Volatility 75 Trend

- Indicateurs

- Ignacio Agustin Mene Franco

- Version: 1.10

- Activations: 10

Volatility 75 Trend - Specialized Technical Indicator

Overview

The Volatility 75 Trend is an advanced technical indicator designed specifically for trading synthetic indices, particularly the Volatility 75 (V75). This indicator combines multiple technical analysis tools to provide accurate trend signals and timely alerts in highly volatile markets.

Key Features

1. Adaptive Trend Algorithm

Uses the Average True Range (ATR) as a basis for calculating dynamic support and resistance levels

Implements a configurable ATR multiplier (2.0 recommended for V75)

Generates trend lines that automatically adapt to market volatility

2. Multi-Criteria Signal System

The indicator offers three signal generation methods:

RSI (Relative Strength Index): Based on price momentum

MFI (Money Flow Index): Incorporates volume analysis

Combined (RSI + MFI): Requires confirmation of both indicators for greater accuracy

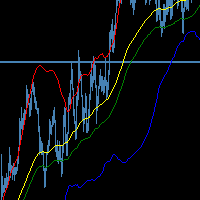

3. Advanced Visualization

Dynamic Fill: Colored area between the main trend line and a shifted line

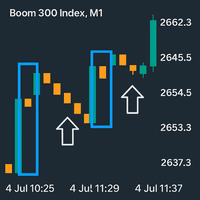

Visual Signals: Green arrows for buy (↑) and red arrows for sell (↓)

Smart Positioning: Signals are automatically placed above/below the candles

4. Integrated Alert System

Alerts Real-time pop-up

Optional push notifications

Duplicate control to avoid repetitive alerts

Informative messages with symbol and timestamp

Technical Parameters

Main Configuration

Calculation Period: 14 (customizable)

ATR Multiplier: 2.0 (optimized for V75)

Applied Price: Configurable (Close, Open, High, Low, etc.)

Signal Levels

RSI: Neutral level 50.0

MFI: Neutral level 50.0

Logic: Values above the level generate a bullish condition

Calculation Methodology

1. Trend Calculation

UpTrend = Low - (ATR × Multiplier)

DownTrend = High + (ATR × Multiplier)

2. Direction Determination

Bullish Condition: RSI/MFI above the configured level

Bearish Condition: RSI/MFI below the configured level

Signal Filter Continuity: Maintains the trend until a change is confirmed

3. Signal Generation

Buy: When the trend changes from bearish to bullish

Sell: When the trend changes from bullish to bearish

Confirmation: Bar counting system to validate signals

Recommended Applications

Target Markets

Primary: Volatility 75 Index

Secondary: Other high-volatility synthetic indices

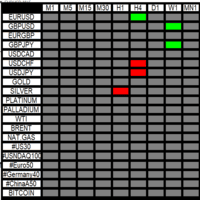

Timeframes: All timeframes (optimized for M1, M5, M15)

Trading Strategies

Trend Following: Trade in the direction of major signals

Reversal: Use signals as contrarian entry points

Confirmation: Combine with other indicators for additional validation

Competitive Advantages

1. Specialization

Designed specifically for synthetic markets

Parameters optimized for V75

Takes into account the unique characteristics of synthetic volatility

2. Flexibility

Multiple trading methods Signal

Fully configurable parameters

Customizable alert system

3. Robustness

Intelligent handling of missing data

Input parameter validation

Optimized resource release system

4. User Experience

Clear and intuitive visual interface

Simplified group configuration

Integrated documentation for parameters

Conclusion

Volatility 75 Trend represents an advanced technical solution for traders operating in high-volatility synthetic markets. Its multi-criteria approach, combined with an intuitive visual interface and a robust alert system, makes it a valuable tool for identifying trading opportunities in the dynamic V75 environment.