by Constance Brown

"Now in its second decade, Technical Analysis for the Trading Professional is the number-one go-to guide for market technicians seeking to improve their market timing skills with the most up-to-date tools and techniques. This second edition provides an updated look at unique formulas and key indicators, while retaining all the foundational material that made the previous edition an instant classic.

Technical Analysis for the Trading Professional has been enhanced and expanded to bring you fully up to date on all the essentials, including:

- Dominant trading cycles

- Moving averages

- Fibonacci projections

- Gann Analysis

- Relative Strength Index and stochastics

- Dominant trend lines

- Price projections

- Elliott Wave Principle

- Volatility bands

- Composite Index"

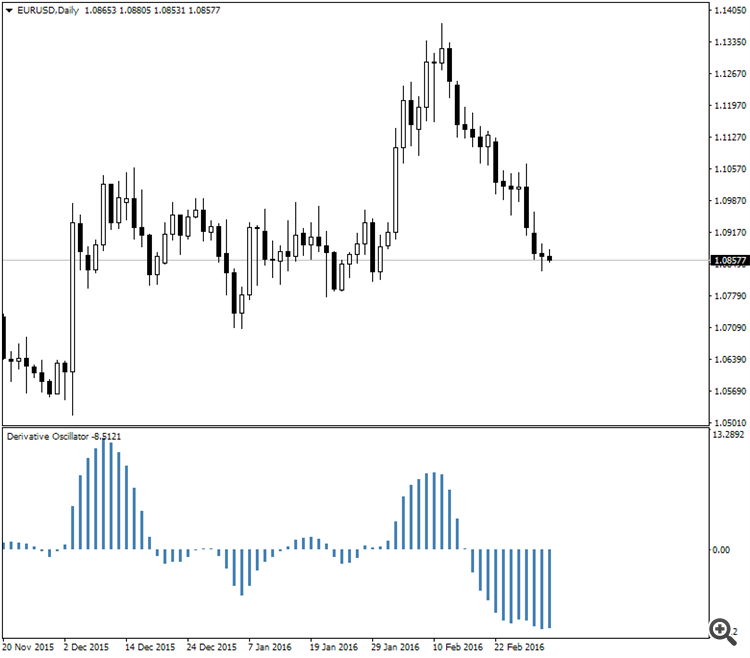

Constance Brown's Derivative Oscillator was published in her this book. The oscillator uses a

14-period RSI . The RSI is then double smoothed with exponential moving

averages . The default settings for the smoothing periods are 5 and 3.

In a second step a signal line is generated from the smoothed RSI by

calculating a simple moving average with a period of 9. The Derivative

Oscillator is calculated as the difference between the smoothed RSI and

the signal line and displayed as histogram.

The formula is:

EMA(EMA(RSI(14), 5)), 3) - MVA(EMA(EMA(RSI(14), 5)), 3), 9)

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2016

Sergey Golubev, 2016.03.02 08:54

RSI Lesson - Trend Follow/Confirming Applications

The signal of overbought and oversold based on 30 and 70 are weak but

can be enhanced but a divergence setup. Even this can extend further.

Perhaps we should look at other approaches of using the RSI, namely the

opposite.

Instead of monitoring the RSI as a range trading tool,

why not look at it as a trend following tool. If the market shows

abundant examples of trend continuing after a show of OB/OS signal maybe

we should examine the trend following applications.

There are 2

advanced signals that they don't teach in the basics of RSI. I first

encountered these techniques in the "Technical Analysis for the Trading

Professional" by Constance Brown. She credits much of her knowledge to

Andrew Cardwell who is a modern day guru of this technical indicator.

We

had previously mentioned that when you think about when the RSI is

above 70, showing overbought conditions, it is also showing bullish

momentum, so in the right context, it it a bullish signal. (The right

context meaning basically that it is not always going to be a bullish

signal.) However, if you witness multiple failures, and then a quick

attempt, it is sometimes considered a "pop". The RSI pop is something we

can investigate closer, but the point is that the overbought condition

sometimes suggest only a temporary pause, but signals further intent.

There are another 2 signals that help confirm the trend.

1)

A healthy bullish trend should be confirmed by the 14-period RSI

staying above the 40 level. Vice versa, a healthy bearish trend should

keep the RSI below 60.

2) After a bullish trend is established, a

positive reversal signal occurs when the RSI makes a lower low, but the

corresponding price low does not. This suggests another swing and we

can use a swing projection.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read January 2015

Sergey Golubev, 2015.01.21 16:33

Technical Analysis from A to Z

by

Steven Achelis

Millions of traders participating in today’s financial markets have shot

interest and involvement in technical analysis to an all-time high.

This updated edition of Technical Analysis from A to Z combines a

detailed explanation of what technical analysis is and how it works with

overviews, interpretations, calculations, and examples of over 135

technical indicators—and how they perform under actual market

conditions. Enhanced with more details to make it easier to use and

understand, this book reflects the latest research findings and

advances. A complete summary of major indicators that can be used in any

market, it covers:

• Every trading tool from the Absolute Breadth Index to the Zig Zag

• Indicators include Arms Index, Dow Theory, and Elliott Wave Theory

• Over 35 new indicators

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read April 2014

Sergey Golubev, 2014.04.07 12:38

How I Made $2,000,000 in the Stock Market: Now Revised & Updated for the 21st Century

by Nicolas Darvas and Steve Burns

How did a world-famous dancer with no knowledge of the stock market, or

of finance in general, make 2 million dollars in the stock market in 18

months starting with only $10,000? Darvas is legendary, and with good

reason. In this new edition: How I Made $2,000,000 in the Stock Market:

Now Revised & Updated for the 21st Century Steve Burns uses his

experience to offer explanations as to why the methods are still

reliable. Updating a classic book is a monumental task. The basic

philosophy of the writer cannot be changed. Steve Burns approach this

work with the eye of a master restorer who looks at a classical painting

that is being refurbished. He carefully studied the text to bring

Nicolas Darvas wisdom into the twenty-first century. Steve Burns

illuminate the dramatic changes in the market to show how Nicolas Darvas

principles are more useful now than ever.

by Robert D. Edwards and John Magee

Technical Analysis of Stock Trends was the first book to produce a

methodology for interpreting the predictable behavior of investors and

markets. It revolutionized technical investment approaches and showed

traders and investors how to make money regardless of what the market is

doing. An indispensable

reference for technical traders, investors, and finance professionals,

the ninth edition features:

- Expanded treatment of Magee's "basing points" procedure

- In-depth discussion and dissection of Dow Theory

- Extensive new material on commodity trading

- Much-needed perspective

on short-term and futures trading

The newest incarnation of one of the true classics of market analysis, this book will be a crucial resource for both seasoned veterans and the new generation alike.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read June 2014

Sergey Golubev, 2014.06.04 15:02

Inside Apple: How America's Most Admired--and Secretive--Company Really Works

INSIDE APPLE reveals the secret systems, tactics and leadership

strategies that allowed Steve Jobs and his company to churn out hit

after hit and inspire a cult-like following for its products.

If Apple is Silicon Valley's answer to Willy Wonka's Chocolate Factory,

then author Adam Lashinsky provides readers with a golden ticket to step

inside. In this primer on leadership and innovation, the author will

introduce readers to concepts like the "DRI" (Apple's practice of

assigning a Directly Responsible Individual to every task) and the Top

100 (an annual ritual in which 100 up-and-coming executives are tapped a

la Skull & Bones for a secret retreat with company founder Steve

Jobs).

Based on numerous interviews, the audiobook offers exclusive new

information about how Apple innovates, deals with its suppliers and is

handling the transition into the Post Jobs Era. Lashinsky, a Senior

Editor at Large for Fortune, knows the subject cold: In a 2008 cover

story for the magazine entitled The Genius Behind Steve: Could

Operations Whiz Tim Cook Run The Company Someday he predicted that Tim

Cook, then an unknown, would eventually succeed Steve Jobs as CEO.

While Inside Apple is ostensibly a deep dive into one, unique company

(and its ecosystem of suppliers, investors, employees and competitors),

the lessons about Jobs, leadership, product design and marketing are

universal. They should appeal to anyone hoping to bring some of that

Apple magic to their own company, career, or creative endeavor.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted