Thi Thu Ha Hoang / Profile

- Information

|

2 years

experience

|

4

products

|

2259

demo versions

|

|

0

jobs

|

3

signals

|

0

subscribers

|

Initially, my trading strategy centered around using price action to identify the most opportune entry points. In order to eliminate any unnecessary psychological factors, I developed a semi-automatic EA (Expert Advisor) to manage orders.

However, due to health concerns and a desire for more personal time outside of trading, I made the decision to develop a fully automated EA. This EA not only identifies entry points but also takes care of order management on my behalf. Thus, Boring Pips was created, representing the culmination of my efforts.

🛠️ Already own Boring Pips EA? 🎁 You’re eligible for an additional 30% discount! 💬 Contact to learn more about: 🔹 How to claim your rebate Trump’s second term has reignited a wave of aggressive trade policies, starting with the return of sweeping tariffs that are rattling global markets Tensions in the Middle East have flared — most recently between Israel and Iran — sending oil prices surging The Russia–Ukraine war continues with no resolution in sight, fueling ongoing

🛠️ Already own Boring Pips EA? 🎁 You’re eligible for an additional 30% discount! 💬 Contact to learn more about: 🔹 How to claim your rebate Trump’s second term has reignited a wave of aggressive trade policies, starting with the return of sweeping tariffs that are rattling global markets Tensions in the Middle East have flared — most recently between Israel and Iran — sending oil prices surging The Russia–Ukraine war continues with no resolution in sight, fueling ongoing

Avoiding Over-fitting in Trading Strategies (Part 1): Identifying the Signs and Causes

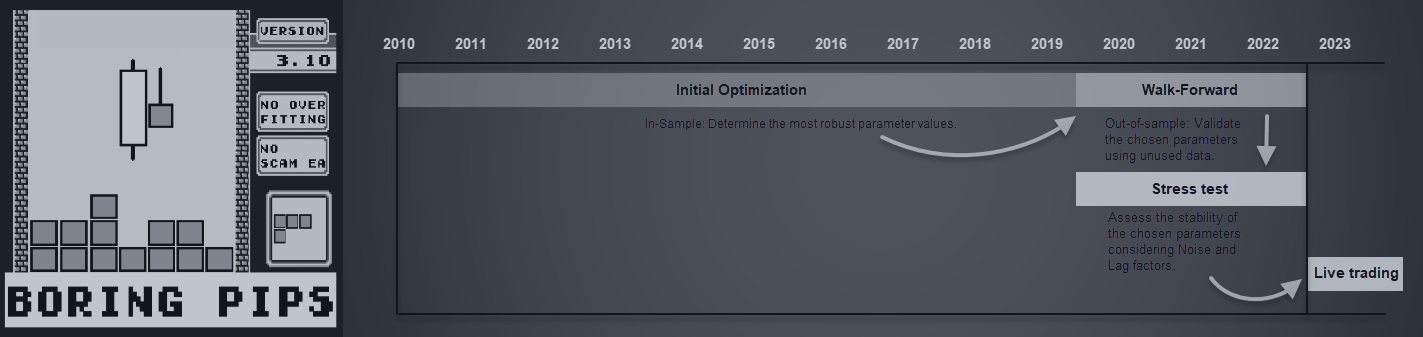

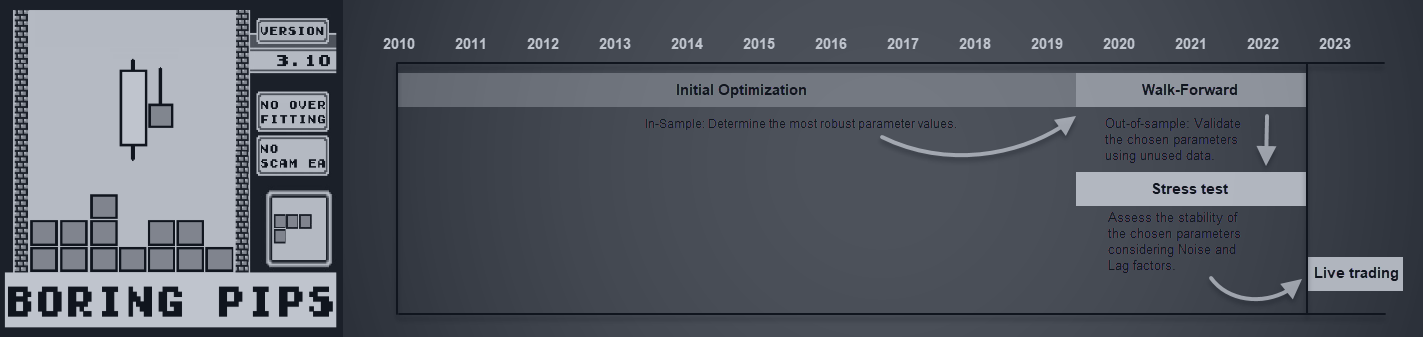

Have you ever wondered why most expert advisors are not effective in live trading, despite their perfect backtest performance? The most likely answer is Over-fitting . Many EAs are created to ‘learn’ and adapt perfectly to the available historical data, but they fail to predict the future due to a lack of generalizability in the constructed model. Some developers simply don't know about the existence of over-fitting, or they know but don't have a way to prevent it. Others exploit it as a

Have you ever wondered why most expert advisors are not effective in live trading, despite their perfect backtest performance? The most likely answer is Over-fitting . Many EAs are created to ‘learn’ and adapt perfectly to the available historical data, but they fail to predict the future due to a lack of generalizability in the constructed model. Some developers simply don't know about the existence of over-fitting, or they know but don't have a way to prevent it. Others exploit it as a tool