Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read November 2014

Sergey Golubev, 2014.11.19 18:56

How Legendary Traders Made Millions: Profiting From the Investment Strategies of the Gretest Traders of All timeby John Boik

From the author of three market books published by McGraw-Hill, Lessons From the Greatest Stock Traders of All Time was chosen by Barron's as one of the top 25 Best Books of 2004. A former stockbroker and currently a financial controller, his second book was released in April 2006 titled How Legendary Traders Made Millions.

Learn how to generate profit, from history's most celebrated traders including William J. O'Neil, Jesse Livermore, and others.

In How Legendary Traders Made Millions, award-winning investment author and historian John Boik has created the first book to put the strategies of history's top traders in one place. Revealing how each trader took advantage of distinct market situations, it details the hands-on specifics of each trade as well as the economic, political, and stock market environments in which the strategy flourished.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read August 2014

Natasya Saad, 2014.08.10 08:54

Enhancing Trader Performance: Proven Strategies From the Cutting Edge of Trading Psychology

Trading is a performance discipline, and like Olympic athletes, elite military troops, and performing artists, traders can structure their development to achieve competence and expertise. Through his own trading experiences and those of individuals he has mentored, Dr. Brett Steenbarger is familiar with the challenges thattraders face and the performance and psychological strategies that can meet those challenges.

In his first book, The Psychology of Trading, Dr. Steenbarger provided a framework for understanding and overcoming the mental obstacles to successful trading. Now, in Enhancing Trader Performance, he goes a step further and shows you how to transform talent into trading skill through a structured process of expertise development.

Straightforward and accessible, this comprehensive guide:

- Discusses the importance of finding an optimal fit between your trading talents and interests; the markets you trade; and the ways you trade those markets

- Explores how you can enter into a learning process that will cultivate your tradingcompetence and expertise

- Introduces the concept of learning loops, which enable you to make progressive improvements in your trading methods

- Breaks down performance into three components—mechanics, tactics, and strategy—and examines the role of each in generating trading success

- Illustrates how you can coach yourself with practical cognitive and behavioral techniques that rapidly change problem patterns and build new, positive ways of thinking and behaving

When you enhance your performance as a trader, you replace a small piece of randomness with intention. This enables you to make more informed trading decisions as you make your way through today's dynamic markets. Filled with in-depth insights, practical advice, solid research, and detailed examples, Enhancing Trader Performance offers an innovative approach to market mastery.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.14 18:29

Trading on Sentiment: The Power of Minds Over Markets

From Forbes:

"Investor sentiment and analysis of media coverage are new frontiers to explore in understanding stock market gyrations. The news unconsciously affects investor behavior, which in turn moves the stock market. Thus analyzing investor behavior could potentially reap enormous profits, says behavioral finance expert Richard Peterson , a board-certified psychiatrist and CEO of MarketPsych in San Luis Obispo, Calif. Peterson’s new book, Trading on Sentiment: The Power of Minds Over the Markets, explains how to potentially “time turns in the stock market using media sentiment at the bottoms and tops of the business cycle.” The book was published by Wiley Finance in March."

"Peterson’s behavioral finance research firm provides data and consults hedge funds, traders and investment banks on economics, investments and trading strategies. His two other books are MarketPsych: How to Manage Fear and Build Your Investor Identity (Wiley, 2010) and Inside the Investor’s Brain: The Power of Mind Over Money (Wiley, 2007)."

Richard Peterson:

- "I started investing at a young age using a brokerage account provided by my father (a finance professor at that time). My first investments were based on recommendations from popular investing magazines. Those investments, based on buying stocks identified as the “Top 10 Fastest Growing Companies” of the year, ended up in large losses again and again. I wondered how I, and the financial magazines I was reading, could be so incredibly wrong, so often."

- "Later I obtained a degree in electrical engineering from the University of Texas. As part of my senior project, I wrote code for artificial neural networks to learn patterns in stock index prices. This stock market prediction model was better than random, and I started to use it in live trading. However, at times, I disagreed with the system’s recommendation."

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read March 2014

Sergey Golubev, 2014.03.26 16:42

Written by leading market risk academic, Professor Carol Alexander,

Pricing, Hedging and Trading Financial Instruments forms part three of

the Market Risk Analysis four volume set. This book is an in-depth,

practical and accessible guide to the models that are used for pricing

and the strategies that are used for hedging financial instruments, and

to the markets in which they trade. It provides a comprehensive,

rigorous and accessible introduction to bonds, swaps, futures and

forwards and options, including variance swaps, volatility indices and

their futures and options, to stochastic volatility models and to

modelling the implied and local volatility surfaces.

All together, the Market Risk Analysis four volume set illustrates

virtually every concept or formula with a practical, numerical example

or a longer, empirical case study. Across all four volumes there are

approximately 300 numerical and empirical examples, 400 graphs and

figures and 30 case studies many of which are contained in interactive

Excel spreadsheets available from the the accompanying CD-ROM .

Empirical examples and case studies specific to this volume include:

- Duration-Convexity approximation to bond portfolios, and portfolio immunization;

- Pricing floaters and vanilla, basis and variance swaps;

- Coupon stripping and yield curve fitting;

- Proxy hedging, and hedging international securities and energy futures portfolios;

- Pricing models for European exotics, including barriers, Asians, look-backs, choosers, capped, contingent, power, quanto, compo, exchange, ‘best-of’ and spread options;

- Libor model calibration;

- Dynamic models for implied volatility based on principal component analysis;

- Calibration of stochastic volatility models (Matlab code);

- Simulations from stochastic volatility and jump models;

- Duration, PV01 and volatility invariant cash flow mappings;

- Delta-gamma-theta-vega mappings for options portfolios;

- Volatility beta mapping to volatility indices.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.09.03 11:03

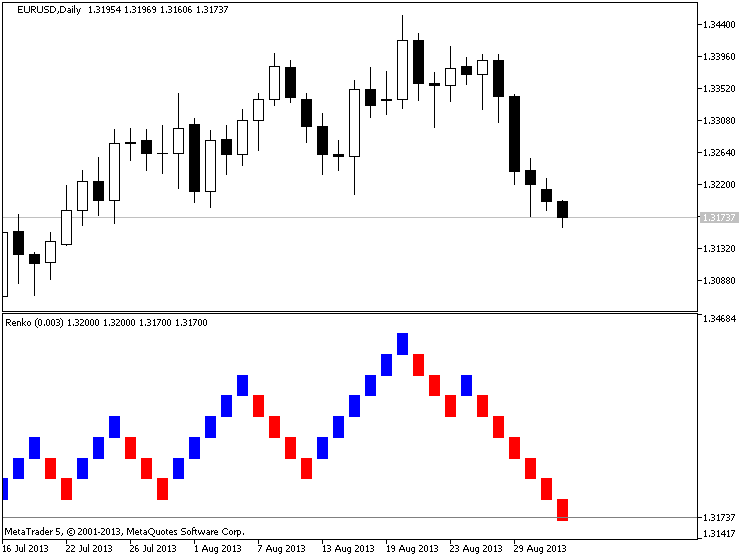

Renko (extraction from Achelis - Technical Analysis from A to Z)

============

Overview

The Renko charting method is thought to have acquired its name from "renga" which is the Japanese word for bricks. Renko charts are similar to Three Line Break charts except that in a Renko chart, a line (or "brick" as they're called) is drawn in the direction of the prior move only if prices move by a minimum amount (i.e., the box size). The bricks are always equal in size. For example, in a 5-unit Renko chart, a 20-point rally is displayed as four, 5-unit tall Renko bricks.

Kagi charts were first brought to the United States by Steven Nison when he published the book, Beyond Candlesticks.

Interpretation

Basic trend reversals are signaled with the emergence of a new white or black brick. A new white brick indicates the beginning of a new up-trend. A new black brick indicates the beginning of a new down-trend. Since the Renko chart is a trend following technique, there are times when Renko charts produce whipsaws, giving signals near the end of short-lived trends. However, the expectation with a trend following technique is that it allows you to ride the major portion of significant trends.

Since a Renko chart isolates the underlying price trend by filtering out the minor price changes, Renko charts can also be very helpful when determining support and resistance levels.

Calculation

Renko charts are always based on closing prices. You specify a "box size" which determines the minimum price change to display.

To draw Renko bricks, today's close is compared with the high and low of the previous brick (white or black):

-

If the closing price rises above the top of the previous brick by at least the box size, one or more white bricks are drawn in new columns. The height of the bricks is always equal to the box size.

-

If the closing price falls below the bottom of the previous brick by at least the box size, one or more black bricks are drawn in new columns. Again, the height of the bricks is always equal to the box size.

If prices move more than the box size, but not enough to create two bricks, only one brick is drawn. For example, in a two-unit Renko chart, if the prices move from 100 to 103, only one white brick is drawn from 100 to 102. The rest of the move, from 102 to 103, is not shown on the Renko chart.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read January 2014

Sergey Golubev, 2014.01.22 10:12

Intermarket-Trading-Strategies

Intermarket Trading Strategies explains how markets interact and

influence each other and how intermarket analysis can be used to

forecast future equity and index price movements by introducing custom

indicators and intermarket trading systems.

Single market technical analysis indicators were designed in the 80s for

national markets, and are no longer sufficient for analyzing the global

market dynamics. This book reveals how you can combine intermarket with

classic technical techniques to develop profitable hybrid systems or

improve on existing ones.

Divided into two parts, part one begins with a discussion of the basic

principles of Intermarket analysis and the benefits of portfolio

diversification by including uncorrelated assets such as commodities and

foreign currencies. It goes on to explain the concept of correlation

and the basic assumptions used before demonstrating the linear

regression method used for predicting one security based on its

correlation with related markets. A variety of custom intermarket

indicators are presented and explanations are given as to how each one

can be used within the framework of a trading system, including eight

new custom Intermarket indicators published for the first time in this

book.

Part two uses the concepts presented in part one to develop intermarket

trading systems to trade popular markets like US and European stock

Index futures, FOREX and Commodities. Techniques for developing a

trading system and evaluating the test results are presented along with

suggested methods of avoiding curve fitting and the illusion of

excellence created by optimization. Stop-loss and other money management

techniques are also discussed. Finally a brief introduction to neural

network systems explains the basic principles of this alternative

approach for designing trading systems.

A total of twenty nine conventional and five neural network trading

systems, appropriate for long and short term and even day trading, are

provided to trade Gold, the S&P ETF (SPY), S&P e-mini futures,

DAX and FTSE futures, Gold and Oil stocks, Commodities, Sector and

International ETF, the Yen and the Euro. Finally a dynamic asset

allocation timing strategy which would systematically keep the portfolio

moving into the strongest asset classes or sectors, enhancing the

return characteristics while decreasing the overall volatility, is also

included. The metastock code for all systems is provided in order to

test and paper trade the system on more recent data before you move from

the computer to the trading desk.

The Bull, The Bear, and The Baboon: FX Lessons Learned the Hard Way

The easiest thing in the world to sell is something a person desperately wants. The three broad categories of human's core needs are - safety, satisfaction and connection. The lure of FX - foreign exchange trading - seems to be the magic formula to satisfy those basic needs. It is easy to make the argument that FX trading offers fast profit and because of the tremendous leverage, rapid accumulation of wealth. If one were to be successful at FX trading that would certainly go a long way toward validation of one's sense of self - it would provide satisfaction. With the economic and satisfaction needs satisfied, connection would seem to follow as a natural by product.

Unfortunately that is exactly the way FX trading has been sold to a rather large segment of vulnerable individuals, desperately looking for financial independence and a way to prove their self-worth. Winsor Hoang, the author of The Bull, The Bear and The Baboon, takes a very realistic look at some of the less than honorable tactics and techniques use to lure unsophisticated investors into the FX trading game.

The book is part novel and part commentary on the FX markets and FX trading in general and an in-depth look at the industry of FX training that targets vulnerable investors. If you are considering becoming an FX trader, do yourself a big favor and read this book before you jump in. As Mr. Hoang points out numerous times throughout the book, FX trading requires a very unique set of skills and discipline. It is not for everyone. Contrary to what a lot of FX training promoters tell you, this is not a business you can learn in six weeks. It actually takes years of study to master the skills necessary to continuously profit from FX trading.

The major purpose of the book is to educate the novice FX trader (or wanna be trader) about all the dangers and pitfalls involved in FX trading. Because the novice FX trader is driven by hopes and dreams, it is very easy to fall victim to the sales pitches of the training programs. I love the way he describes the training courses: "Trading instructors were basically selling balloons: large and grand on the outside, but hollow on the inside." In the book, Mr. Hoang presents many different trader personality types. If you are contemplating trading FX, you will probably be able to see yourself as one of the characters. Don't think your fate will be dramatically different from the character in the book. Even the most suitable FX trader will fail unless he/she has sufficient capital. It is naïve to think that you will be able to spend a few hundred dollars and a few weeks and master FX trading.

In the beginning of the book, Mr. Hoang talks about the dot.com bust of 2000 and attributes it in large part to the Y2K. I believe the Y2K was a minor side issue - the problem was more venture capitalist funding too many solutions for which there was no market. But that certainly does not detract form the value of the book.

Shakespeare warns us, "Tempt not a desperate man." Unfortunately the FX training industry has largely ignored that advice. The FX trainer in the book rues not heeding the advice.

At the end of the book, Mr. Hoang offers an alternative to manual FX trading. His approach adopts a much more realistic rate of investment return. It also takes the emotion out of trading. I have no way to judge if his automated trading is successful or not. He makes an excellent case that the average small investor should shy away from FX trading. I suspect that to be successful with his system also requires a sufficient amount of capital and the discipline to withstand a certain period of losses.

The bottom line is you will get a very honest look at FX trading - with all the hype and dreams stripped away. Before you sink your hard earned money into a FX training course and trading account, read this book. "Forewarned is fore armed."

Forex Price Action Scalping: an in-depth look into the field of professional scalping

Forex Price Action Scalping provides a unique look into the field of professional scalping. Packed with countless charts, this extensive guide on intraday tactics takes the reader straight into the heart of short-term speculation. The book is written to accommodate all aspiring traders who aim to go professional and who want to prepare themselves as thoroughly as possible for the task ahead. Few books have been published, if any, that take the matter of scalping to such a fine and detailed level as does Forex Price Action Scalping. Hundreds of setups, entries and exits (all to the pip) and price action principles are discussed in full detail, along with the notorious issues on the psychological side of the job, as well as the highly important but often overlooked aspects of clever accounting. The book, counting 358 pages, opens up a wealth of information and shares insights and techniques that are simply invaluable to any scalper who is serious about his trading.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted