You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The dollar slid lower against the other major currencies on Friday as heightened geopolitical risks prompted investors to take profits following the greenback’s recent run higher.

The drop in the dollar came after the U.S. launched airstrikes in Iraq, in a bit to halt the advance of extremists in the country’s north, while a breakdown in the ceasefire between Israel and Gaza also soured market sentiment.

Meanwhile, fears over hostilities between Russia and Ukraine eased on Friday after Russia’s defense ministry said it had concluded military exercises it was holding close to the border with Ukraine.

EUR/USD was up 0.35% to 1.3410 late Friday, trimming the week’s losses to 0.13%.

On Thursday, European Central Bank President Mario Draghi indicated that the bank was pleased with the weaker exchange rate for the euro, which should help to bolster inflation and shore up exports.

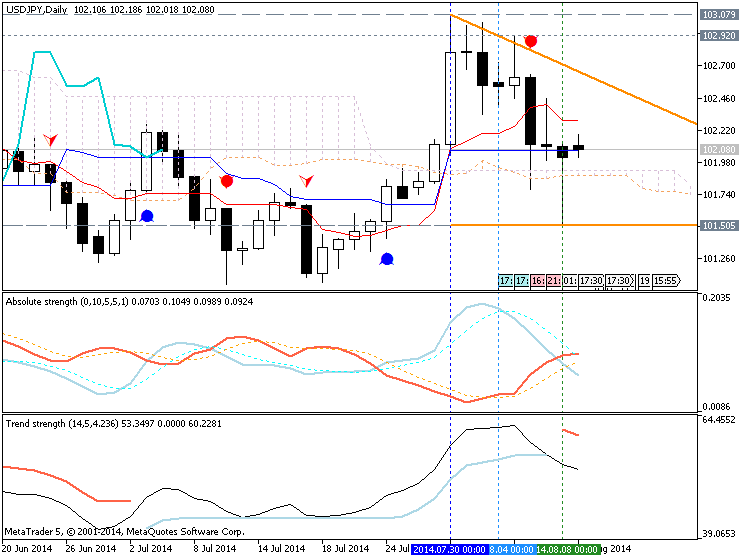

USD/JPY ended Friday’s session down 0.06% at 102.03, after falling to a more-than two week low of 101.50 earlier in the session.

The greenback was also weaker against the Swiss franc, with USD/CHF sliding 0.38% to 0.9053 at the close.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, was down 0.17% to 81.46, off Thursday’s 11-month highs of 81.78.

Elsewhere Friday, the Canadian dollar weakened against its U.S. counterpart after official data showed that the country’s economy added fewer than expected jobs in July.

Statistics Canada reported that the economy added just 200 jobs last month, falling well short of expectations for jobs growth of 20,000. The unemployment rate ticked down to 7.0% from 7.1% in June.

USD/CAD was up 0.45% to 1.0973 late Friday, from 1.0908 ahead of the release of the jobs report.

In the week ahead, investors will be continuing to monitor geopolitical risk, while preliminary data on second quarter growth from the euro zone and Japan will be closely watched. Markets watchers will also be looking ahead to Wednesday’s inflation report from the Bank of England and the U.S. report on retail sales.

Monday, August 11

- Japan is to release data on tertiary industry activity.

- Switzerland

is to publish data on retail sales, the government measure of consumer

spending, which accounts for the majority of overall economic activity.

- Later in the day, Canada is to release data on housing starts.

Tuesday, August 12- Australia is to release reports on business confidence and house prices.

- The U.K. is to release private sector data on retail sales.

- The

ZEW Institute is to release its closely watched report on German

economic sentiment, a leading indicator of economic health.

Wednesday, August 13- The Bank of Japan is to publish the minutes of its

latest policy meeting, which contain valuable insights into economic

conditions from the bank’s perspective.

- Japan is to

publish preliminary data on gross domestic product, the broadest

indicator of economic activity and the leading measure of the economy’s

health.

- Australia is to publish data on consumer sentiment and the wage price index.

- China is to release a report on industrial production.

- The

U.K. is to publish data on the change in the number of people employed

and the unemployment rate, as well as data on average earnings. Later in

the day, the BoE is to publish its quarterly inflation report and

Governor Mark Carney is to speak.

- The ZEW Institute is to publish a report on economic expectations in Switzerland, a leading indicator of economic health.

- The euro zone is to release data on industrial production.

- The U.S. is to publish data on retail sales and business inventories.

Thursday, August 14- New Zealand is to release data on retail sales as well as a private sector report on manufacturing activity.

- Japan is to publish data on machinery orders.

- The euro zone is to publish preliminary data on gross domestic product, in addition to revised data on consumer price inflation.

- Elsewhere in Europe, Switzerland is to release data on producer price inflation.

- Canada is to produce data on new house price inflation.

- The U.S. is to release the weekly report on initial jobless claims.

Friday, August 15The Australian dollar bounced off a nine-week low against its U.S. counterpart on Friday, as appetite for riskier assets strengthened after news reports that Russia ended military exercises on the Ukrainian border, easing concerns that an invasion could take place.

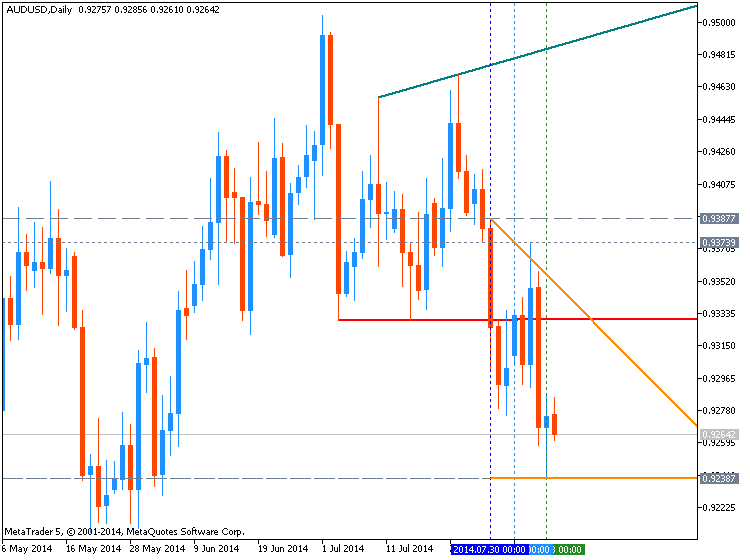

AUD/USD hit a daily low of 0.9239 on Friday, the pair’s weakest level since June 3, before subsequently consolidating at 0.9277 by close of trade, up 0.03% for the day but still 0.39% lower for the week.

The pair is likely to find support at 0.9228, the low from June 3 and resistance at 0.9356, the high from August 7.

Fears over hostilities between Russia and Ukraine eased on Friday after Russia’s defense ministry said it had concluded military exercises it was holding close to the border with Ukraine.

NATO warned earlier in the week that Russia massed around 20,000 combat-ready troops on Ukraine's border in preparation for a possible ground invasion.

Meanwhile, U.S. President Barack Obama authorized air strikes in Iraq to halt a Sunni insurgency there and to protect Iraqi civilians from the uprising as well as U.S. personnel in the country.

The Australian dollar sold off on Thursday after a poor employment report revived expectation that the Reserve Bank of Australia may cut interest rates again from the current record low.

Official data showed that the number of employed people in Australia fell by 300 in July, confounding expectations for an increase of 12,000. June's figure was revised down to a 14,900 gain from a previously estimated 15,900 rise.

The report also showed that Australia's unemployment rate rose to 6.4% last month, from 6.0% in June. Analysts had expected the unemployment rate to remain unchanged in July.

On Tuesday, the RBA left its benchmark interest rate unchanged at a record low 2.50% and reiterated that it expects borrowing costs to remain low for an extended period of time.

Commenting on the decision, RBA Governor Glenn Stevens said "the most prudent course is likely to be a period of stability in interest rates."

Data from the Commodities Futures Trading Commission released Friday showed that speculators decreased their bullish bets on the Australian dollar in the week ending August 5.

Net longs totaled 33,300 contracts, down from net longs of 39,606 in the preceding week.

In the week ahead, investors will continue to monitor geopolitical risk, while a U.S. report on July retail sales will also be in focus for further clues about the strength of the economy and the timing of future interest rate hikes.

Tuesday, August 12

- Australia is to release reports on business confidence and house prices.

Wednesday, August 13- Australia is to publish data on consumer sentiment and the wage price index.

- China is to release a report on industrial production. The Asian nation is Australia’s largest trade partner.

- The U.S. is to publish data on retail sales and business inventories.

Thursday, August 14- The U.S. is to release the weekly report on initial jobless claims.

Friday, August 15AUDUSD for Monday, August 11, 2014 (based on seekingalpha article)

The Australian dollar is trading in a very small trading range between 0.9270 and 0.9280 after dropping so sharply in to finish out last week from above 0.9350 down to a two week low at 0.9240. In the middle of last week the Australian dollar surged higher to a one week high near 0.9375, before easing back and then falling sharply. It had done well of late to cling onto the 0.93 level after its sharp fall last week which saw it move from above 0.9400 down to a seven week low just below 0.9300, and in more recent days receive solid support there too. A couple of weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance. The Australian dollar reached a three week high just shy of 0.9480 a few weeks ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week.

Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

AUDUSD TechnicalYen off highs as geopolitical tensions ease, sentiment fragile (based on reuters article)

Yen retreats from Friday's highs as safety demand slows

Markets still keeping a wary eye on geopolitical developments

The yen eased versus the dollar on Monday, having backed off from peaks hit late last week as a slight relaxation in geopolitical tensions dampened demand for the safe-haven Japanese currency.

The dollar inched up 0.1 percent to 102.17 yen, having bounced off Friday's two-week trough of 101.51. The euro edged up 0.1 percent to 136.91 yen , well off an 8-1/2 month low of 135.73 set on Friday.

News on Friday that Russia was ending military drills near the Ukrainian border helped U.S. stocks post their best one-day gain since March.

Asian shares were last up 0.9 percent, regaining some footing after having suffered their biggest weekly fall in nearly five months last week.

In a further boost to risk sentiment, Israel and the Palestinians agreed on Sunday to an Egyptian proposal for a new 72-hour ceasefire in Gaza starting at 2100 GMT.

"The conclusions from the weekend are that conflicts are cooling, and the risk-off events of the past two weeks may see upside risk as de-escalation spreads across the conflicts," said Evan Lucas, strategist at IG in Melbourne.

Trading the ZEW Economic Sentiment (based on forexminute article)

EUR/USD is trading at the crossroads ahead of a couple of ZEW Economic Sentiment data, most important of which for Germany and the Eurozone as a whole. Let’s take a look at the fundamental factors first.

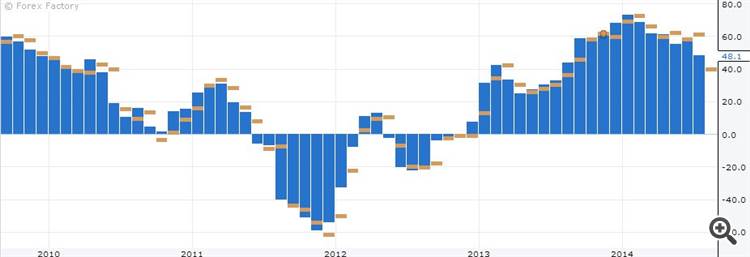

German ZEW Economic Sentiment – Forecast: 18.2, Previous 27.1

Eurozone ZEW Economic Sentiment – Forecast: 41.3, Previous 48.1

The readings since 2010 for both of these data points show that sentiment has been positive since 2013, but looks to have made a downturn early this year. Readings have missed forecasts and have been trending down. This reflects the credit issues lingering in the Eurozone, slower growth seen in Q2, and the geopolitical tensions escalating in Q3.

The EUR/USD has been falling since the 1.3993 high made in May, which is also the current high on the year. As we began this week, EUR/USD still looks pressured in the 1H chart.

EUR/USD 1H Chart 8/12

Here are some observations:

1) Price structure of the Monday (8/11) session has been corrective. It looks like a flag pattern.

2) The bullish momentum from Friday’s push looks lost as the 1H RSI dips below 40 at the start of the 8/12 Asian session.

3) Failure of price to push and stay above the 200-, 100-, and 50- simple moving averages (SMAs) is a sign that bulls are losing control.

4) However, the rising trendline from last week is still intact.

5) There is also a key support/resistance pivot at 1.3365.

Scenarios Around the ZEW Economic Sentiment data:

1) Now, a break below 1.3365 could be a bearish continuation signal. IF the ZEW comes in worse than expected, AND price indeed falls below 1.3365, we should look for a bearish outlook toward the 1.3340 area, then the 1.3295-1.33 lows from Nov. 2013. If there is a pullback after the break below 1.3365, there should be sellers in the 1.3390-1.34 area if this bearish scenario were to materialize.

2) Now, if the data is soft, and price dips below 1.3365, but you get a sharp rejection and price climbs quickly back up above 1.34, we are likely in a bullish correction scenario for the short-term, with upside toward the 1.3444 August high, and a key resistance.

3) If data is better than expected and you see an initial reaction push towards 1.3390-1.34 area but settle and fail to break by day’s close, we are likely to see further weakness toward the 1.3340 area.

4) If good data can push EUR/USD back above 1.34, there is a chance that EUR/USD has legs this week for a bullish correction toward the 1.3444 area. However, because this is consolidation mode, it might be prudent to wait for price to break above 1.34, then wait for a pullback to the 1.3390-1.34 area before confirming the bullish attempt.

We know EUR/USD has been bearish, but it looks due for a consolidation, or a short-term bullish correction. If ZEW economic data is soft, look for price to remain neutral-bearish. Strong data might pave the way for a more bullish consolidation with upside limited to 1.3444 for now. Basically, going with the prevailing bearish trend, we should have a more bearish bias, unless price is able to stay north of 1.34.

2014-08-12 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

if actual > forecast = good for currency (for AUD in our case)

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

==========

Australia Business Confidence Climbs In July

An index measuring business confidence in Australia touched a four-year high in July, the latest survey from National Australia Bank revealed on Tuesday - showing a score of +11.

That's up from +8 in June.

The index for business conditions came in with a score of +2, rising from +2 in the previous month.

Among the individual components of the survey, home construction, retailing, sales, profitability and employment all showed improvement in July, the bank said.

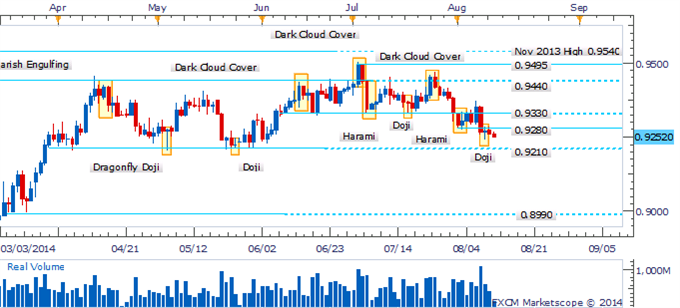

AUDUSD Technical Analysis (based on dailyfx article)

The Australian Dollar has resumed its descent in recent trading with an absence of bullish reversal signals casting doubt on the potential for a recovery. This sets the Aussie up for a make-or-break moment as it drifts towards its range-bottom at 0.9210. A daily close below the nearby barrier would pave the way for a sustained decline to the 0.8990 mark.

Test of 0.9210 To Offer Make-Or-Break Moment:

2014-08-13 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

if actual > forecast = good for currency (for AUD in our case)

[AUD - Westpac Consumer Sentiment] = Change in the level of a diffusion index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

Trading the News: Bank of England (BoE) Inflation Report (based on dailyfx article)

The Bank of England’s (BoE) Inflation report is likely to heavily influence the near-term outlook for the GBP/USD as the central bank looks to move away from its easing cycle.

What’s Expected:

Why Is This Event Important:

Indeed, the updated forecasts for growth and inflation is likely to spur increased volatility in the British Pound, but we would need to see Governor Mark Carney show a greater willingness to normalize monetary policy in 2014 for the GBP/USD to resume the upward trend carried over from the previous year.

Sticky inflation paired with the ongoing improvement in the labor market may spur a greater dissent within the Monetary Policy Committee (MPC), and the GBP/USD may carve a key low in August should the fresh batch of central bank rhetoric boost interest rate expectations.

Nevertheless, the BoE may introduce a more relaxed approach in normalizing policy amid the ongoing slack in the U.K. economy, and the GBP/USD may face a larger decline over the remainder of the month if Governor Carney adopts a more neutral tone for monetary policy.

How To Trade This Event Risk

Bullish GBP Trade: BoE Sees Scope to Raise Benchmark Interest Rate in 2014

- Need green, five-minute candle following the statement to consider a long British Pound trade

- If market reaction favors buying sterling, go long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: Governor Carney Talks Down Rate Expectations- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBPUSD Daily

- Interim Resistance: 1.7200 Pivot to 1.7220 (100.0% expansion)

- Interim Support: 1.6697 (June low) to 1.6730 (61.8% expansion)

Impact that the BoE Inflation Report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

The Bank of England (BoE) struck an improved outlook for the U.K. economy and said that spare capacity has ‘narrowed’ somewhat, but the fresh batch of central bank rhetoric did little to boost interest rate expectations as Governor Mark Carney argued that there needs to be a further reduction in the economic slack before the Monetary Policy Committee (MPC) can start to normalize monetary policy. The British Pound struggled to hold its ground following the statement, with the GBP/USD dipping below the 1.6800 handle, and the sterling continued to weaken during the U.S. trade as the pair ended the day at 1.6764.

2014-08-13 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

if actual > forecast = good for currency (for AUD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity

==========

U.S. Retail Sales Unexpectedly Flat In July

Retail sales in the U.S. unexpectedly came in unchanged in the month of July, according to a report released by the Commerce Department on Wednesday.

The Commerce Department said retail sales were virtually unchanged in July after edging up by 0.2 percent in June. Economists had been expecting another 0.2 percent increase.

Excluding a modest drop in auto sales, retail sales inched up by 0.1 percent in July compared to a 0.4 percent increase in the previous month.