Introduction to Bonds (Part II)

Step Coupon Bonds: These are bonds whose coupon rates increase

over the duration of the bond. Often these bonds start by yielding below

what similar bonds do, but end up with a higher than average yield. It

should be noted that many step coupon bonds are callable, and have a

call schedule that mirrors the step coupon rate schedule. In other

words, instead of paying the higher interest rate when it may be due,

the bond issuer has the right to call the bond (return the par value to

the bondholder).

Putable Bonds: These bonds allow the bond holder to redeem them

at face value pre-defined intervals. Putable bonds are basically the

inverse of callable bonds. Bondholders typically pay a premium for

putable bonds, which is another way of saying that the coupon rate on

putable bonds is lower because of the buyer is essentially paying for a

put option on the bond in addition to the bond itself.

Tax Status: Various bonds have different tax implications. For

instance, many government bonds around the world allow interest-income

to be tax-free, while corporate bonds are often taxed as ordinary income

is (it should be noted that tax rules are subject to the jurisdiction

one is in, as well as their own personal situation). When comparing

bonds, understanding the tax implications can provide a complete picture

on the yield that the bond will actually provide.

Survivor's Option. Survivors option bonds are those that, in the

event the bondholder passes away, allows the beneficiary to inherit the

bond with the option of redeeming it at par value. Bonds with a

survivor's option often have many conditions -- i.e. how jointly held

bonds are handled if one bondholder passes away, proof of death and

inheritance rights that must be provided, time limits on providing this

proof, limits the amount of the survivor's option --- and thus it is

paramount for bondholders with survivor's options to read the fine

print. Survivor's options are usually of interest to large estates that

are handled by professional executors.

Forum on trading, automated trading systems and testing trading strategies

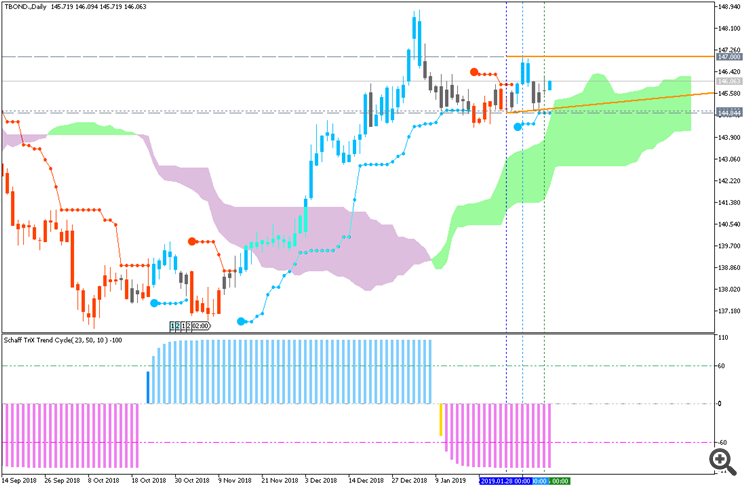

Sergey Golubev, 2019.02.07 11:34

Your Bond Strategy For 2019 (based on the article)

- "What might 2019 hold for the bond markets and how should you invest for it? The U.S. bond market in 2019 is getting perhaps a bit more interesting for investors. Yields aren't enticing by historical standards. Yet, they are higher than they have been for much of the decade given we're currently closer to 3% than 2% on Treasury 10-year bonds. Plus, if we truly are at the top of the cycle as the markets, and yield curve, seem to be suggesting, then perhaps bonds will form a more important part of your portfolio in 2019.”

- "First off, a quick reminder on what determines returns to a bond investment. First off, the current yield. This is, in a sense, your baseline. If you buy a bond with a current yield of 3% and essentially nothing happens over the coming months and years, then you'll earn 3%. But it's important not to fixate on current yield alone. On top of that initial yield there are two other things to consider that can move prices over the shorter term."

- "So for, 2019 fixed income yields in the U.S. are potentially better than for some years over the last decade, but remain muted by historical standards. If you have confidence in a continuing expansion, then shorter-term bonds with some credit risk may make sense. If you see a recession coming, then intermediate government bonds may be the better move. If you are unsure, then various exchange-traded bond funds track the broader market without forcing you to take a view on specific market moves."

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

- MaksiGen_Range_Move MTF - indicator for MetaTrader 5

- ColorSchaffTriXTrendCycle - indicator for MetaTrader 5

Same system for MT4:

- Brainwashing. Trades: manually and using EAs (MT4)

- Brainwashing EAs - the thread (MT4)

- Brainwashing: system setup for trading manually and for EAs (MT4) - the thread

- Brainwashing: system development (MT4) - the thread

Forum on trading, automated trading systems and testing trading strategies

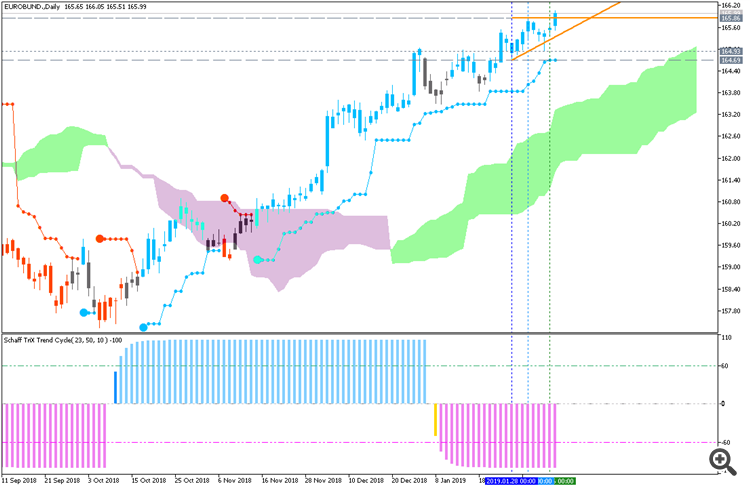

Sergey Golubev, 2020.03.02 09:08

Sell Bonds Now (based on the article)

- "Let us look at the performance of the former month. If the month of February has been up in the past, March has been down in 17 of

20 years. (If the month had been up, then March has been down in in 10 of 17 cases). Note that the tendency for March to be down rises

to 85% if the prior month has closed on the upside."

- "Notes had a strong day on Friday, hitting the objective set by the breakout from the 5-month range that had been confining price. The first half of March is likely to be very weak due to the seasonality and the falling cycles. Notes are likely to fall back to 132.0-132.5."

- "The period from the 18th through the 23rd has been one of the most bearish weeks in any year."

- "The monthly cycle already is in a falling phase."

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

- MaksiGen_Range_Move MTF - indicator for MetaTrader 5

Same system for MT4:

- Brainwashing. Trades: manually and using EAs (MT4)

- Brainwashing EAs - the thread (MT4)

- Brainwashing: system setup for trading manually and for EAs (MT4) - the thread

- Brainwashing: system development (MT4) - the thread

I already know this information, but it's great information to put up. :D

Great job buddy!!!

Forum on trading, automated trading systems and testing trading strategies

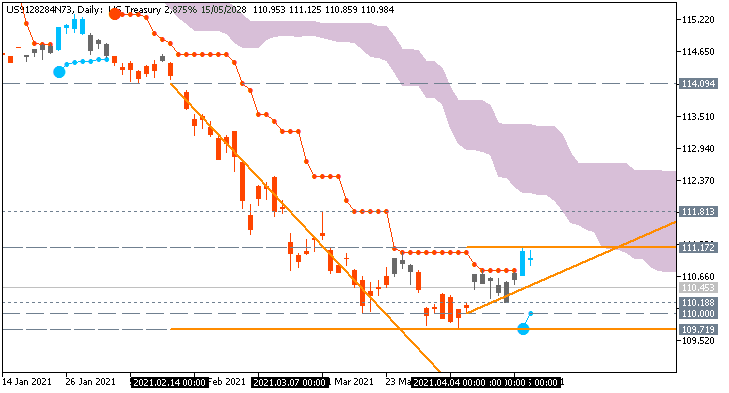

Sergey Golubev, 2021.04.19 06:58

Bands: remain above average (based on the article)

- "Corporate bond markets have proven remarkably resilient in the face of the sharp contraction caused by the Covid-19 pandemic. Bond issuance increased substantially in the last week of March 2020 and has remained substantially above average pre-pandemic levels. For example, between March and June 2020, $502 billion of corporate bonds were issued—compared to just $151 billion in 2019 and $204 billion in 2018."

- "Yet the syndicated loan market—in which groups of banks provide debt financing to firms—shut down, and the origination of new loans fell below their levels in previous years."

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

- MaksiGen_Range_Move MTF - indicator for MetaTrader 5

Same system for MT4:

- Brainwashing. Trades: manually and using EAs (MT4)

- Brainwashing EAs - the thread (MT4)

- Brainwashing: system setup for trading manually and for EAs (MT4) - the thread

- Brainwashing: system development (MT4) - the thread

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Introduction to Bonds (Part I)

1. Principal: This is the face value of the bond; the amount that the first bond buyer initially loaned to the company or government issuing the bond. This is also known as the par value.

2. Coupon Payment: This is the numeric amount of interest payments that are scheduled to the bondholder. For instance, if a bond pays an investor $3,000 twice per year, the coupon amount is $3,000.

3. Yield: The yield is the sum of coupon payments in a year divided by the amount paid for the year. For instance, if a bond buyer pays $100,000 for a bond, and the bond issues 2 coupon payments of $3,000 per year, the yield is 6% (2*3,000/100,000). This is also known as the bond equivalent year, or the annualized yield.

4. Maturity Date: The maturity date is the date that coupon payments will end, and the original principal will be repaid. For instance, if a bond with a principal of $100,000 and bi-annual coupon payments of $3,000 has a maturity date of January 1, 2040, that means the bond will no longer issue coupon payments, and will give the bondholder the $100,000 that was initially borrowed, on January 1 of 2040.

5. Call Date: If a bond has a call date(s), that means the government or corporation issuing the bond has the option of paying back the principal and ending coupon payments on the call date --- which is scheduled before the maturity date specified. For instance, if a bond with a maturity date of January 1, 2040 has a call date of January 1, 2027, that means the bond issuer can pay back the principal in 2027 and no longer make any have payment obligations related to the bond.

Now that we understand the basic jargon, we are one step closer to incorporating bonds into our income investment strategy, which we'll continue to focus on in this series.