Rejoignez notre page de fans

- Vues:

- 5101

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

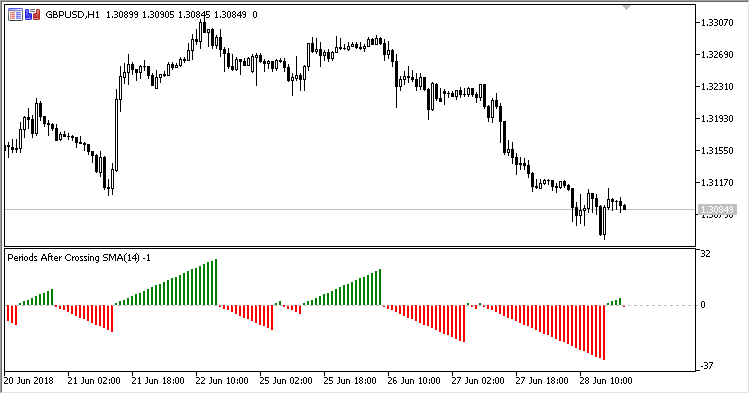

PAC (Periods After Crossing MA) is an oscillator displaying the number of bars elapsed after the last crossing of the price and the moving average.

If the moving average crossed the price upwards, then the positive histogram columns are drawn in green; if the last crossing was downwards, the negative columns are drawn in red.

The indicator has three configurable parameters:

- Period - MA period;

- Method - MA calculation method;

- Applied price - MA calculation price and crossing price.

Calculations:

-

If Price > MA and PrevPrice > PrevMA:

PAC = PrevPAC + 1

-

If Price < MA and PrevPrice < PrevMA:

PAC = PrevPAC - 1

-

If Price > MA:

PAC = 1

-

If Price < MA:

PAC = -1

where:

Price - SMA(Applied price, 1) MA - MA(Applied price, Period, Method)

Fig 1. By default, SMA(Close,14)

Fig 1. In the price chart, the SMA(Close,14)

Traduit du russe par MetaQuotes Ltd.

Code original : https://www.mql5.com/ru/code/21264

DMI_Difference

DMI_Difference

Indicator showing the difference between the +DI and -DI of indicator ADX.

BuffAverage

BuffAverage

Buff Dormeier's moving average weighted by volume.

RP

RP

Indicator RP (Range Position) displays the price position within the range (from Low to High) reached over the previous N periods.

Self_Adjusting_RSI

Self_Adjusting_RSI

In pscillator Self-Adjusting RSI, we have implemented the methods of automated adjusting the RSI oscillator overbought/oversold levels, described in David Sepiashvili's article The Self-Adjusting RSI.