Rejoignez notre page de fans

- Vues:

- 19479

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

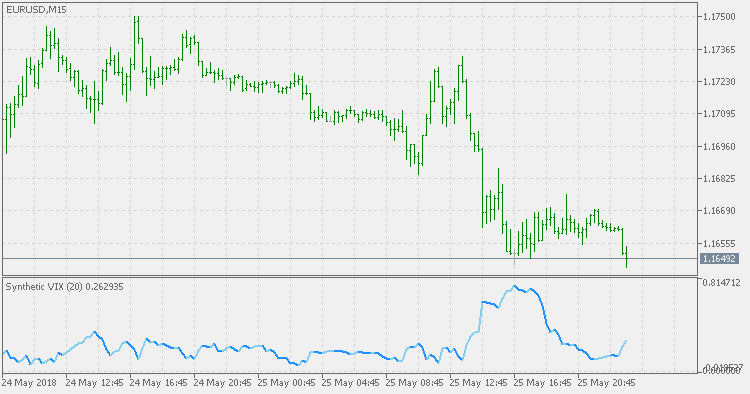

The Synthetic VIX indicator is based on Larry Williams' TASC article "Fix the VIX":

When it comes to describing what markets do, Bernard Baruch said it best: "Markets fluctuate."

That idea is embodied in the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), which has become a very popular measure of market risk since it was introduced in 1993. The VIX, which is derived from the implied volatility of stock index options, is intended to represent traders' expectations of volatility over the next 30 days.

Essentially, the VIX reflects investor fear — high readings are associated with high-volatility conditions (and market bottoms) while low readings are associated with low-volatility conditions (and market tops).

Unfortunately, the VIX is calculated only for the S&P 500 Index, NASDAQ Composite Index, and the Dow Jones Industrial Average. What about other markets?

Luckily, it is easy to duplicate the VIX for any market — Treasury bonds, gold, silver, soybeans, even individual stocks — with a simple formula.

....

PS: Synthetic VIX is not a directional indicator. It indicates the increase or decrease of volatility and it should be used as that.

BB Stops - EMA Deviation

BB Stops - EMA Deviation

This version of BB Stops changes uses EMA deviation for calculation.

Bollinger Bands - EMA Deviation

Bollinger Bands - EMA Deviation

This version of Bollinger Bands does not use standard deviation for Upper and Lower Bands, but uses the EMA deviation.

EMA Deviation

EMA Deviation

EMA Deviation is similar to Standard Deviation, but on a first glance you shall notice that it is "faster" than the Standard Deviation and that makes it useful when the speed of reaction to volatility is expected from any code or trading system.

End Point MA

End Point MA

End Point MA indicator uses the original formula described in the "The End Point Moving Average" article with one deviation: it is made to be "faster" (i.e., to react to market changes in a faster mode than the original version).