You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Essam, the standard indicators have often the problem you must fit them first. Stochastic with lenght 20 is quick and for ranging markets, but it kills you in trends. For trends a length of 80 is appropriate. RSI is very jagged and you can't raise period much higher than 14 (typical lengths are 3, 8 and 14). RSX is the smoothed brother, both are momentum indicators and are for ranging markets only. The advantages of RSX to a RSI with EMA signal line (e.g. the RSI3EMA5 setup) is, that RSX has minimal lag, smooth but has good amplitude, so much more user friendly.

Dear Krelian,

thanks for the detailed explanation about stoch,rsi and rsx , so it means rsx is best and compromising, comparatively.

regards

mntiwana

Hmm, Krelian, why are Bollinger Bands horrible ?

It depends on how you use them and how much time you want to spend to look for a good setting.

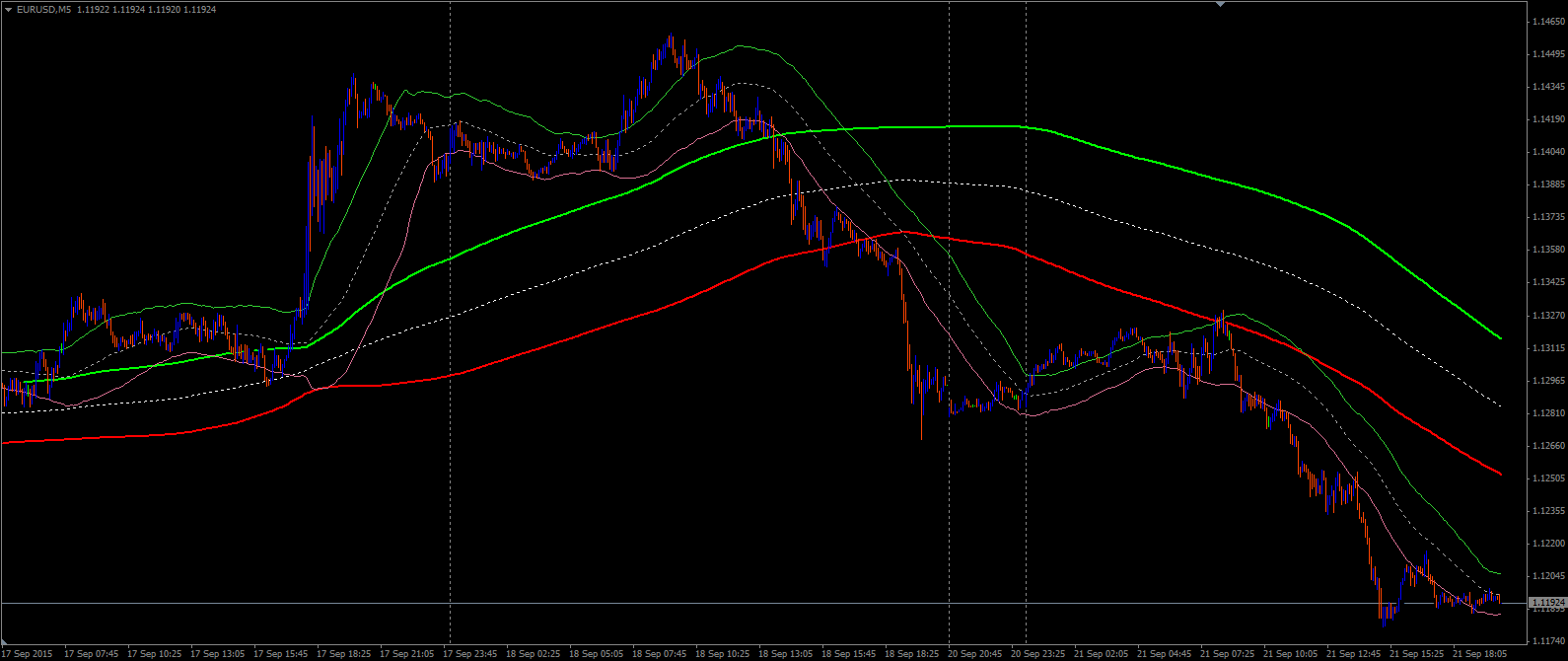

Look, 3 pics of BB360 applied on M1 timeframe.

First one, when price jumps around between the 3 bands, price has no direction and goes sideways.

Second one, when price gets under the lowest band and it gets a maroon color, trend is clearly down ...

Third one, price meets the maroon one and gets very scared ...

Dear Wulong10,

with a lot of respect,first,thanks for your contribution.....you are exact right with your opinion and demonstrating.........with out arguing with you...if you put some kind of dynamic zone along with bands with same equal criteria or adjust them and best fine tune them, then see what results comes out of all two, which one is easy to use and understand and which one is more compromising.......no and never any indicator is useless and false and wrong,actually we are seeing them and experimenting comparatively.we needs your best knowledge and experience....and this time your line/lines are not so thick,lol ....:).thanks

regards

mntiwana

Ah, that's why this thread is a good idea. We, the normal traders, often use standart setup of standart indicators and loose. We have to change the point of view, use tools in an unorthodox manner. Try different approaches. Wulong, nice one. What deviation you have? It is much less than 1. This kind to use BB as breakout indicator reminds me on Keltner channel 40 or 60 (on M15). Together, it seems to be a nice combo. Enter when out of BB and and both in same direction and exit when it goes back into Keltner Channel. Mntiwana, isn't that something for you?

BB (360, 0.6) and Keltner Ch (60).

On Anyway Mr.Krelian

I Solve This Problem For Me I Not Use Any Indicators or Expert EA.

I Hope For You Good And Anther Idea

Thanks For All

Ah, that's why this thread is a good idea. We, the normal traders, often use standart setup of standart indicators and loose. We have to change the point of view, use tools in an unorthodox manner. Try different approaches. Wulong, nice one. What deviation you have? It is much less than 1. This kind to use BB as breakout indicator reminds me on Keltner channel 40 or 60 (on M15). Together, it seems to be a nice combo. Enter when out of BB and and both in same direction and exit when it goes back into Keltner Channel. Mntiwana, isn't that something for you?

BB (360, 0.6) and Keltner Ch (60).yes Krelian,i am already fan of Wulong,because he often showing pictures of M1,and i like M1 also,it was good you said horrible,that way Wulong disclosed his secrets (at the moment-only one),lol.:) ...this is the good idea for to encroach experts.

regards

Essam, you trade naked? What's your style? Harmonic patterns, S&R and TL, volume, EMA20 and 50 (are EMA and MACD indicators when naked trader use them?), your oppinion is welcome.

Mntiwana, yes, BB in default setup and alone it is horrible. Someone says he uses only this and a bit price action (search on YT for Bollinger bands 50.000$ in 16 month). I tried it in my first days with bad results.

First of all, my approach is very different, because I scalp the M1 and trade BO, which is already different.

I know most of you do not like BO, but I do not want to talk about the pros and the contras, otherwise we will never get to the 'point'.

Scalping the M1 is murder, they say, but there it all begins AND ends. Only a bit crazy people dare trade the M1, so if you are not a bit crazy, do not attempt to do it !

I have been simulating H4 and in my case it's almost the same as M1 ....

About indicators ...you make them very smooth on M1 and rather fast on H4 for instance, at least in my case ...

The problem is, here there are too many good indicators and it's hard to choose the best ones for novice traders.

What I do, is testing indicators thoroughly, I have been testing the VA DSS of RSX for instance this weekend and it took me 6 hours for this one alone....

I think that everyone should make his own system, of course you can pick up ideas from others, nothing wrong with that.

Dynamic zone thingies might be interesting, but with all those thick lines and subwindows I use I hardly see the DZ; I like simple oversold and overbought levels better.

Oh yes, BB 360, deviation 0.9, no shift, no MTF, since period 360 is already MTF without being MTF.

And I use the BB enclosed, it's not even one from here ...

Sleep tight.

Wulong

Hmm, trading naked ?

Are those then nudist traders?

I already see it before me ....

Dear Wulong10,

with a lot of respect,first,thanks for your contribution.....you are exact right with your opinion and demonstrating.........with out arguing with you...if you put some kind of dynamic zone along with bands with same equal criteria or adjust them and best fine tune them, then see what results comes out of all two, which one is easy to use and understand and which one is more compromising.......no and never any indicator is useless and false and wrong,actually we are seeing them and experimenting comparatively.we needs your best knowledge and experience....and this time your line/lines are not so thick,lol ....:).thanks

regards

mntiwanaHa, ha, not all my lines are thick, some have thickness 15, others 8, there are also with 5 and others are really skinny, only 3 ...

That's true, everybody likes other styles (scalp, swing, trend, naked or whatever), other indicators and their many distributions (step, adaptive, cross (RSI of OMA or DSS of SMI), it is endless). As little trader you don't know where to start, even as adult you make mistakes. Better many good indicators and having the choice than just haveing a handful of bad indicators (and I don't even mean the repainting stuff for 399$). But I think you have to be a bit crazy when you wanna be a trader.

Maybe there are some TSD-T-shirts soon. The winter is coming. Without something to wear Essam and I'll get a cold. mladen, please help