Carsten Pflug / Perfil

- Información

|

7+ años

experiencia

|

14

productos

|

116

versiones demo

|

|

9

trabajos

|

0

señales

|

0

suscriptores

|

https://www.mql5.com/en/market/product/67274

EL Asesor Experto flexible para estrategias comerciales personalizadas en MetaTrader 5 El experto Netsrac TradeAid es una poderosa herramienta para los comerciantes que buscan desarrollar sus propias estrategias de negociación en MetaTrader 5. Con este asesor experto, usted puede combinar una variedad de indicadores técnicos y reglas de operación con una simple lógica de "Si Esto (Y Esto...) Entonces Aquello" para crear estrategias de operación personalizadas que se ajusten a sus preferencias

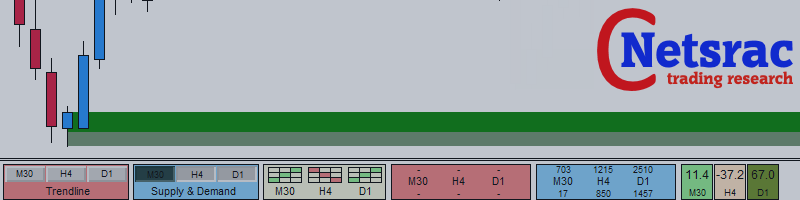

El Cuadro de Mando de Oferta y Demanda de Netsrac le muestra de un vistazo dónde se encuentran las zonas relevantes de sus activos favoritos. Abra su gráfico directamente desde el tablero y opere las zonas que realmente importan. Características Encuentra la siguiente zona relevante de oferta y demanda y muestra la distancia a esta zona (en pips) Busca y muestra las zonas en tres marcos temporales diferentes Calcula un indicador de tendencia para la vela actual y la pasada para cada marco

Netsrac "Supply and Demand Easy" es una herramienta pequeña pero muy especializada para encontrar rápidamente zonas de oferta y demanda sin florituras. Muestra la próxima zona de oferta y demanda en el marco temporal actual. Altamente eficiente y rápido. Funciona perfectamente con el "Tablero de Oferta y Demanda" de Netsrac (https://www.mql5.com/en/market/product/96511) Controla Variable Descripción (SD01) Color de suministro Establezca el color para las zonas de suministro (por defecto es

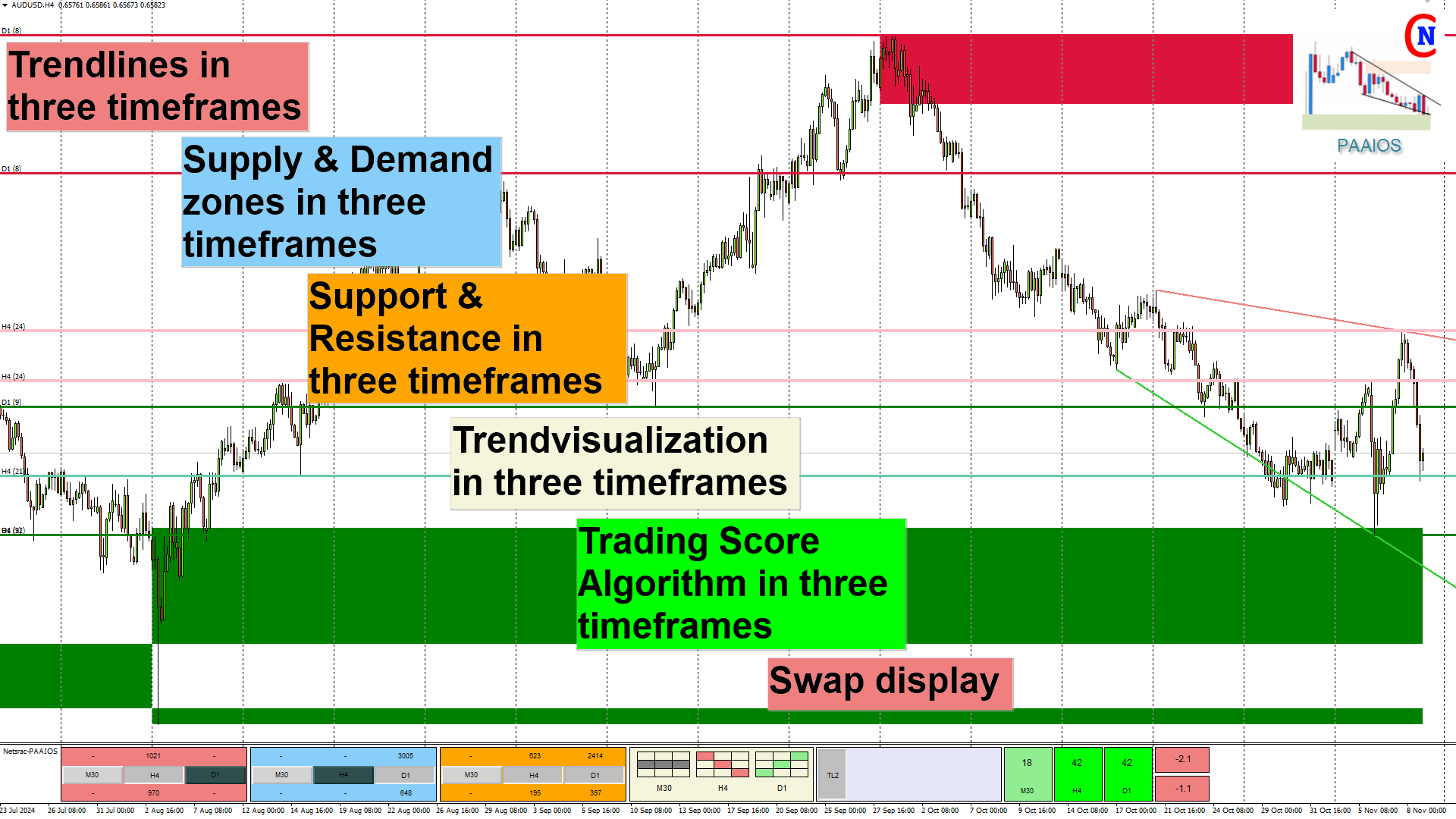

PAAIOS PAAIOS significa Price Action All In One Solution. Y ese es el propósito del indicador. Debe proporcionarle una herramienta para mejorar su comercio de forma decisiva, ya que obtiene la información crucial de un vistazo. El indicador simplifica la búsqueda de señales fuertes. Muestra las líneas de tendencia, las zonas de demanda y de oferta de los marcos de tiempo libremente seleccionables. Características * Detecta zonas de oferta y demanda en múltiples marcos temporales * Detecta y

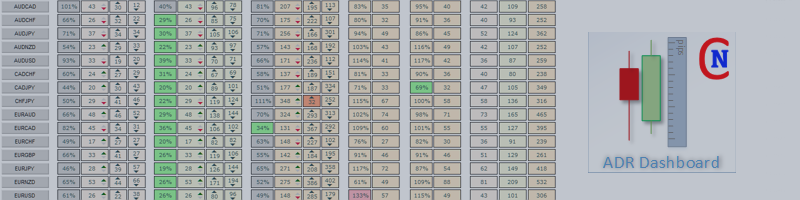

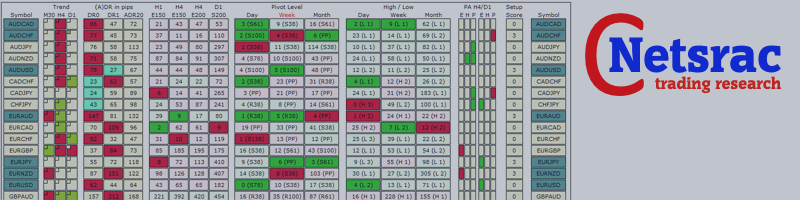

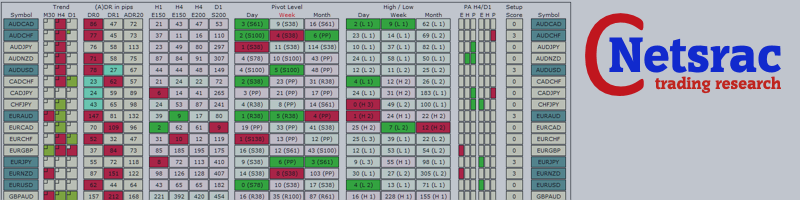

Con el Tablero SR, usted obtiene una poderosa herramienta para controlar parte de la información más importante en el trading. Montar una configuración de acuerdo a su estrategia y ser informado tan pronto como esta configuración es válida. Asigne puntuaciones a condiciones definidas y deje que el Tablero las encuentre. Elija entre Tendencia, Rango Medio Diario, RSI, Medias Móviles, Pivote (Diario, Semanal, Mensual), Máximos y Mínimos, Patrones de Velas. ¿Qué puede hacer con esta herramienta

La intención del cuadro de mandos es ofrecer una visión rápida del rango diario, semanal y mensual de los activos configurados. En el "modo de activo único", el cuadro de mandos le muestra los posibles puntos de inversión directamente en el gráfico, con lo que las estadísticas son directamente negociables. Si se supera un umbral configurado, el cuadro de mandos puede enviar una alerta en pantalla, una notificación (a la MT5 móvil) o un correo electrónico. Hay varias formas de utilizar esta

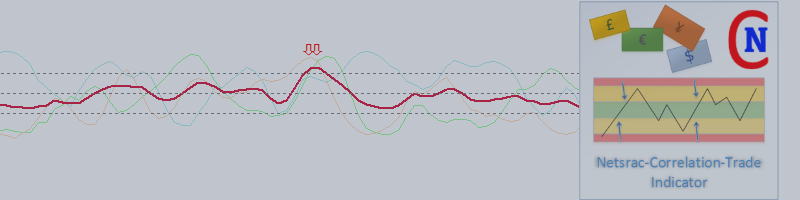

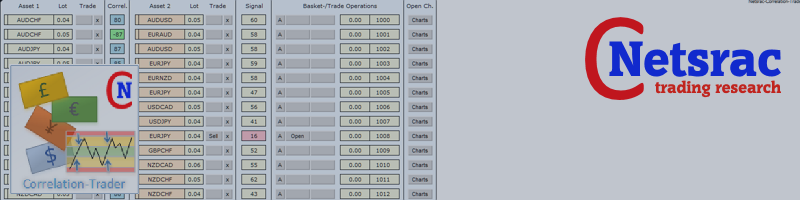

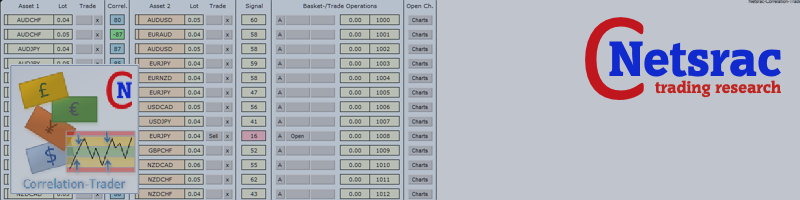

El Netsrac Correlation Trade Indicator (NCTI) fue creado para operar correlaciones entre diferentes activos. NCTI ofrece cinco estrategias diferentes para hacerlo. Cinco estrategias diferentes para operar correlaciones con dos o tres activos Acceso rápido a sus activos con un solo clic a través de los botones de activos Sus ganancias/pérdidas de un vistazo Alertas configurables a través de la pantalla o del móvil Puede utilizar el indicador con cualquier marco temporal. Los marcos temporales

El Netsrac Correlation Trade Indicator (NCTI) fue creado para operar correlaciones entre diferentes activos. NCTI ofrece cinco estrategias diferentes para hacerlo. Cinco estrategias diferentes para operar correlaciones con dos o tres activos Acceso rápido a sus activos con un solo clic a través de los botones de activos Sus ganancias/pérdidas de un vistazo Alertas configurables a través de la pantalla o del móvil Puede utilizar el indicador con cualquier marco temporal. Los marcos temporales

Netsrac Correlation Trader (NCT) es una herramienta muy potente para operar con pares de divisas correlacionados positiva y negativamente con órdenes cubiertas. 1) Busca pares correlacionados positiva y negativamente 2) Muestra una señal, si los pares correlacionados no están en equilibrio 3) Puede "autotrade" algunos o todos los pares correlacionados con su configuración de los marcos de tiempo y los valores de la señal (manejar con cuidado) 4) Puede establecer el tamaño de lote correcto

- New section: RSI (it is the last feature update for SR-Dashboard to stay consistently for my existing customers)

- Optical and performance enhancements

https://www.mql5.com/en/market/product/34855