Evgeniy Scherbina / Perfil

- Información

|

12+ años

experiencia

|

33

productos

|

592

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

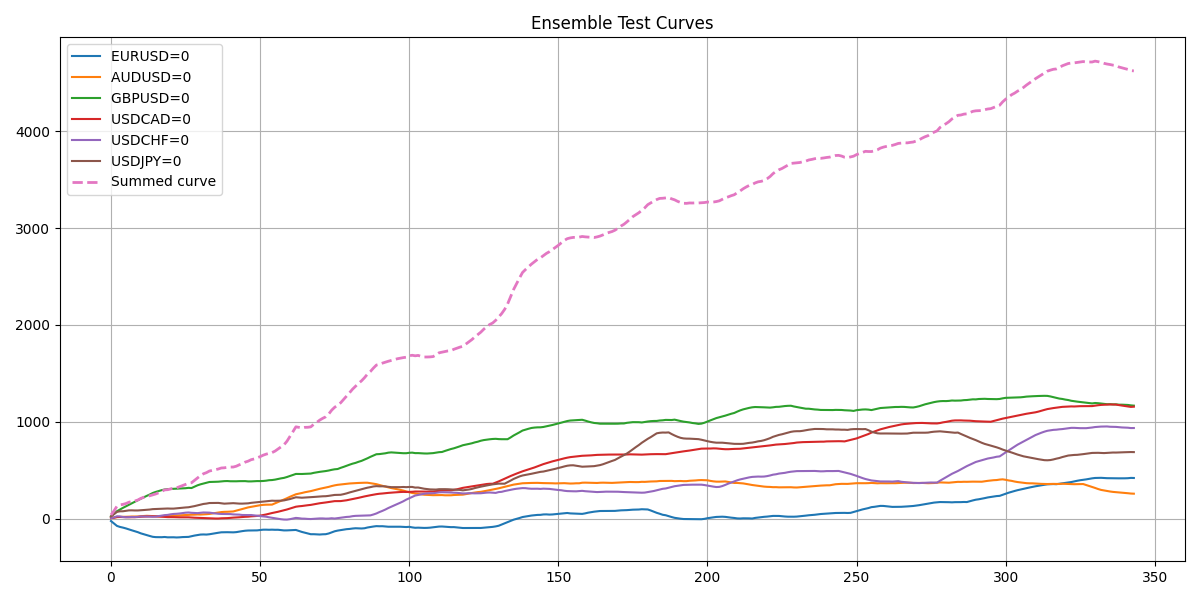

I'm excited to share my best-performing model to date: the LSTM+TCN ensemble. It has achieved the highest returns yet in a rigorous out-of-sample test (Aug-Sep 2025 period, starting balance: $1,000). See the equity curve below.

What changed? I moved away from simplified "maximum exposure" backtesting to a realistic trading simulation. This methodological shift was the game-changer.

I must also highlight the standalone power of a 12-model Transformer ensemble. Yet, the quest to successfully hybridize it with the LSTM+TCN core continues.

In short: the current LSTM+TCN architecture has proven its high effectiveness. An upgraded version will be implemented in the trading advisors shortly.

Its robust performance is driven by an ensemble of 12 models of the same class, significantly aided by frequent signal changes. I have now devised a way to improve this ensemble variant further by adding a second timeframe. The primary one is H6, and I am adding H8 this weekend.

I know the rule: if it works well, don't touch it. However, all tests indicate the "LSTM Ensemble" can perform even better with two timeframes simultaneously.

This weekend, I will also update another advisor, the "Edge Ensemble," to include two timeframes alongside its three model classes. Furthermore, advisors for trading Gold and Bitcoin are next in line.

So far, a fixed profit of 4.5% has been recorded, and the current equity is above the balance by the same amount. This early performance already allows for some preliminary conclusions.

It appears that competition between models of the same class, when combined into a single ensemble, may provide tangible advantages. Building an ensemble from models of one class seems to be more predictable and easier to stabilize at early stages.

In contrast, an ensemble that combines models from three different classes clearly requires more extensive testing and longer validation. However, this does not mean that such an approach is inferior. The "Edge Ensemble" EA is also operating in positive territory and remains profitable. It is possible that the "Edge Ensemble" is designed to wait for larger, more significant market movements rather than reacting to smaller fluctuations.

In any case, ensemble-based trading systems are still a very new concept in retail algorithmic trading.

At the moment, no one except me is selling EAs based on neural model ensembles, which is why the price is still relatively low — but I am confident this will change very soon.

An ensemble approach means combining multiple neural network models instead of relying on just one 🔗.

Right now, I’m the only developer actually selling a true neural ensemble in trading — and that makes a real difference 🚀.

Currently available:

“LSTM Ensemble” — combines 12 LSTM models

“Edge Ensemble” — combines 12 models of two different types: LSTM and TCN

Each model is trained on different folds of the data, so they learn different market behaviors instead of repeating the same mistakes 🎯.

I’m currently working with LSTM, TCN, and Transformer models, each representing a different class of memory and pattern recognition 🧩. TCN and especially Transformer are mathematically complex models, and that complexity allows them to capture structures that simpler models may miss 🧮.

Because each model “remembers” the market differently, the ensemble becomes more stable, adaptive, and resilient over time 🛡️.

Below, you can see a chart showing how this ensemble performs on a true out-of-sample test period, far beyond the training data 📈.

Selecting the winning model within its own fold is a critical step — this diversity is the real power behind the ensemble ⚡. The result is honestly stunning, unlike anything I’ve seen before ✨.

And yes — strategies of this class, powered by neural ensembles, are available only here 🔥.

Edge Ensemble es un asesor de trading profesional construido sobre un conjunto de 12 redes neuronales independientes de dos arquitecturas diferentes: LSTM y TCN. Cada red del conjunto actúa como una estrategia de negociación independiente, mientras que la señal de negociación final se forma a partir de la decisión colectiva de todo el conjunto de modelos. En lugar de buscar un único modelo universal entrenado mediante el esquema clásico 80/20, Edge Ensemble emplea un conjunto específicamente

When you train on 15 years of data, the most recent 3 years are thrown away ❌ and never used for learning.

Even worse, those final years cannot represent the full diversity of market behavior that came before them 📉📈.

A far more robust solution is to use historical folds 🧩, where each period trains its own dedicated model.

Instead of one fragile model trying to learn everything, I found a solution in an ENSEMBLE ARCHITECTURE, where each model specializes in its own market regime 🔍.

This approach mirrors how real markets work: they evolve, rotate, and repeat — but never stay the same 🔄.

By combining proven architectures like LSTM 🧠, known for their stability, with modern innovations like Temporal Convolutional Networks (TCN) ⚡, a true breakthrough in time-series forecasting emerges.

TCN is rapidly becoming a new standard for sequential data, including complex financial markets 💹, and its synergy with LSTM is remarkably powerful 🤝.

Today, there is not a single marketplace strategy built on a true 12-model ensemble 🚀.

This is not a cosmetic improvement — it is A FUNDAMENTAL SHIFT in how trading systems are designed and validated 🛠️.

What is most striking in technical testing is the consistency 📊: even with extremely aggressive settings where the history is almost memorized, the strategy still manages to push the equity curve upward on completely unseen data 📈✨.

That level of robustness is not an accident — it is the direct result of THE ENSEMBLE PHILOSOPHY 🎯.

Over the next year, I plan to release several more strategies, all based on this ensemble-driven approach 🧪.

Let’s test a new way of trading together — one that finally respects market history instead of discarding it 🤖💡.

Wishing you a profitable year ahead, steady growth, and confident trading decisions in the Forex market.

To celebrate the holiday season, I’m offering 35% discounts on my selected best products:

LSTM Ensemble — new price $210 USD

Chanlun Master — new price $210 USD

May the new year bring strong trends, clean signals, and plenty of profits.

Trade smart, manage risk, and let the market work in your favor.

LSTM Ensemble es un experto en negociación profesional basado en un conjunto de 12 modelos LSTM independientes, cada uno de los cuales representa una estrategia de negociación distinta. En lugar de un único modelo "ideal" entrenado según el esquema clásico 80/20, el experto utiliza un enfoque de decisión colectiva, en el que la señal de negociación final se forma a partir del consenso de múltiples redes neuronales. Idea clave: un conjunto en lugar de un único modelo El enfoque tradicional para

Traditional machine learning often relies on a standard 80/20 data split 🤖, but it is strange to think 🤔 that the final 20% can truly "verify" the entire learning process. Over a long history ⏳, the market transitions through vastly different environments; while Brexit and the COVID crash 📉 are the most obvious examples, there are countless other specific trading regimes. A single rigid model simply cannot adapt to all of them effectively 🧊❌.

This adaptive strategy employs an ensemble approach where each sub-model 🧩 is responsible for covering a specific regime found in historical data. Instead of relying on a single logic, the models weigh their inputs ⚖️ to reach a robust consensus decision 🤝✅.

To be clear, this strategy still does not draw a perfectly straight equity line 🚫📈, because that is theoretically impossible in real markets. However, the Ensemble Trader solves many classic stability issues ⚓🛠️. It finally provides solid grounds to believe that earning with a fully automated Forex strategy is absolutely possible 💰🎯.

You can already check out a live demo signal on myfxbook.com.

You’ll notice that the strategy expects large moves and usually opens trades early in the day.

One of the key differences between this strategy and my previous ones is the way it’s trained. It’s based on time-series learning, which usually means you split the data by time — the “right” part of the data, the most recent one, is excluded from training. But after thinking about it, I realized this approach is both illogical and counter-productive.

So I changed it. I split the training into folds, where each fold has its own training and validation sets. Tests show that this method is more stable and reliable. Of course, the real results will become clear in a few months — fingers crossed!

My new EA Chanlun Master blends the Eastern logic of Chanlun 🏯 with modern neural networks 🤖 to give you a clean and intuitive trading style.

It focuses on spotting Super Turning Points ⚡ — those moments when a trend finally runs out of steam and a strong reversal is likely.

Smart filtering keeps out the noise, and the system works smoothly across several symbols on higher timeframes 📈.

What really makes it shine is consistency: historical tests show stable accuracy, loss, and—most importantly—profitability 🚀 even on unseen data beyond the training period.

This kind of stability means the model isn’t overfitting, but actually learning real market behavior.

Chanlun Master is simple, focused, and surprisingly powerful.

Chanlun Master: Fusión de Filosofía Oriental del Mercado y Redes Neuronales Chanlun Master es un robot de trading profesional que combina la legendaria teoría china del movimiento de precios con modernas tecnologías de Aprendizaje Profundo (Deep Learning) . 🏯 Historia: ¿Qué es Chanlun? En 2006, apareció un misterioso trader en el segmento chino de Internet bajo el seudónimo Chan Shi ("Maestro Zen"). Publicó una serie de artículos describiendo una estructura matemática única del mercado, que

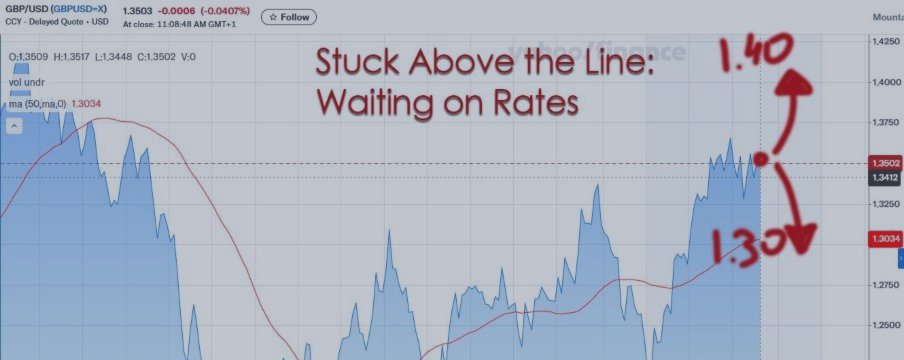

Most likely, that breakout will be to the upside, with potential targets around 1.20 to 1.40. It won't happen overnight, but the setup is already there. So what's been holding EurUsd back? Mainly politics and uncertainty out of France, where the financial and political crises are still dragging on. Germany already went through a similar phase, and its right-centrist forces managed to stabilize things. France, on the other hand, is still trying to figure out what's next — and Macron, being a republican rather than a socialist, has limited room to maneuver.

Once that cloud lifts, the euro could easily regain momentum. Whether it's by the end of the year or even in the next month, a strong rally in EurUsd looks more like a question of when, not if.

My Latte EA operates in a trend-following mode — it's built to catch big moves, not minor noise. And right now, it's been waiting far too long. The market's been quiet, but that silence won't last forever. What's clear is that Latte's cumulative position remains against the USD — and that's the right side to be on. When the breakout finally comes, Latte will already be where it needs to be.

This post is to announce that I'm integrating a small, yet powerful, component of the system—the inside bars—into my top EAs, Latte and Quantum Pip, in the very near future!

Inside bars, or "bars within bars," are simple but seriously effective in Chanlun analysis. They essentially shout, "The market is taking a breather!" They signal a moment of consolidation, which usually precedes a big move. They're all about potential energy building up in a tight range. Given the large, painful flat stalemate we've been stuck in since August, these inside bars are flashing major warnings. This principle is the perfect mechanism to help my EAs overcome this frustrating, sideways chop. October is finally setting up to fire big, and I want my top EAs to catch the full thrust of the breakout!