a fixed lot size of 0.05 and 0.1 using two parameters. You can add Ctrl+D to your favorites to follow trading developments.

Video

The video shows how to launch the robot, test results for gold and stocks and also bitcoin. Proving the algorithm's flexibility using one set of calculations.

I recommend setting it to good quality, the button is at the bottom right.

Launch and testing

In the robot, I've created separate algorithm and trading parameters by category: currencies, cryptocurrencies, stocks, gold. Choose one of the desired options from all the options and conduct your first back test, preferably with high-quality simulation. Start with a minimum spread, then with your broker's spreads. If they are high, there are brokers with affordable spreads. Especially for large deposits, the commission may be lower and the spreads smaller.

The settings have been simplified. You can change parameters using drop-down menus. Watch the video; you can see how to launch the strategy on gold (XAUUSD) right from the start. Other parameters are named according to trading instruments. You can test them out.

Real trading

You can start at any time, but managing the risks of your funds remains your responsibility. Jumping straight into a real account with the same risk lot as in the tests isn't the smartest move.

Strategy tester -> Select a broker -> demo -> Real account with a minimum fixed lot and only then free trading.

News

Stay tuned or contact us to stay updated on the progress.