You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Week Ahead: High Volatility, limited GBP downside risk from the current levels - Crédit Agricole (based on the article)

What to watch:

USD - "Next week’s PCE data will be key. Only a considerably weaker than expected outcome may lower rate expectations further."

GBP - "Growth data should become a more important currency driver anew. Hence next week’s GDP data will be closely watched. We see limited GBP downside risk from the current levels."

JPY - "It remains to be seen if weaker inflation data will drive the JPY lower. This is due to increased uncertainty about the BoJ’s policy stance being efficient in bringing inflation back to target."Forex Weekly Outlook Feb. 22-26 (based on the article)

The market mood was generally positive, with the safe haven currencies losing some of their shine. US Consumer Confidence, GDP data in the UK and the US, Durable Goods Orders stand out in the last full week of February.

Fundamental Analysis: Weekly Trading Forecast for Dollar Index, GBP/USD, USD/JPY, USD/CAD, AUD/USD, NZD/USD and Gold (XAU/USD) (based on the article)

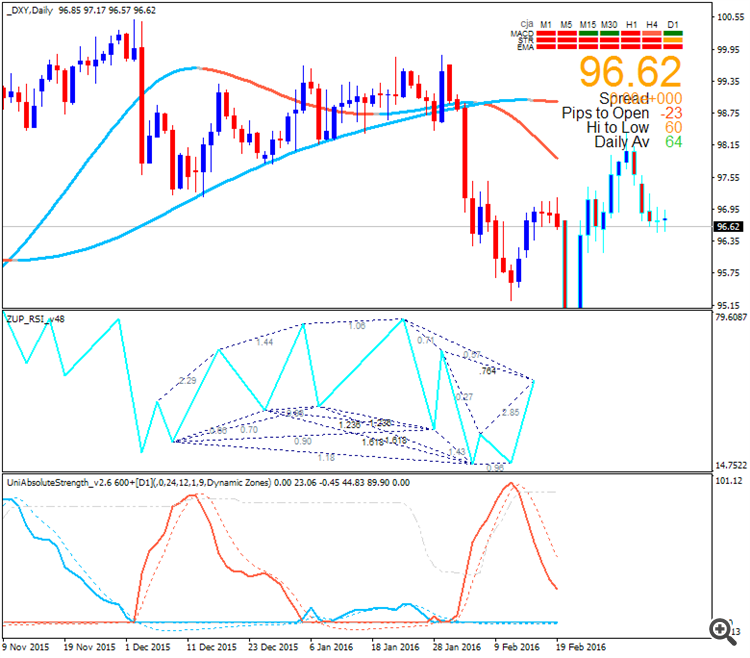

Dollar Index

"Friday’s PCE deflator will carry more of an air of authority though. The Fed’s favored inflation gauge is still well below pace on both a headline and core basis. Outside of the influence of Fed timing, Dollar traders should also keep track of the other major central banks as well as the G-20 meeting Thursday and Friday. ECB officials have threatened to escalate their accommodative effort while the BoJ is seen as being pressured to upgrade as its currency gains and economy stumbles. China and the PBoC are unpredictable but cracks are showing again in their effort at control. As for the G-20, it is one of the few outlets to answer the major concerns listed by world authorities."

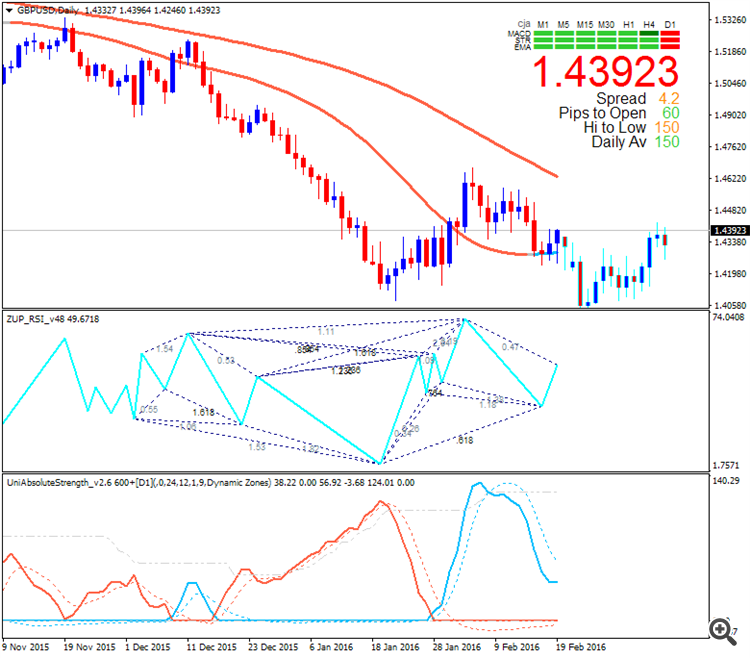

GBPUSD

"In the near-term, this could be GBP positive as fears of a Brexit on the back of stalled negotiations had driven the Sterling lower. Longer-term will depend on British voters. For now, we take a bullish forecast on GBP moving into next week, and will review as more information on negotiations and a potential Brexit become available."

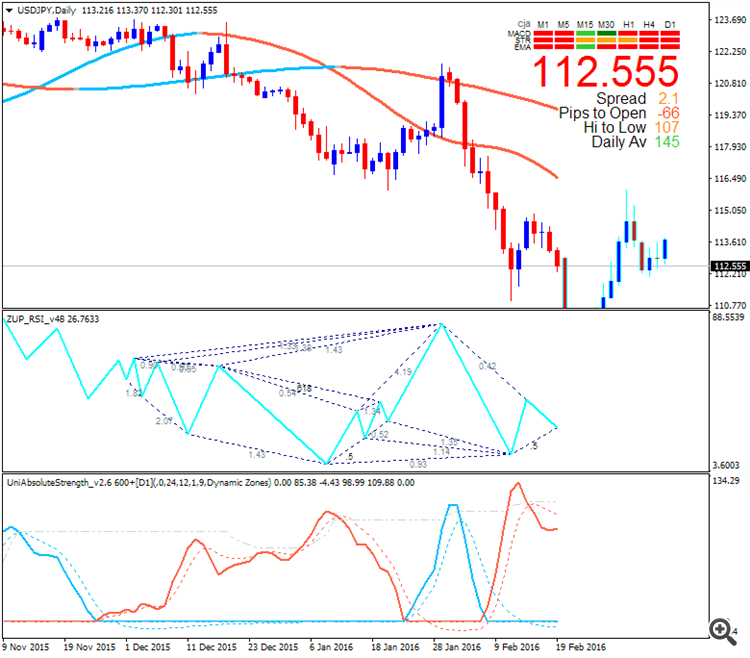

USDJPY

"Impressive Yen appreciation leaves momentum firmly in its favor, and however much they try Japanese officials seem unlikely to reverse the trend. Absent a substantive improvement in global financial market conditions and/or aggressive rhetoric from the upcoming G20 meeting, we think the USD/JPY will trade to further lows through the coming week of trading."

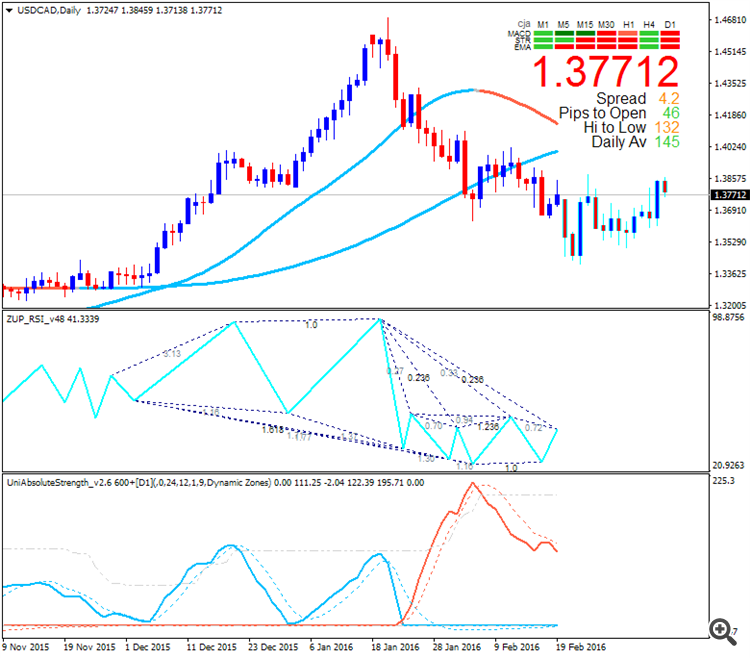

USDCAD

"With Fed Vice-Chair Stanley Fischer, Governor Jerome Powell and Governor Lael Brainard on tap to speak next week, the fresh batch of central bank rhetoric may also spur increased volatility in the exchange rate as market participants speculate the timing of the next rate-hike. However, the central banks officials may refrain from saying anything new as the FOMC is scheduled to release its updated forecasts next month, and a more of the same from the Fed officials may produce a limited market reaction ahead of the GDP report as USD/CAD retains the range-bound price action from earlier this month."

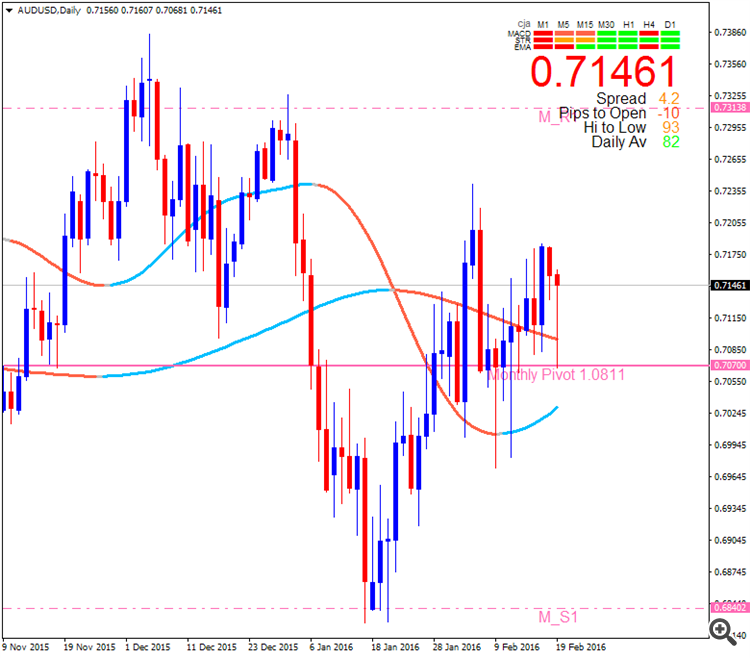

AUDUSD

"The most potent of the data points on tap is January’s PCE measure, the Fed’s preferred gauge of inflation trends. The core year-on-year growth reading is expected to rise to 1.5 percent, an increase from December’s 1.4 percent result and the fastest pace in 14 months. Core CPI surprised on the upside for the same period. A similar outcome on PCE may help revive near-term stimulus removal fears, weighing on risk appetite and sending the Aussie lower alongside stock prices."

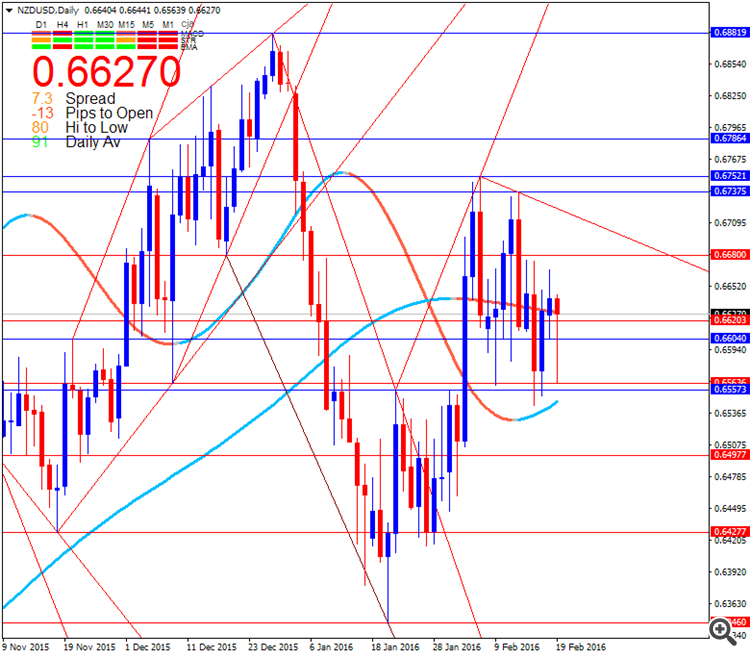

NZDUSD

"This week, we’ll see New Zealand Trade Balance, which is expected, widen further from last month’s reading of -53m toward economists’ expectations of -250m as exports, which the economy relies upon for real growth continues to lag imports. There isn’t a huge amount of data until the RBNZ March meeting. Up to the meeting, we have an environment where risk-sentiment will be the key driver for NZD, and if the Japanese Yen is any indication, the bird could be heading lower."

Gold (XAU/USD)

"Aside from the economic docket, be on the lookout for a host of Fed speakers next week with Vice Chair Stanley Fisher, St Louis President James Bullard, Atlanta President Dennis Lockhart and San Francisco President John Williams slated for speeches next week. Traders will be attempting to ascertain the timing & willingness of the central bank (or if there even is a willingness) to further normalize monetary policy amid the ongoing turmoil in broader financial markets."

EUR/USD Intra-Day Fundamentals: ECB Sabine Lautenschläger Speech and 19 pips price movement

2016-02-22 18:00 GMT | [EUR - ECB Sabine Lautenschläger Speech]

[EUR - ECB Sabine Lautenschläger Speech] = Sabine Lautenschläger is a member of the European Central Bank's Executive Board since January 2014.

==========

"Rede von Sabine Lautenschläger, Mitglied des Direktoriums der EZB und stellvertretende Vorsitzende des Aufsichtsgremiums des einheitlichen Aufsichtsmechanismus, Bankenabend der Hauptverwaltung in Baden-Württemberg der Deutschen Bundesbank, Stuttgart, 22. Februar 2016."

==========

EURUSD M5: 19 pips price movement by ECB Sabine Lautenschläger Speech news event :

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and 38 pips price movement

2016-02-23 09:00 GMT | [EUR - German Ifo Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

"Sentiment among German businesses continued to weaken in February. The Ifo Business Climate Index for German industry and trade fell to 105.7 points this month from 107.3 points in January, marking its third consecutive decrease. The majority of companies were pessimistic about their business outlook for the first time in over six months. Assessments of the current business situation, by contrast, were slightly better than last month. German businesses expressed growing concern, especially in manufacturing."

==========

EURUSD M5: 38 pips price movement by German Ifo Business Climate news event :

EUR/USD Intra-Day Fundamentals: CB Consumer Confidence and 20 pips price movement

2016-02-23 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

"The Conference Board Consumer Confidence Index®, which had increased moderately in January, declined in February. The Index now stands at 92.2 (1985=100), down from 97.8 in January. The Present Situation Index declined from 116.6 to 112.1, while the Expectations Index decreased from 85.3 to 78.9 in February.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was February 11."

“Consumer confidence decreased in February, after posting a modest gain in January,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions weakened, primarily due to a less favorable assessment of business conditions. Consumers’ short-term outlook grew more pessimistic, with consumers expressing greater apprehension about business conditions, their personal financial situation, and to a lesser degree, labor market prospects. Continued turmoil in the financial markets may be rattling consumers, but their assessment of current conditions suggests the economy will continue to expand at a moderate pace in the near-term.”

==========

EURUSD M5: 20 pips price movement by CB Consumer Confidence news event :

The U.K.’s Gross Domestic Product (GDP) report may heighten the bearish sentiment surround British Pound and fuel the near-term decline in GBP/USD should the data encourage the Bank of England (BoE) to further delay its normalization cycle.

What’s Expected:

Why Is This Event Important:

Even though BoE officials sees a ‘solid’ recovery in the U.K. and talk down bets for additional monetary support, the downside risk surrounding the economic outlook may prompt the Monetary Policy Committee (MPC) to retain its current policy throughout 2016 as the central bank struggles to achieve the 2% target for inflation.

Nevertheless, increased demand from home and abroad may encourage a stronger-than-expected GDP print, and an unexpected upward revision in the growth rate may spur a near-term rebound in GBP/USD as the fundamental outlook for the U.K. improves.

How To Trade This Event Risk

Bearish GBP Trade: U.K. Expands Annualized 1.9% or Less

- Need red, five-minute candle following the GDP report to consider a short British Pound trade.

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: GDP Report Beats Market Expectations- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: Ranging - Daily closing below 1.0989 would shift to bearish.

"EUR edged below 1.0990 (low of 1.0987) but closed higher at 1.1015. Only a daily closing below 1.0990 would indicate further EUR weakness towards the next support at 1.0850. Overall, this pair is expected to remain under pressure unless it can reclaim 1.1130 in the next few days."

As we see from the chart above - the daily price broke 200-day SMA for the primary bearish market condition with the ranging around 100-day SMA area. If the price breaks 1.0989 key support level on close daily bar so the primary bearish trend will be continuing, otherwise - the price will be ranging within 200-SMA/100-SMA levels waiting for direction.

We expect gold prices to average $980 an ounce this year and $860 in 2017 - BNP Paribas (based on the article)

Harry Tchilinguirian, global head of commodity markets strategy at BNP Paribas:

As we see from the image - the XAU/USD weekly price is located between 200 period SMA and 100 period SMA for the ranging bearish market condition.

AUDIO - The Trend is Your Friend with Vishal Subandh

For the past 6+ months, every time Vishal has been on the show, he has been adamant about selling the rallies! And for 6+ months, he has been SPOT on! Will his market view persist? Tune in and find out the answer and much more as Vishal calls in from Mumbai to talk to Merlin on Power Trading Radio.