Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read August 2014

matfx, 2014.08.18 13:44

The Little Book Of Sideways Markets : How To make Money In Markets That Go Nowhere

With the stock market turning into a roller-coaster ride of all-time highs and stomach-churning lows, where does that leave your portfolio? Pretty much back where you started in 2000. Which may be fine for visitors to Six Flags, but for your retirement, savings, and investments, you'd like to actually get somewhere.

In The Little Book of Sideways Markets, respected value investor and author Vitaliy Katsenelson shows you how to survive a stagnant market that's neither bull nor bear but instead what he calls a cowardly lion—it displays occasional bursts of bravado but is ultimately overcome by fear.

Katsenelson, known for the commonsense principles he has written frequently about in the Financial Times, Bloomberg Businessweek and elsewhere, decodes the theories and cuts to the chase with practical and timely strategies for how you can survive and thrive during a sideways market—a state of affairs, by the way, we should expect for the next decade. He'll show you:

- Why your investments will stall in neutral and what to do about it

- Why, despite its place as the Rodney Dangerfield of investing, you should treat mean reversion with respect

- Why Tevye was a rich man—and what you can learn from his purchase of Golde, the cow

- How the dire state of economic affairs in China and Japan will impact your investments, and what to do about it

- The three crucial concepts of value investing—Quality, Growth, and Valuation

- How focus on process, boring as it may sound, leads to success

- Why you should become a born-again value investor

- How to break bad habits and find, buy and sell stocks in a sideways market

Making progress in a sideways market is difficult, but the lively and entertaining Little Book of Sideways Markets will help you triumph even when the market is stalled.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read August 2014

matfx, 2014.08.24 13:55

Following The Trend : Diversified Managed Futures Trading

During bull and bear markets, there is a group of hedge funds and

professional traders which have been consistently outperforming

traditional investment strategies for the past 30 odd years. They have

shown remarkable uncorrelated performance and in the great bear market

of 2008 they had record gains. These traders are highly secretive about

their proprietary trading algorithms and often employ top PhDs in their

research teams. Yet, it is possible to replicate their trading

performance with relatively simplistic models. These traders are trend

following cross asset futures managers, also known as CTAs. Many books

are written about them but none explain their strategies in such detail

as to enable the reader to emulate their success and create their own

trend following trading business, until now.

Following the Trend

explains why most hopefuls fail by focusing on the wrong things, such

as buy and sell rules, and teaches the truly important parts of trend

following. Trading everything from the Nasdaq index and T-bills to

currency crosses, platinum and lean hogs, there are large gains to be

made regardless of the state of the economy or stock markets. By

analysing year by year trend following performance and attribution the

reader will be able to build a deep understanding of what it is like to

trade futures in large scale and where the real problems and

opportunities lay.

Written by experienced hedge fund manager Andreas

Clenow, this book provides a comprehensive insight into the strategies

behind the booming trend following futures industry from the perspective

of a market participant. The strategies behind the success of this

industry are explained in great detail, including complete trading rules

and instructions for how to replicate the performance of successful

hedge funds. You are in for a potentially highly profitable roller

coaster ride with this hard and honest look at the positive as well as

the negative sides of trend following.

The Little Book of Stock Market Cycles

by

Hirsch

While predicting the direction of the stock market at any given point is difficult, it's a fact that the market exhibits well-defined and sometimes predictable patterns. While cycles do not repeat exactly all of the time, statistical evidence suggests that cyclical tendencies are very strong and should not be ignored by investors. The Little Book of Stock Market Cycles will show you how to profit from these recurring stock market patterns and cycles.

Written by Jeffrey Hirsch, President of the Hirsch Organization and Editor-in-Chief of the Stock Trader's Almanac, this reliable resource explains why these cycles occur, provides the historical evidence behind them, and shows you how to capture consistent profits from them moving forward. In addition to describing his most widely followed cycles and patters, Hirsch also discusses both longer term boom-bust economic cycles and shorter term tendencies involving the best days, weeks, and months of the year to trade the market.

- The methods found here follow everything from presidential election cycles to the "Santa Claus" effect

- Written by Jeffrey Hirsch, the pre-eminent authority on market cycles and seasonal patterns

- The strategies explored are easy-to-implement, and based on research that has proven profitable over the course of time

For investors looking to beat the buy-and-hold philosophy, The Little Book of Stock Market Cycles will provide simple, actionable ideas that have stood the test of time and consistently outperformed the market.

An accessible look at the art of investing and how to adopt the practices of top professionals

What differentiates the highly successful market practitioners—the Market Wizards—from ordinary traders? What traits do they share? What lessons can the average trader learn from those who achieved superior returns for decades while still maintaining strict risk control? Jack Schwager has spent the past 25 years interviewing the market legends in search of the answers—a quest chronicled in four prior Market Wizards volumes totaling nearly 2,000 pages.

In The Little Book of Market Wizards, Jack Schwager seeks to distill what he considers the essential lessons he learned in conducting nearly four dozen interviews with some of the world's best traders. The book delves into the mindset and processes of highly successful traders, providing insights that all traders should find helpful in improving their trading skills and results.

- Each chapter focuses on a specific theme essential to market success

- Describes how all market participants can benefit by incorporating the related traits, behaviors, and philosophies of the Market Wizards in their own trading

- Filled with compelling anecdotes that bring the trading messages to life, and direct quotes from the market greats that resonate with the wisdom born of experience and skill

- www.amazon.com

by Perry J. Kaufman

The ultimate guide to trading systems, fully revised and updated

For nearly thirty years, professional and individual traders have turned to Trading Systems and Methods for detailed information on indicators, programs, algorithms, and systems, and now this fully revised Fifth Edition updates coverage for today's markets. The definitive reference on trading systems, the book explains the tools and techniques of successful trading to help traders develop a program that meets their own unique needs.

Presenting an analytical framework for comparing systematic methods and techniques, this new edition offers expanded coverage in nearly all areas, including trends, momentum, arbitrage, integration of fundamental statistics, and risk management. Comprehensive and in-depth, the book describes each technique and how it can be used to a trader's advantage, and shows similarities and variations that may serve as valuable alternatives. The book also walks readers through basic mathematical and statistical concepts of trading system design and methodology, such as how much data to use, how to create an index, risk measurements, and more.

Packed with examples, this thoroughly revised and updated Fifth Edition covers more systems, more methods, and more risk analysis techniques than ever before.

- The ultimate guide to trading system design and methods, newly revised

- Includes expanded coverage of trading techniques, arbitrage, statistical tools, and risk management models

- Written by acclaimed expert Perry J. Kaufman

- Features spreadsheets and TradeStation programs for a more extensive and interactive learning experience

- Provides readers with access to a companion website loaded with supplemental materials

Written by a global leader in the trading field, Trading Systems and Methods, Fifth Edition is the essential reference to trading system design and methods updated for a post-crisis trading environment.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read June 2014

newdigital, 2014.06.12 13:25

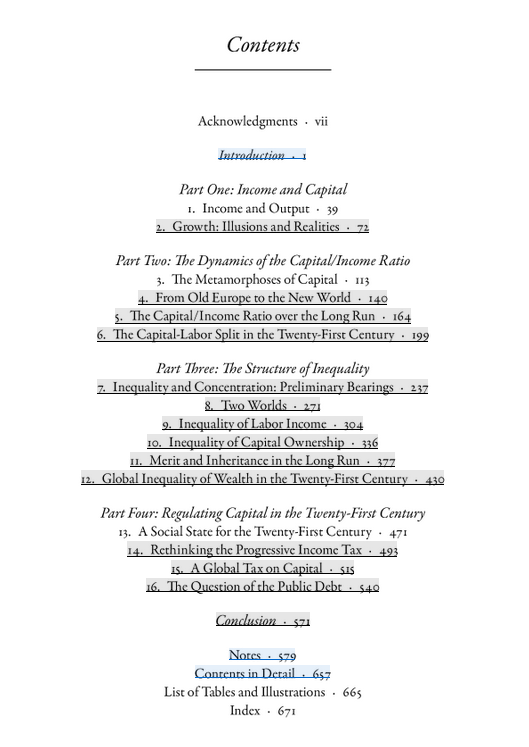

Capital in the Twenty-First Century

What are the grand dynamics that drive the accumulation and distribution

of capital? Questions about the long-term evolution of inequality, the

concentration of wealth, and the prospects for economic growth lie at

the heart of political economy. But satisfactory answers have been hard

to find for lack of adequate data and clear guiding theories. In Capital

in the Twenty-First Century, Thomas Piketty analyzes a unique

collection of data from twenty countries, ranging as far back as the

eighteenth century, to uncover key economic and social patterns. His

findings will transform debate and set the agenda for the next

generation of thought about wealth and inequality.

Piketty shows that modern economic growth and the diffusion of knowledge

have allowed us to avoid inequalities on the apocalyptic scale

predicted by Karl Marx. But we have not modified the deep structures of

capital and inequality as much as we thought in the optimistic decades

following World War II. The main driver of inequality--the tendency of

returns on capital to exceed the rate of economic growth--today

threatens to generate extreme inequalities that stir discontent and

undermine democratic values. But economic trends are not acts of God.

Political action has curbed dangerous inequalities in the past, Piketty

says, and may do so again.

A work of extraordinary ambition, originality, and rigor, Capital in the

Twenty-First Century reorients our understanding of economic history

and confronts us with sobering lessons for today.

-----

Thomas Piketty on Economic Inequality

"Every now and then, the field of economics produces an important book;

this is one of them," writes Tyler Cowen in his Foreign Affairs review

of Thomas Piketty's Capital in the Twenty-First Century. "Piketty's tome

will put capitalist wealth back at the center of public debate,

resurrect interest in the subject of wealth distribution, and

revolutionize how people view the history of income inequality."

But Cowen deems Piketty's main prescription, a proposal for the global

taxation of wealth, "an unsatisfying conclusion to a groundbreaking work

of analysis that is frequently brilliant -- but flawed, as well."

Justin Vogt, deputy managing editor of Foreign Affairs, recently sat

down with Piketty to discuss his analysis of inequality and his

controversial policy proposals.

by

George Kleinman

As an asset class, commodities are now as important as stocks and bonds – and with rapid growth in demand, profit opportunities in commodities are larger than ever. But today’s computer-driven markets are volatile and chaotic. Fortunately, you can profit consistently – and this tutorial will show you how. Building on more than 30 years of market success, George Kleinman introduces powerful trend-based techniques for consistently trading in your “sweet spot” for profits.

Kleinman reveals exactly how the commodities markets have changed – and how you can use consistent discipline to avoid “shark-infested waters” and manage the market’s most dangerous risks. Ideal for every beginning-to-intermediate level trader, speculator, and investor, this guide begins with the absolute basics, and takes you all the way to highly-sophisticated strategies.

You’ll discover how futures and options trading work today, how trading psychology impacts commodity markets even in an age of high-frequency computer trading, and how to avoid the latest pitfalls. Kleinman offers extensively updated coverage of electronic trading, today’s contracts, and advanced trading techniques – including his exclusive, powerful Pivot Indicator approach.

Three previous editions of this tutorial have become international best-sellers. But the game has changed. Win it the way it’s played right now, with Trading Commodities and Financial Futures, Fourth Edition .

by John F. Carter

There are 2nd editions of the book, which is basically a

revision of the original version. John has added more content as well

as updated previous trading concepts as they apply to current day

market conditions.

Mastering the Trade has a lot of focus on futures trading, and this book has something for every trader, regardless of experience or knowledge. Reading this book will not necessarily make you an instant success, but reading a book on how to hit a golf ball from Tiger Woods doesn't mean you'll be on tour with a winning streak next year either.

- www.amazon.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted

August is this thread