Evgeniy Scherbina / 个人资料

- 信息

|

12+ 年

经验

|

33

产品

|

595

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

In the coming days I'll be dropping updates for both "LSTM Ensemble" and "Edge Ensemble" — and there's a lot to cover. The headline news is the switch to ONNX-based computations. This makes neural network inference significantly faster and cleaner, and most importantly, adding Transformer models to the ensemble is no longer a headache.

Speaking of which — Transformer models are now joining the party! More diverse architectures mean a more robust ensemble, and that's always a win.

And here's the one you've been waiting for: next month "Edge Ensemble" is finally getting a live real-money signal. I've been building toward this for a while, and it's almost here. Stay tuned — March is going to be a big one!

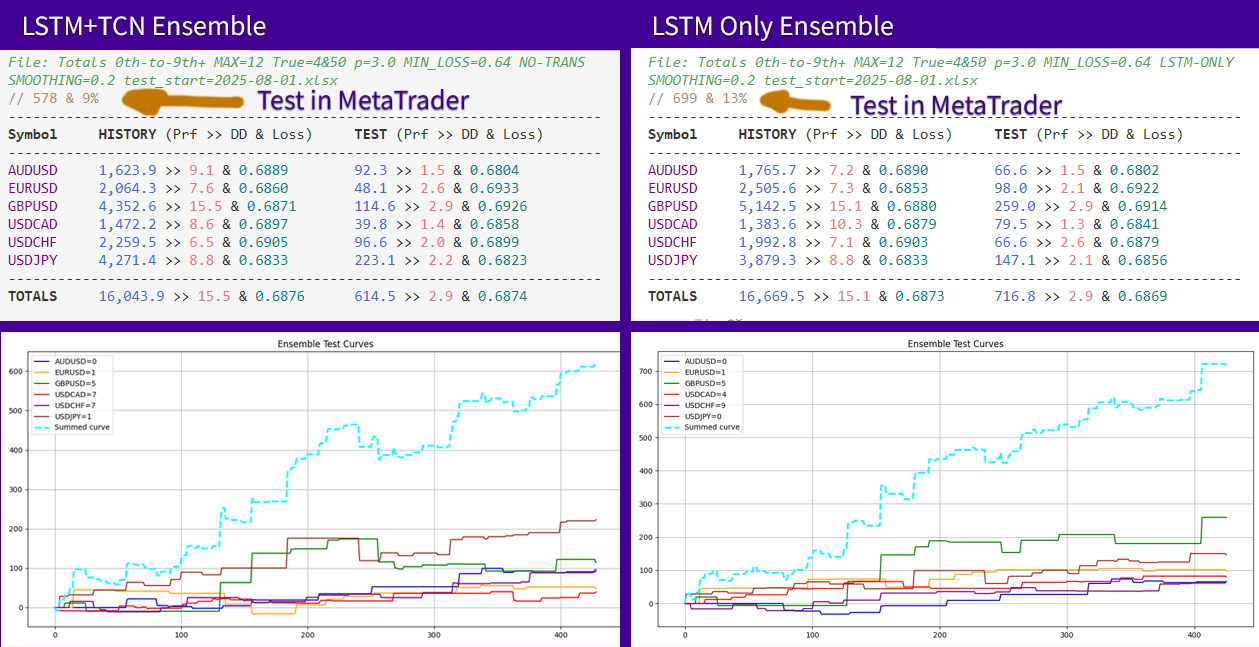

However, this same responsiveness also results in slightly lower total profit during the August–December 2025 test period. The LSTM-only ensemble, on the other hand, makes adjustments less often, commits to its positions longer, and therefore carries a bit more drawdown. Yet this steadier behavior allowed it to accumulate more profit overall — about 21% more (699 vs. 578).

So what does this mean in practice? Honestly, it might mean absolutely nothing — because only live trading can truly validate these differences. And what are we seeing right now? At the moment, the "LSTM Ensemble" is indeed “hammering in” more profits, while the "Edge Ensemble" (LSTM+TCN) continues searching for higher-quality opportunities with a more adaptive approach.

Very soon these latest updates will be published, and real trading performance will give us the final answer. Stay tuned — the most important results are always the live ones.

A | 100% | 10% | 10

B | 120% | 15% | 8

C | 90% | 2% | 45

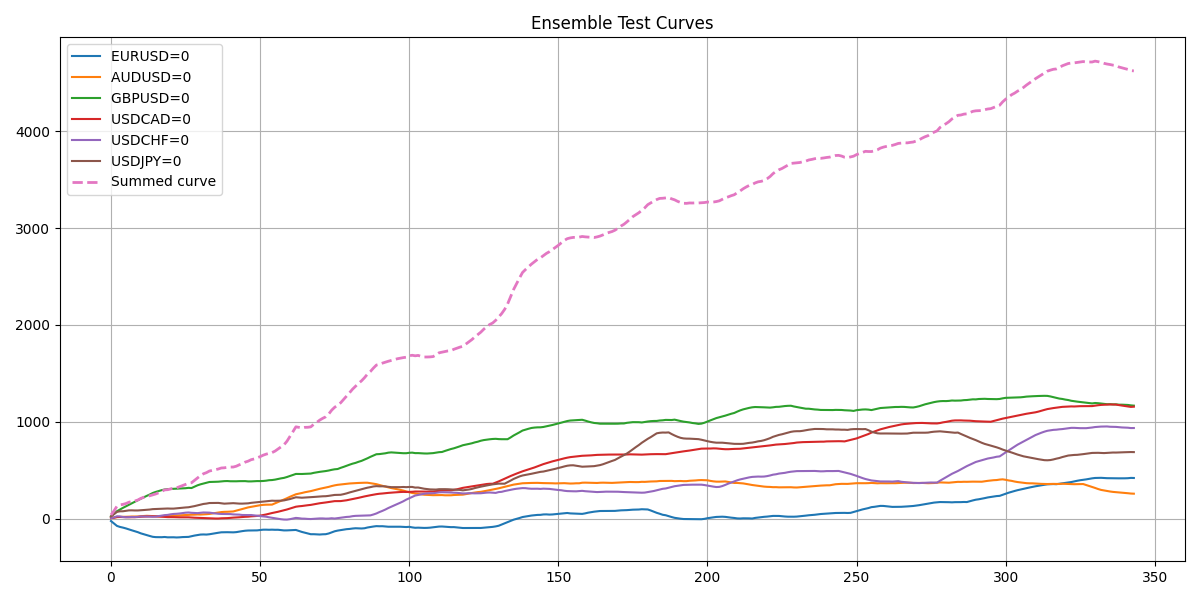

I'm excited to share my best-performing model to date: the LSTM+TCN ensemble. It has achieved the highest returns yet in a rigorous out-of-sample test (Aug-Sep 2025 period, starting balance: $1,000). See the equity curve below.

What changed? I moved away from simplified "maximum exposure" backtesting to a realistic trading simulation. This methodological shift was the game-changer.

I must also highlight the standalone power of a 12-model Transformer ensemble. Yet, the quest to successfully hybridize it with the LSTM+TCN core continues.

In short: the current LSTM+TCN architecture has proven its high effectiveness. An upgraded version will be implemented in the trading advisors shortly.

Its robust performance is driven by an ensemble of 12 models of the same class, significantly aided by frequent signal changes. I have now devised a way to improve this ensemble variant further by adding a second timeframe. The primary one is H6, and I am adding H8 this weekend.

I know the rule: if it works well, don't touch it. However, all tests indicate the "LSTM Ensemble" can perform even better with two timeframes simultaneously.

This weekend, I will also update another advisor, the "Edge Ensemble," to include two timeframes alongside its three model classes. Furthermore, advisors for trading Gold and Bitcoin are next in line.

So far, a fixed profit of 4.5% has been recorded, and the current equity is above the balance by the same amount. This early performance already allows for some preliminary conclusions.

It appears that competition between models of the same class, when combined into a single ensemble, may provide tangible advantages. Building an ensemble from models of one class seems to be more predictable and easier to stabilize at early stages.

In contrast, an ensemble that combines models from three different classes clearly requires more extensive testing and longer validation. However, this does not mean that such an approach is inferior. The "Edge Ensemble" EA is also operating in positive territory and remains profitable. It is possible that the "Edge Ensemble" is designed to wait for larger, more significant market movements rather than reacting to smaller fluctuations.

In any case, ensemble-based trading systems are still a very new concept in retail algorithmic trading.

At the moment, no one except me is selling EAs based on neural model ensembles, which is why the price is still relatively low — but I am confident this will change very soon.

An ensemble approach means combining multiple neural network models instead of relying on just one 🔗.

Right now, I’m the only developer actually selling a true neural ensemble in trading — and that makes a real difference 🚀.

Currently available:

“LSTM Ensemble” — combines 12 LSTM models

“Edge Ensemble” — combines 12 models of two different types: LSTM and TCN

Each model is trained on different folds of the data, so they learn different market behaviors instead of repeating the same mistakes 🎯.

I’m currently working with LSTM, TCN, and Transformer models, each representing a different class of memory and pattern recognition 🧩. TCN and especially Transformer are mathematically complex models, and that complexity allows them to capture structures that simpler models may miss 🧮.

Because each model “remembers” the market differently, the ensemble becomes more stable, adaptive, and resilient over time 🛡️.

Below, you can see a chart showing how this ensemble performs on a true out-of-sample test period, far beyond the training data 📈.

Selecting the winning model within its own fold is a critical step — this diversity is the real power behind the ensemble ⚡. The result is honestly stunning, unlike anything I’ve seen before ✨.

And yes — strategies of this class, powered by neural ensembles, are available only here 🔥.

Edge Ensemble is a professional trading advisor built on an ensemble of 10 independent neural networks of three different architectures: LSTM, TCN and Transformer. Each network in the ensemble acts as a standalone trading strategy, while the final trading signal is formed based on the collective decision of the entire model set. Instead of searching for a single universal model trained using the classical 80/20 scheme, Edge Ensemble employs an ensemble specifically designed to work with

When you train on 15 years of data, the most recent 3 years are thrown away ❌ and never used for learning.

Even worse, those final years cannot represent the full diversity of market behavior that came before them 📉📈.

A far more robust solution is to use historical folds 🧩, where each period trains its own dedicated model.

Instead of one fragile model trying to learn everything, I found a solution in an ENSEMBLE ARCHITECTURE, where each model specializes in its own market regime 🔍.

This approach mirrors how real markets work: they evolve, rotate, and repeat — but never stay the same 🔄.

By combining proven architectures like LSTM 🧠, known for their stability, with modern innovations like Temporal Convolutional Networks (TCN) ⚡, a true breakthrough in time-series forecasting emerges.

TCN is rapidly becoming a new standard for sequential data, including complex financial markets 💹, and its synergy with LSTM is remarkably powerful 🤝.

Today, there is not a single marketplace strategy built on a true 12-model ensemble 🚀.

This is not a cosmetic improvement — it is A FUNDAMENTAL SHIFT in how trading systems are designed and validated 🛠️.

What is most striking in technical testing is the consistency 📊: even with extremely aggressive settings where the history is almost memorized, the strategy still manages to push the equity curve upward on completely unseen data 📈✨.

That level of robustness is not an accident — it is the direct result of THE ENSEMBLE PHILOSOPHY 🎯.

Over the next year, I plan to release several more strategies, all based on this ensemble-driven approach 🧪.

Let’s test a new way of trading together — one that finally respects market history instead of discarding it 🤖💡.

Wishing you a profitable year ahead, steady growth, and confident trading decisions in the Forex market.

To celebrate the holiday season, I’m offering 35% discounts on my selected best products:

LSTM Ensemble — new price $210 USD

Chanlun Master — new price $210 USD

May the new year bring strong trends, clean signals, and plenty of profits.

Trade smart, manage risk, and let the market work in your favor.

LSTM Ensemble is a professional trading expert built on an ensemble of 10 independent LSTM models, each of which represents a separate trading strategy. Instead of a single “ideal” model trained using the classic 80/20 scheme, the expert uses a collective decision approach, where the final trading signal is formed based on the consensus of multiple neural networks Key idea: an ensemble instead of a single model The traditional approach to training neural networks in trading is: one model → one

Traditional machine learning often relies on a standard 80/20 data split 🤖, but it is strange to think 🤔 that the final 20% can truly "verify" the entire learning process. Over a long history ⏳, the market transitions through vastly different environments; while Brexit and the COVID crash 📉 are the most obvious examples, there are countless other specific trading regimes. A single rigid model simply cannot adapt to all of them effectively 🧊❌.

This adaptive strategy employs an ensemble approach where each sub-model 🧩 is responsible for covering a specific regime found in historical data. Instead of relying on a single logic, the models weigh their inputs ⚖️ to reach a robust consensus decision 🤝✅.

To be clear, this strategy still does not draw a perfectly straight equity line 🚫📈, because that is theoretically impossible in real markets. However, the Ensemble Trader solves many classic stability issues ⚓🛠️. It finally provides solid grounds to believe that earning with a fully automated Forex strategy is absolutely possible 💰🎯.

You can already check out a live demo signal on myfxbook.com.

You’ll notice that the strategy expects large moves and usually opens trades early in the day.

One of the key differences between this strategy and my previous ones is the way it’s trained. It’s based on time-series learning, which usually means you split the data by time — the “right” part of the data, the most recent one, is excluded from training. But after thinking about it, I realized this approach is both illogical and counter-productive.

So I changed it. I split the training into folds, where each fold has its own training and validation sets. Tests show that this method is more stable and reliable. Of course, the real results will become clear in a few months — fingers crossed!

My new EA Chanlun Master blends the Eastern logic of Chanlun 🏯 with modern neural networks 🤖 to give you a clean and intuitive trading style.

It focuses on spotting Super Turning Points ⚡ — those moments when a trend finally runs out of steam and a strong reversal is likely.

Smart filtering keeps out the noise, and the system works smoothly across several symbols on higher timeframes 📈.

What really makes it shine is consistency: historical tests show stable accuracy, loss, and—most importantly—profitability 🚀 even on unseen data beyond the training period.

This kind of stability means the model isn’t overfitting, but actually learning real market behavior.

Chanlun Master is simple, focused, and surprisingly powerful.

Chanlun Master: 融合东方市场哲学与现代神经网络 Chanlun Master 是一款专业的交易机器人(EA),它将传奇的中国价格运动理论与现代深度学习(Deep Learning)技术完美结合。 🏯 历史:什么是缠论 (Chánlùn)? 2006年,一位以笔名 Chan Shi (“禅师”)而闻名的神秘交易员出现在中国互联网上。他发表了一系列文章,描述了一种独特的市场数学结构,并将其命名为 “缠论” (Chanlun) 。 与传统技术分析不同,缠论将市场视为一个具有分形结构的生命体,由“笔”(Bǐ)、“线段”(Xiànduàn)和“中枢”(Zhōngshū)组成。多年来,这种策略被视为亚洲市场的“圣杯”,但由于其主观性,手动交易极其困难。 🤖 进化:人工智能 将近二十年过去了。对人类来说困难的任务,对机器而言却是完美的挑战。 Chanlun Master 使用循环神经网络(LSTM),经过数万个历史模式的训练。缠论的规则已经被数字化,并通过现代计算能力得到了强化。 📊 策略核心 该 EA 在日线图(D1)上运行,有效消除市场噪音,使交易保持冷静和稳健。