You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forex Weekly Outlook October 12-16 (based on forexcrunch article)

UK and US inflation data, German economic sentiment, UK and Australian employment data, US Retail sales, Unemployment Claims, Philly Fed Manufacturing Index and Consumer Sentiment. These are the main market movers on forex calendar.

Last week the Federal Open Market Committee released the minutes from its crucial meeting in September, where the members decided to hold off raising the Federal funds rate. The policymakers acknowledged that the labor market has improved over the year, getting closer to their estimates of longer-run normal rates. Regarding inflation, FOMC members stated that subdued inflation will improve in the near term and would return to normal levels over the medium term. Fed Chair Janet Yellen said it was decided to hold off the rate hike in September but expects such a move later this year.

Week Ahead by Crédit Agricole (based on efxnews article)

"Next week could prove pivotal for the policy divergence trade with important releases out of the US and the UK likely to determine whether the recent aggressive repricing of Fed and BoE rate hikes has been justified. We think that the US activity and inflation data as well as the UK inflation and labour market data will highlight that investors may have overreacted selling USD and GBP of late. At the same time, we think that data out of Japan should strengthen the case for more QE at the end of the month (CACIB’s central case) and weaken JPY."

What we’re watching:

JPY - "CACIB economists have front-loaded their call for BoJ QE to 30 October from January 2016. We revised our year-end forecast for USD/JPY higher to 125 from 123 previously."

USD - "Better-than-expected data may bring expectations of the Fed considering higher rates this year back on the agenda."

GBP - "Still constructive labour market conditions as reflected in next week’s data should prevent rate expectations from falling further."

AUD - "Disappointing labour data should keep RBA rate expectations strongly capped. We remain in favour of selling AUD rallies."

EUR/USD: calm before storm - Barclays (based on efxnews article)

Barclays made a fundamental forecast for EURUSD expecting big volatility for this pair and for USD/JPY as well:

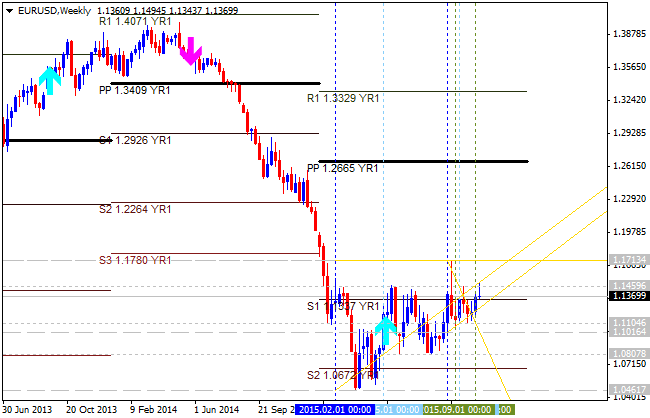

So, Barclays is still keeping sell position with 1.0460 take profit and stop loss as 1.1562. And as we see from the chart above - the price is on bearish market condition for the secondary ranging within 1.0461 key support level and 1.1713 key resistance level, so 1.0460 may be the real bearish target at year-end for example.

EURUSD Intra-Day Fundamentals - ZEW Economic Sentiment (based on efxnews article)

Credit Agricole made a fundamental forecast concerning ZEW news event - German ZEW Economic Sentiment and ZEW Economic Sentiment. It's a leading indicator of economic health - investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity:

From the technical point of view - EURUSD price is on bullish market condition in intra-day basis for the ranging within 1.1396 key resistance level and 1.1343 key support level. The 'reversal' level for this pair is 1.1270 so if the price breaks this support level from above to below - the reversal from the primary bullish to the primary bearish market condition may be started.EURUSD Intra-Day Fundamentals - USD Into Retail Sales (based on efxnews article)

BNP Paribas made fundamental forecast concerning Retail Sales news event for today:

From the technical points of view - the price is located to be above 200 period SMA and above 100 period SMA for the bullish breakout: the price broke key resistance levels in intra-day basis and stopped near 1.1469 level. If the price will break this 1.1469 resistance level from below to above so the bullish breakout will be continuing, otherwise - ranging bullish.

Outlooks For EUR/USD: Sell Signal - SEB (based on efxnews article)

Skandinaviska Enskilda Banken made a technical forecast for EUR/USD pair related to intra-day and day basis:

Thus, SEB is estimating two key levels for this pair: 1.14 in intra-day base and 1.15 on long term situation. Anyway, the bearish AB=CD pattern was formed on W1 timeframe together with the bearish retracement pattern so we can expect more bearish situation with this pair in the few coming weeks for example.

Outlooks For EUR/USD: Sell Signal - SEB (based on efxnews article)

Skandinaviska Enskilda Banken made a technical forecast for EUR/USD pair related to intra-day and day basis:

Thus, SEB is estimating two key levels for this pair: 1.14 in intra-day base and 1.15 on long term situation. Anyway, the bearish AB=CD pattern was formed on W1 timeframe together with the bearish retracement pattern so we can expect more bearish situation with this pair in the few coming weeks for example.

3 reasons to sell EUR/USD - BNP Paribas (based on efxnews article)

BNP Paribas suggested to make a short with EUR/USD with 1.0900 target and 1.1630 stop loss, and it is based on 3 fundamental reasons:

"We entered a short EUR/USD position with a target at 1.0900, and a stop at 1.1630."Weekly Outlook: 2015, October 18 - 25 (based on forexcrunch article)

The US dollar showed weakness against most currencies as the data proved weak. Is this a change of direction? Mark Carney’s and Janet Yellen’s speeches, US Building Permits, and rate decisions in Canada and the Eurozone stand out. These are the major events on forex calendar. Here is an outlook of the top events for this week.

Last week U.S. Retail sales and Philly Fed Manufacturing Index missed expectations reducing chances for a Fed rate hike this year. Retail sales report inched up 0.1% while expected a 0.2% gain. Philadelphia Manufacturing Index contracted for the second month in October. The better inflation numbers allowed the dollar to recover, especially against the euro, which was hit by its own central bank. Commodity currencies were mixed, each to its own, with the Aussie being the weaker link.

EUR: outlook for the coming week by Morgan Stanley (based on efxnews article)

EUR: Bullish

"We believe that EURUSD could head higher before we see pushback from the ECB. Indeed, we don’t expect anything from next week’s meeting. Our base case is for no further easing, but in the tail risk that the central bank does decide to do more, this would be likely to come in December alongside the ECB’s new forecasts. With further action from the ECB unlikely in the near term, and US rates falling, EUR is becoming less attractive as a short term funder, offering it support."

From the technical point of view - the price is on primary bearish market condition for the ranging between the following key support/resistance levels:

The price may start the bear market rally by the breaking 1.1459 and 1.1713 resistance levels from below to above, and we may see the local uptrend in this case only for example.