You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

It looks like the best alternatives are to be found in the elite section of this forum.

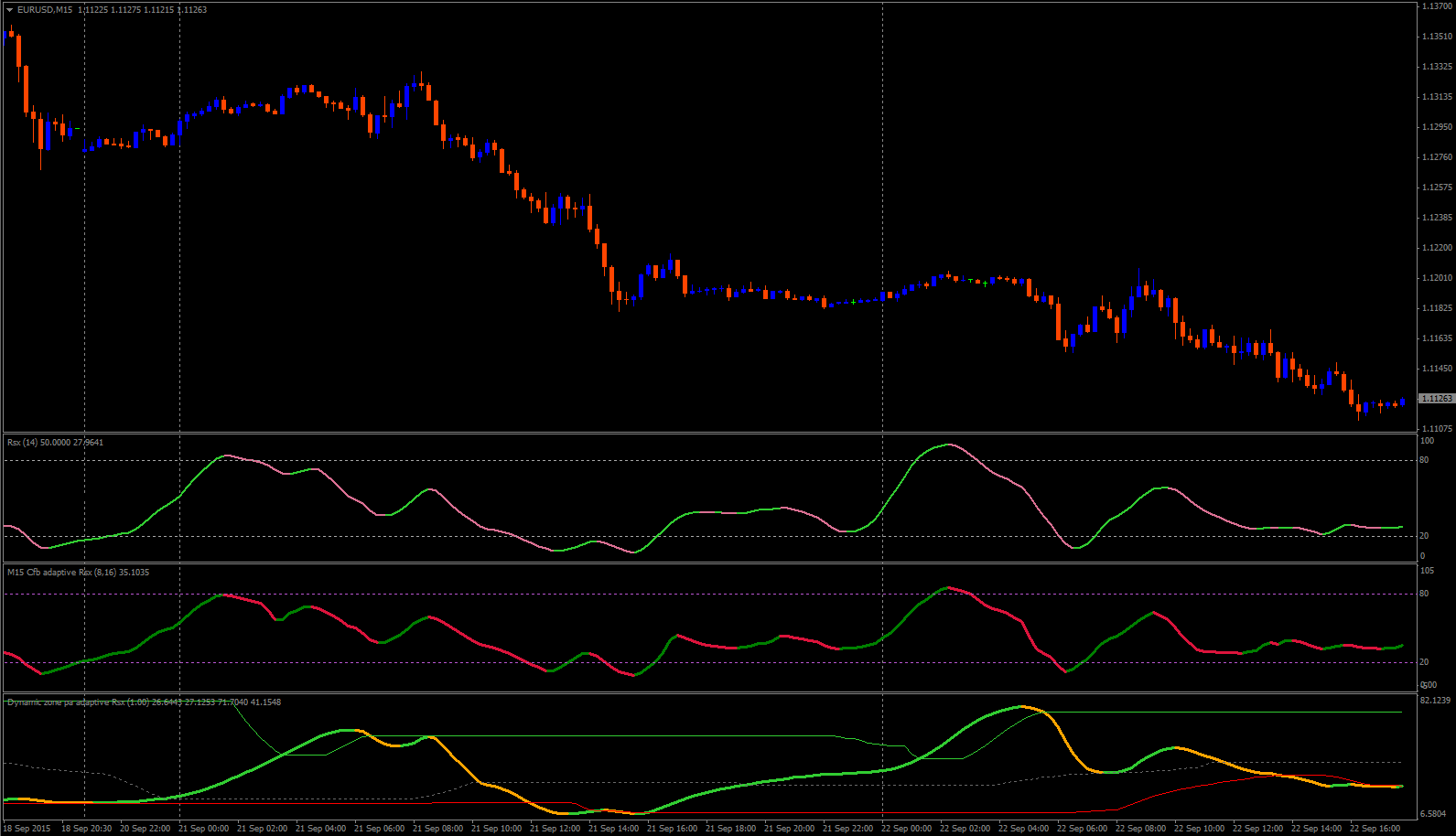

Some of you know this one (it as a dynamic zones composite rsi)

If used properly, it is rather safe

Dearest MLADEN,

thank you boss for your contribution,i was not awared before,that there is some composite DZ rsi exist ,and is suitable for medium and high terms trading,so nice and thanks.

regards

It looks like the best alternatives are to be found in the elite section of this forum.

Hi myrx

of course,the purpose of this new born thread is this.all level participant are invited and requested to come here with their best knowledge and experience to contribute and improve the usefulness of best indicators they have.thanks.

regards

mntiwana

It looks like the best alternatives are to be found in the elite section of this forum.

That's why it's called elite section But there are good solutions in the non-elite section, too. Composite RSI or DSS are nice ones. You have to look for it longer and have to try a lot. This thread should't be ad, please don't missunderstand that.

But there are good solutions in the non-elite section, too. Composite RSI or DSS are nice ones. You have to look for it longer and have to try a lot. This thread should't be ad, please don't missunderstand that.

That's why it's called elite section

I agree 100%

I did not post the picture of it with an intention to add (spamm the thread), but simply it did not seem logical that I don't post at this thread too, and I like that one (I like some more, but all in due time )

)

I'm also into more than two indicators. To my favorite gems later. No, please mladen, we're always interested of your opinion. I mean, who would it know better than you? The view or mrtools would also be interesting.

To the Composite RSI: If you choose another MA than EMA the differences are neglectable. NTL, Composite RSI is a kicker.

I do like the composite RSI on higher timeframes, but not on M1, there it goes up or down suddenly and gives sometimes false signals.

To tame the M1 and M5 beast you are better off with the Rapid RSI of Averages, if you want to use RSI.

You can make it fast, medium fast and very slow and that's what you need on small timeframes ....

==================================================

So M15 is good to start with the Composite RSI and of course not lower, or is it better from H1 on ?

dear Wulong10,

thanks for your advice on rapid rsi of averages for lower TFs, and composite for higher TFs,an new good information for me.thanks,

regards

mntiwana

I'm also into more than two indicators. To my favorite gems later. No, please mladen, we're always interested of your opinion. I mean, who would it know better than you? The view or mrtools would also be interesting. To the Composite RSI: If you choose another MA than EMA the differences are neglectable. NTL, Composite RSI is a kicker.

Dear Krelian99,

we got a lot of interesting and high class work (coding) from MRTOOLS, of course he is the best man of the forum in so many ways,one thing more i want get and learn from him,he always goes straight in nose angle,he never saw here and there,never touch any unconcerned (non related to code) thing,never said a word that is not concerned with coding,even never smiled (smiley icon)......what is the logic behind,a mystery.....i want learn,how i can do same way,any hint ? ....or at least.....he may say few words of coding knowledge here just as his contribution to improve the thread importance,just a request and curiosity too.....for to encourage the thread participants....thanks

regards

mntiwana

There are some possibilities for adapting an indicator: e.g. PA (phase accumulation), cfb (composite fractal behavior), alb (adaptive lookback).

Here is the RSX adapted. One can see, that the cfb RSX is a bit quicker than the normal RSX, while the PA RSX is much smoother. Should I use PA RSX (Hilbert transformation tends to periods around 20) better as filter?

There are some possibilities for adapting an indicator: e.g. PA (phase accumulation), cfb (composite fractal behavior), alb (adaptive lookback).

Here is the RSX adapted. One can see, that the cfb RSX is a bit quicker than the normal RSX, while the PA RSX is much smoother. Should I use PA RSX (Hilbert transformation tends to periods around 20) better as filter?krelian99

With PA, you should do some experimenting with the number if cycles required from the PA - that way you can fine tune any PA adaptive indicator (default value for the number of cycles is usually not so good)