You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

USDJPY Stuck in a Triangle (based on dailyfx article)

The USDJPY has been stuck in a sideways range since December and appears to be carving out a larger degree 4th wave triangle. That means that each of the 5 sub-waves of the triangle should shape up as a zig-zag, triangle, or combination between them.

US Dollar May Fall as FOMC Fails to Fuel Interest Rate Hike Bets (based on dailyfx article)

A quiet economic calendar in European trading hours is likely to see traders looking ahead to the US session for direction cues, with the spotlight pointing firmly to the outcome of the FOMC monetary policy meeting. Janet Yellen and company introduced a much-discussed change to the language of the policy statement at December’s sit-down, swapping out a pledge to hold rates low for a “considerable time” after the end of QE3 and replacing it with another promising to be “patient” before tightening. It seems unlikely that the cautiously slow-moving US central bank will opt to tinker with policy again so soon after making an adjustment, meaning today’s announcement will probably stick closely to the status quo.

The substance of the FOMC outcome and its interpretation by the financial markets need not align however. The markets seem primed for a hawkish result, if only because the US Dollar is hovering near six-year highs while speculative net-long positioning in the benchmark unit is at the highest since at least 1993. An outcome that sees the Fed in wait-and-see mode and fails to meaningfully advance the case for tightening may have a hard time sustaining such levels. In fact, it may serve to remind investors that the central bank has signaled no rate hikes will occur through April.if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

"To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. The Committee also reaffirmed its expectation that the current exceptionally low target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent."

if actual > forecast (or actual data) = good for currency (for NZD in our case)

[NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

RBNZ Holds OCR Steady At 3.50%

The Reserve Bank of New Zealand's monetary policy board on Thursday decided to hold its Official Cash Rate steady at 3.50 percent - in line with expectations.

It was the fourth straight month with no change for the RBNZ, which had hiked the OCR by 25 basis points in each of previous four meetings prior to September.

Before that, there were 23 straight meetings with no change. The OCR had been at a record low 2.50 percent since March 10, 2011 as the country dealt with the global economic slowdown.

It wasn't until last March that the central bank felt confident enough in a recovery that it lifted the OCR - although no additional action is likely in the near term.

"Trading partner growth in 2015 is expected to be similar to 2014, though the outlook is weaker than anticipated last year. Divergences continue among regions, with growth in China, Japan and the euro area easing in recent quarters, while growth in the US has remained robust," the bank said in a statement accompanying the decision.

EURUSD takes a look below the 100 hour MA. USDJPY also moving lower. Stocks falling (based on forexlive article)

The EURUSD has dipped below the 100 hour MA as traders debate more hawkish or more dovish. The RBNZ statement which was decidedly more bearish, may have also attracted some sympathy selling in the EURUSD in the process, but that is just an observation, not a statement of fact.

The 100 hour MA held support in early NY trading. The current level comes in at 112.90. The low extended to 112.81. IF the price is to go lower, traders will want to see further momentum soon. If not expect consolidation into the early Asian trading as traders reassess.

Meanwhile, the USDJPY is moving lower as well, as stocks move to lows for the day and flows lead into the JPY. The pair is moving toward the 117.17 support floor. The pair has been finding dip buyers against the 117.17-32 area over the last 7 or so trading days with quick reactionary buys. Those looking for the dip to buy, this is your area to lean against judging from the recent history. However, be careful on a break. There should be some stops below the low.

if actual < forecast (or actual data) = good for currency (for USD in our case)

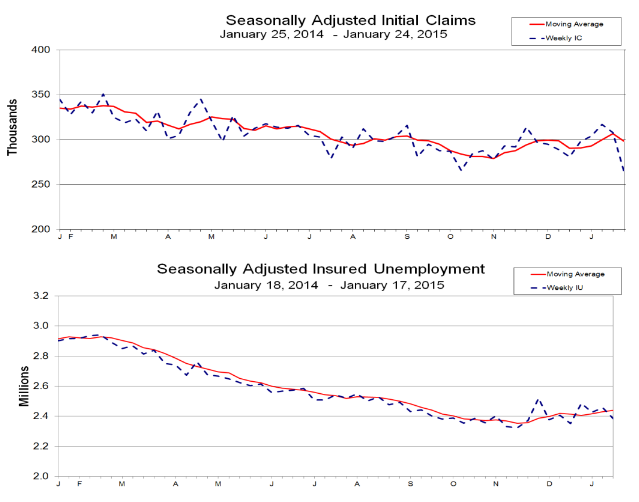

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy

==========

"In the week ending January 24, the advance figure for seasonally adjusted initial claimswas 265,000, a decrease of 43,000 from the previous week's revised level. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The previous week's level was revised up by 1,000 from 307,000 to 308,000. The 4-week moving average was 298,500, a decrease of 8,250 from the previous week's revised average. The previous week's average was revised up by 250 from 306,500 to 306,750.

There were no special factors impacting this week's initial claims. The advance seasonally adjusted insured unemployment ratewas 1.8 percent for the week ending January 17, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemploymentduring the week ending January 17 was 2,385,000, a decrease of 71,000 from the previous week's revised level. The previous week's level was revised up 13,000 from 2,443,000 to 2,456,000. The 4-week moving average was 2,438,500, an increase of 8,250 from the previous week's revised average. The previous week's average was revised up by 3,250 from 2,427,000 to 2,430,250."EUR/USD stalls at key Gann level (based on dailyfx article)

- EUR/USD recovery stalled near the 3rd square root relationship of the year’s low near 1.1415 on Tuesday

- Our near-term trend bias remains positive on the euro while above 1.1210

- A push above the 3rd square root relationship of the year’s low at 1.1415 is needed to set off a new leg higher

- A minor turn window is seen on Friday

- A close under 1.1210 would turn us negative on the euro again

EUR/USD Strategy: Like the long side while over 1.1210.Trading News Events: U.S. Gross Domestic Product (based on dailyfx article)

The advance U.S. 4Q Gross Domestic Product (GDP) report may generate a larger rebound in EUR/USD should the fresh batch of data highlight a slowing recovery in the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Even though the Federal Open Market Committee (FOMC) is widely expected to raise the benchmark interest rate in mid-2015, a dismal GDP print may push the central bank to further delay its normalization cycle especially as it struggles to achieve the 2% target for inflation.

Nevertheless, improved confidence along with the ongoing recovery in the labor market may prompt a strong GDP figure, and a positive development may promote a further decline in EUR/USD amid the deviation in the policy outlook.

How To Trade This Event Risk

Bearish USD Trade: 4Q GDP Fails to Meet Market Expectations

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD

- If market reaction favors a short dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Growth Rate Expands 3.0% or Greater- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in reverse

Potential Price Targets For The ReleaseEUR/USD Daily

- Keeping a close eye on the RSI as it continues to flirt

with the 30 level; rebound from oversold territory to favor a larger

rebound for EUR/USD.

- Interim Resistance: 1.1440 (23.6% retracement) to 1.1470 (78.6% expansion)

- Interim Support: 1.1096 (January low) to 1.1100 pivot

Impact that the U.S. GDP report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

3Q 2014 U.S. Gross Domestic Product (GDP)

EURUSD M5: 36 pips price movement by USD - GDP news event :

The U.S. economy advanced more-than-expected in the third-quarter, with the growth rate expanding another annualized 3.5% following the 4.6% expansion during the three-months through June. At the same time, Personal Consumption climbed 1.8% during the same period amid forecasts for a 1.9% print, while the core Personal Consumption Expenditure (PCE) narrowed to 1.4% from 2.0% in the second-quarter. Despite the better-than-expected GDP print, the Fed appears to be in no rush to normalize monetary policy as it struggles to achieve the 2% target for inflation. The initial reaction in EUR/USD was short-lived as the pair snapped back from the 1.2550 region, with the pair ending the day at 1.2602.

AUDIO - Currencies vs. Forex with Bob Dunn (based on fxstreet article)

Former CME floor trader Bob Dunn joins Merlin for a show revolving around trading Currencies through the futures market. Bob stresses the difference between the terms “Currencies and Forex”, citing significant differences. Bob also shares with listeners some stories from the trading floor days.

Forex Weekly Outlook February 2-6 (based on forexcrunch article)

US ISM Manufacturing PMI, Rate decision in Australian and the UK, US Trade Balance and important employment data including the big NFP event. These are forex market movers for this week. Check out these events on our weekly outlook

Last week US jobless claims plunged 43,000 to a 15 year low indicating the labor market strides in the right direction. Economists expected claims to tick down to 301,000. Earlier that week, the Fed held its monthly monetary policy meeting, repeated the “patience” wording regarding a possible rate hike. However the policy makers were more concerned about international developments and their possible effect on US future growth. The Fed also stated that the labor market has improved further and household spending rose moderately, boosted by low energy prices. Will the US economy continue to improve?