Evgeniy Scherbina / Perfil

- Información

|

12+ años

experiencia

|

33

productos

|

592

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

The 6 major symbols are currently at 0 profit with the default settings. However, they are winning for both Filter=ATR and Filter=None (though UsdChf drags down performance for ATR, and EurUsd does the same for None - but the overall profit sum remains positive).

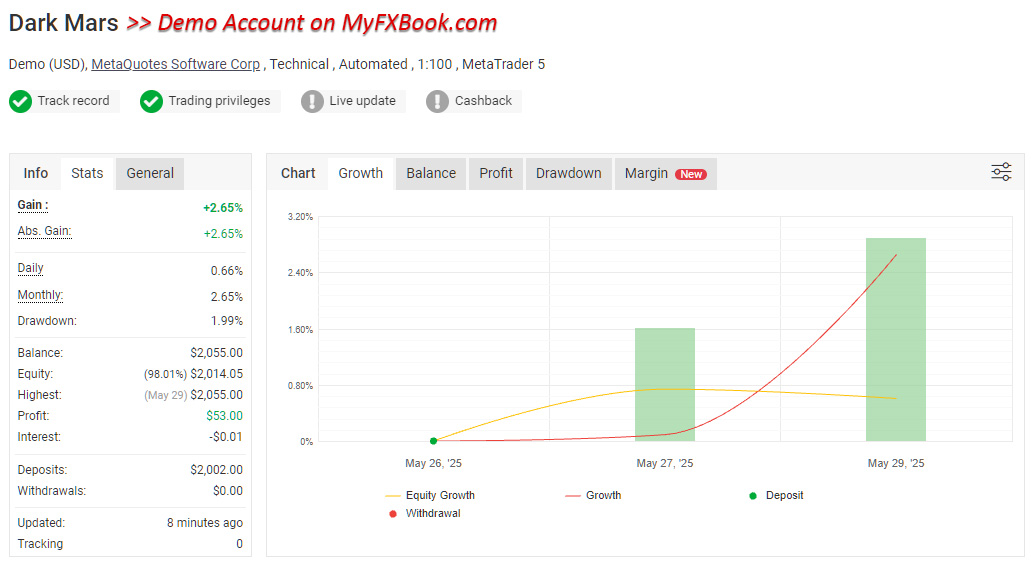

The EA isn’t showing profitability on my Myfxbook demo signal because my server wasn’t fit for the task. All my other strategies are daily, so occasional connection losses weren’t an issue. However, "Dark Mars" is an hourly strategy, meaning it missed many profitable exits due to disconnections. I’ll need to switch to a more reliable server for this EA.

Now, here’s the interesting part! I’ve long suspected that a technical scalper system could deliver outstanding results on cross-pairs - and yes, that’s true! You can test it on "real ticks" and "profit in pips for faster calculations" (it may not calculate profit at all without this flag set). Filter=ATR or Filter=None for cross symbols. It shows amazing results for AudCad, AudNzd, GbpChf, and NzdCad. I haven’t checked larger target values for potentially higher profits. The drawdown is close to 0.

Must try a new server on cross symbols!

Cheers! Stay tuned!

I testing "Dark Mars" with GBPUSD with 5M timeframe and 1H for ATR filter, LSTM for the trend, I'm using ICMarket demo-server with VPS server. Will share the results with you.

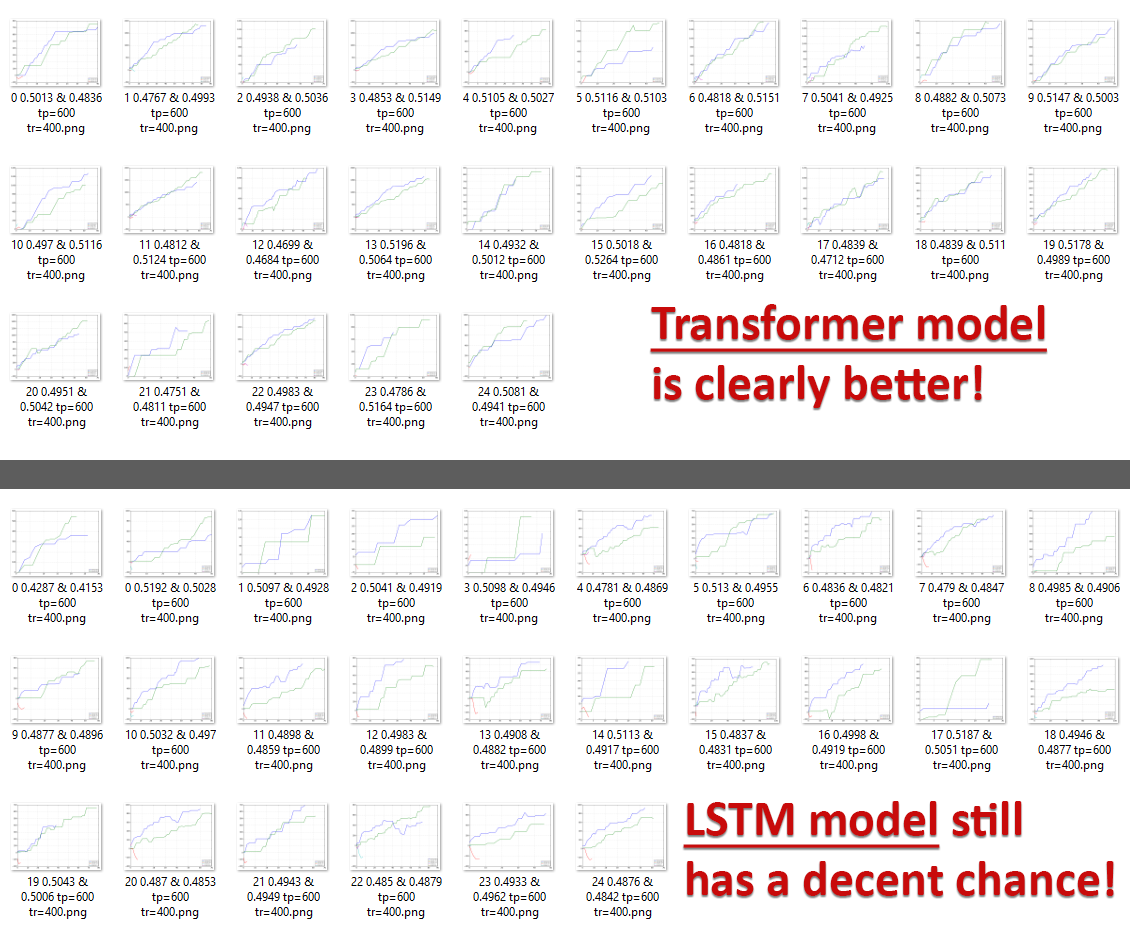

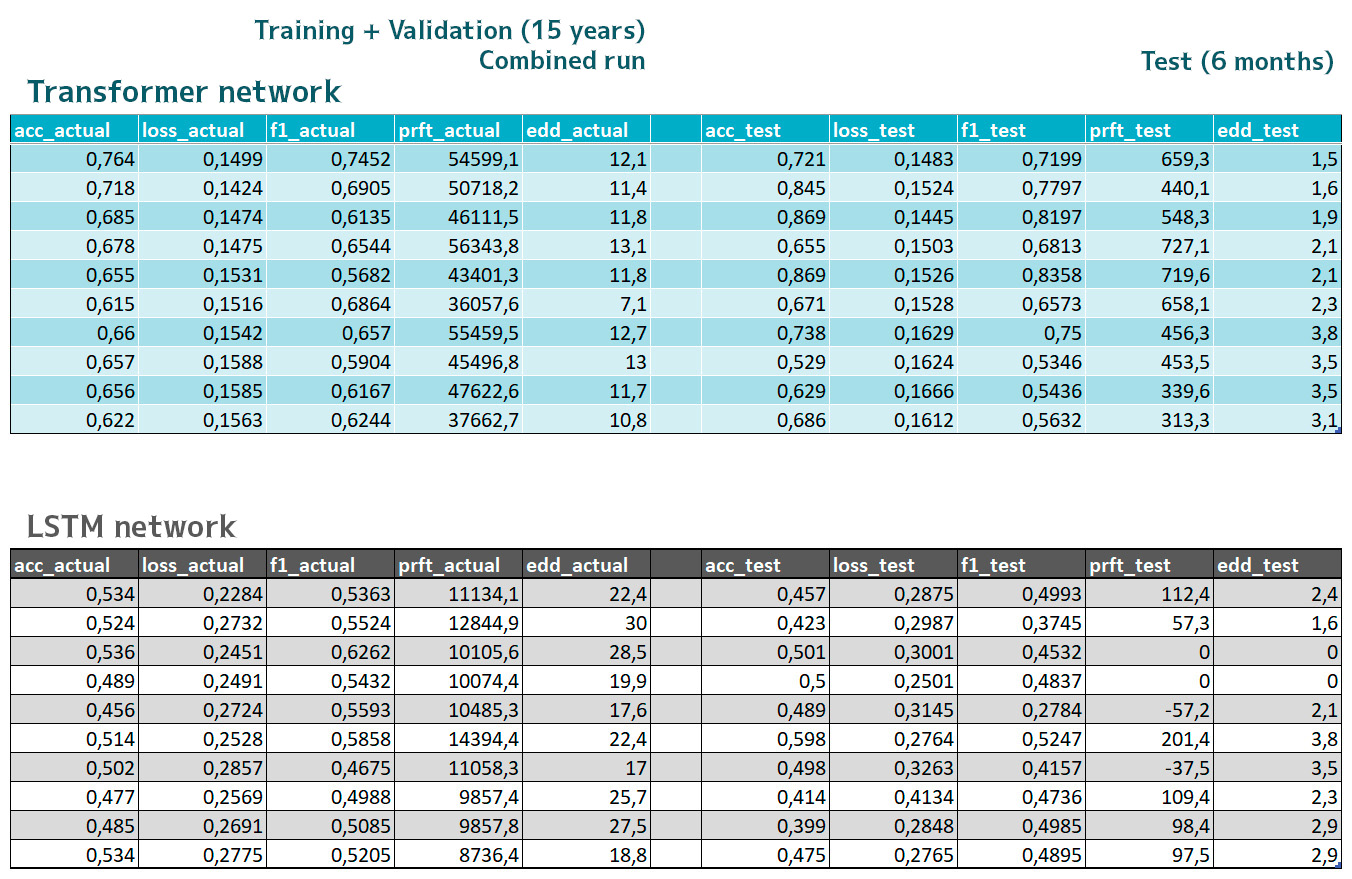

1/ Longer Context: Transformers digest more price bars, spotting trends LSTMs miss.

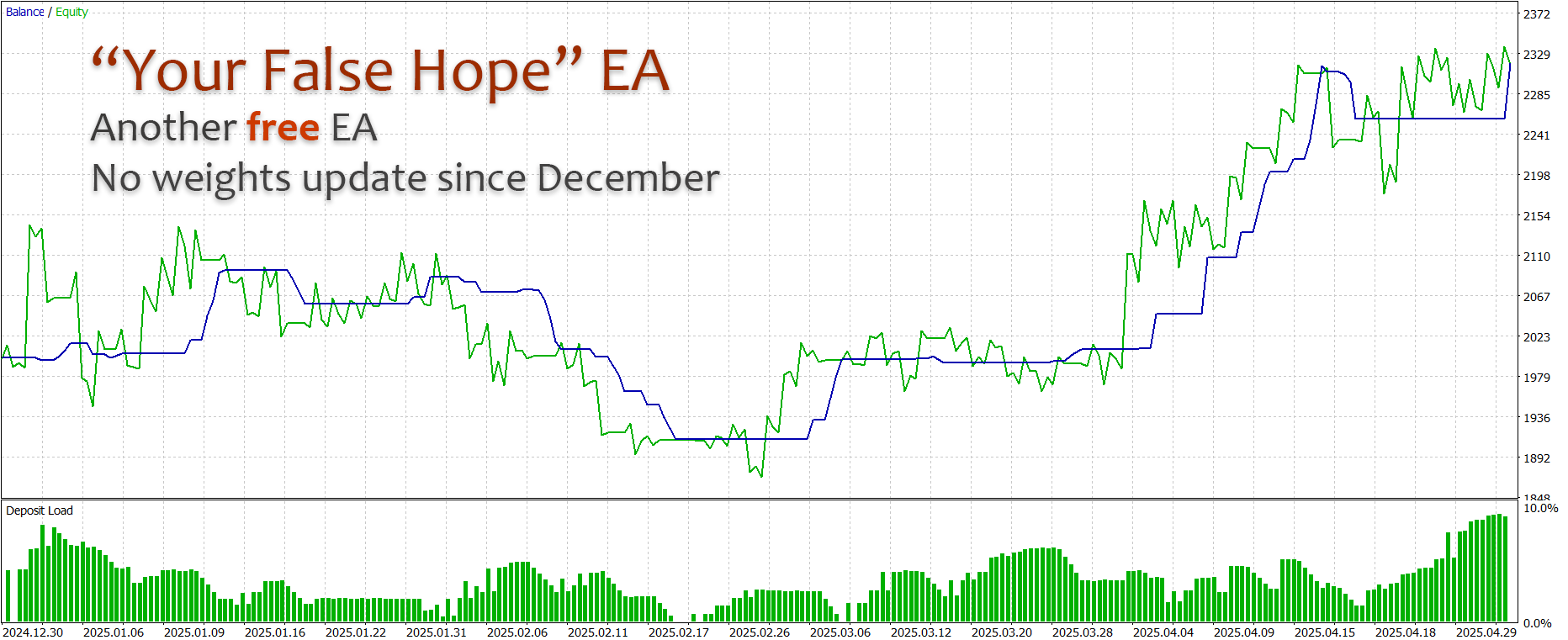

2/ Cleaner Growth: The attached image shows transformer passes (small pics) trending up steadily; LSTMs jump around.

3/ Efficiency Wins: We don’t need many passes—just one solid one. LSTMs can deliver, but transformers do it more reliably.

4/ Key Insight: My "2 numbers" method (forecast + its accuracy score) cuts noise. Transformers leverage both best.

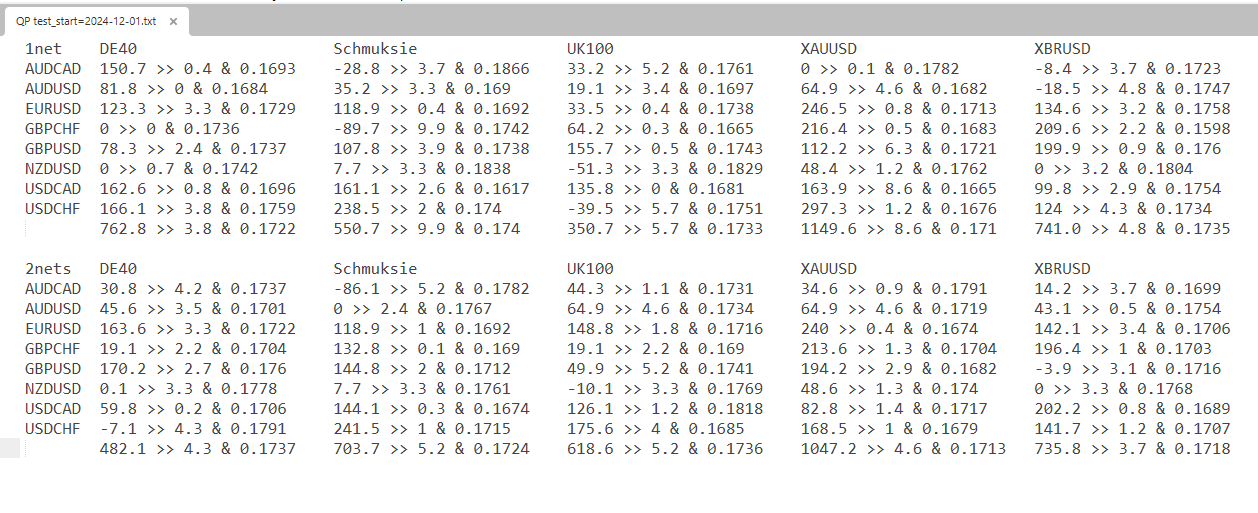

I’m attaching a complete test for Dec 2024 – April 2025 (1net + 2nets) that shows this approach is very viable. Historical curves fluctuate but grow steadily. And the best pass - selected by its F1 metric - always makes the sum for the symbols heavily profitable. I’m going to publish this version very soon, and then I’ll update the transformer-based EAs with this approach, too. Cheers, stay tuned!

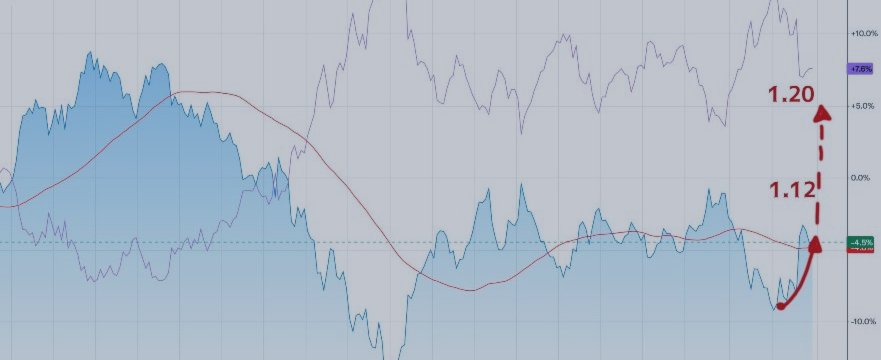

Markets in the Madness: Tariffs, Trophies, and Triple Tops

Meet Dark Mars—an aggressive scalper that lives on the edge:

⚡ Trades H1 charts but sneaks peeks at D1 trends for extra conviction

⚡ Pulls trades like a machine—stacking positions to average in/out

⚡ Pure scalper mentality: "Grab tiny wins, repeat, survive"

The Raw Truth:

✅ Hyper-active – It trades a lot (you wanted action? Here it is)

✅ Self-healing – Cuts losses by doubling down (high risk, high drama)

✅ Small bites only – Don’t expect home runs; this is a micro-profit grind

Ideal for: Traders who want non-stop adrenaline and trust the math of volume > windfalls.

⚠️ Warning: Not for the faint-hearted. Drawdowns can get spicy before the rebound.

The Gold Chaser EA 3.0 is finally here—smarter, stronger, and packed with upgrades:

✅ Cutting-edge Transformer AI (yes, the tech behind ChatGPT!) for sharper predictions

✅ Dual-network power—1net and 2nets working together to crush market noise

✅ New indices! Trade US30 and US500—more opportunities, same killer logic

✅ Bitcoin just got safer (though stay sharp—it’s still crypto, so expect livelier swings!)

The best part? The system’s built to adapt and recover, no matter what the markets throw at it.

🔥 Ready to test the future? Grab v3.0 now!

Gold Chaser: May-June

QuantumPip and LuminaFX: June

Atari: June-July

It takes a while to make new tests and find better configurations. So stay tuned, profits will be ours!

El Dark Mars Expert Advisor está listo para el comercio totalmente automatizado con varios símbolos. El Dark Mars EA es un scalper que he probado en el M5, M15, M30, y H1 marcos de tiempo. El EA abre operaciones en rupturas o retrocesos basados en el indicador de Bandas de Bollinger. El EA está listo para operar de inmediato con la configuración por defecto - no se necesita optimización para GBPUSD y USDCAD. Una ventaja bien conocida de los scalpers es el alto número de operaciones ejecutadas

El EA "Latte" está preparado para operar con varios símbolos en el modo totalmente automatizado desde 1 gráfico. El EA utiliza una red neuronal "Transformer" para predecir los movimientos de los precios. La principal ventaja del Transformer sobre una red LSTM es su capacidad para encontrar patrones incluso a través de secuencias muy largas de datos. Mientras que las LSTM suelen perder información cuando tratan secuencias de más de 2 o 3 meses, las Transformer manejan secuencias de hasta un año

The Transformer architecture was first introduced by Google in 2017 for language translation tasks. Since then, this type of neural network has been widely adopted for building artificial intelligence systems, including ChatGPT. The key difference with the Transformer is that it encodes each input into a high-dimensional space (tens of thousands of dimensions), allowing it to capture complex relationships between all elements in the sequence. This approach sparked a revolution in machine learning, initially discussed only among experts, but later driving major advances as AI became more mainstream. As a result, Transformer models have increasingly replaced LSTMs in many fields, including financial market forecasting.

What impressed me the most is that the Transformer is able to continue learning even when the validation data differs from the training data. In my experience, LSTM networks often require the validation set to contain similar patterns to the training set in order to make further progress. When the validation examples are too different, LSTM training does not move at all. The Transformer, however, generalizes much better and continues to improve even on unfamiliar validation data. My tests show that the Transformer significantly outperforms LSTM in binary classification tasks.

1. A control of spread instead of "time open" and "time close" properties. Spreads tend to widen over midnight, and when spreads become usual again, trading resumes.

2. A new "Close all" function. It is now one property - "Close all profit (%)" - which triggers for all trades at any time when the value is reached. The historical chart may now look more straight-lined due to this. Trades can be reopened the next day, so after this function triggers, new trades will be opened only next week.

3. The "Max trades per signal" property changed, and now it count all trades for one symbol.

Plus some other minor impovements!