And this pair of next week, the two have to be careful. Possible reversal of reducing ...

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.07 11:07

Forex Weekly Fundamentals - Outlook June 9-13Rate decision in New Zealand and Japan, employment data in the UK, Australia and the US and US retail sales are the highlights of this week. Here is an outlook on the main market-movers coming our way.

Last week, US Non-Farm Payrolls showed a 217K gain in jobs in May reinforcing estimates that the five-year-long recovery has accelerated this spring. April’s jobs addition was the best in more than two years. Meanwhile the unemployment rate remained unchanged at 6.3% in May, matching the lowest level since September 2008. Analysts expected a lower job addition of 214,000 and a higher unemployment rate of 6.4%. May’s advance tops the average monthly gain of about 200,000 during the past year. Will this positive trend continue?

- UK employment data: Wednesday, 8:30. U.K. jobless claims declined less-than-expected in April, down 25,100 from 30,600 in the previous month while economists expected a contraction of 30,700 claims. However the rate of unemployment declined to 6.8% in the three months to March from 6.9% in the three months to February, in line with market forecast. The average earnings increased by a seasonally adjusted 1.7% in the three months to March, the same as in the prior three months, lower than the 2.1% rise expected. The number of unemployed is expected to decline further by 25,000 and the unemployment rate is expected to decline to 6.7%.

- US Federal Budget Balance: Wednesday, 18:00. The US government posted a large $106.9 billion surplus in April, lowering deficit to $305.8 billion for a dramatic 37% improvement from this time last year. Receipts were on the rise led by a11% fiscal year-to-date increase in corporate taxes and a 7% increase in individual taxes. The rate of improvement indicates a positive trend of deficit contraction. Us Federal budget is predicted to show a 142.8billion deficit this time.

- NZ rate decision: Wednesday, 21:00. Governor of the Reserve Bank of New Zealand, Graeme Wheeler decided to raise rates by 25 basis points to 3.0% in April in light of positive growth in New Zealand’s economic activity. The rate hike was in line with market forecast. Prices for New Zealand’s export commodities remain very high, despite a 20% drop in auction prices for dairy products in recent months. Domestically, the long period of low interest rates and the strong expansion in the construction sector led to strong recovery. The RBNZ is expected to increase rates once more by 0.25% to 3.25%.

- Australian employment data: Thursday, 1:30. Australia’s unemployment rate remained steady at 5.8% in April, amid positive signs of recovery in the labor market. The number of people employed increased by 14,200 to 11.57 million in April. Full-time employment edged up 14,200 to 8.05 million during the period. Part-time employment remained unchanged at 3.53 million. If the rate of improvement continues, the RBA may have to consider raising rates. Australian job addition is expected to reach 10,300, while the unemployment rate is expected to grow to 5.9%.

- US retail sales: Thursday, 12:30. U.S. retail sales were slow in April after strong gains posted in the previous two months, but the overall growth trend for the second quarter remains robust. Retail sales edged up 0.1% affected by declines in receipts at furniture, electronics and appliance stores, restaurants and bars and online retailers. Retail sales edged up 1.5% in March after a 1.1% advance in February following stagnation during the cold winter season. April’s low reading may reflect growing caution amid consumers waiting to confirm economic recovery. Meanwhile, Core sales, excluding automobiles, remained unchanged in April after advancing 1.0% in March, much lower than the 0.6% rise anticipated by analysts. U.S. retail sales are expected to grow by 0.5% , while core sales are predicted to gain 0.4%.

- US unemployment claims: Thursday, 12:30. The number of US jobless claims rose last week to 312,000 from 304,000 in the prior week, but the general trend continues to point to a strong labor market. Analysts expected a smaller increase to 309,000. The four-week average fell 2,250 to 310,250, the lowest level since June 2007. Even if job growth slows in May as expected, economists say it should not be viewed as a loss of momentum in the labor market and the economy as payrolls would still be above the average for the preceding six months. US jobless claims are expected to reach 306,000 this week.

- Stephen Poloz speaks: Thursday, 15:15.BOC Governor Stephen Poloz will speak in Ottawa. Market volatility is expected.

- Mark Carney speaks: Thursday, 22:00.BOE Governor Mark Carneywill speak in London. Carney may talk about the BOE’s latest rate decision and the reasons for maintaining monetary policy in June. Volatility is expected.

- Japan rate decision: Friday. The Bank of Japan maintained rates in May, renewing their commitment to boost monetary base by 60-70 trillion yen per year. The bank statement said Japan’s economy is progressing according to forecasts and capital spending is expected to advance in the coming weeks. Exports are stable and will remain unchanged according to the forecast. No change in rates is exected.

- US PPI: Friday, 12:30. The prices that U.S. finished goods increased 0.6% in April, following a 0.5% rise in March indicating a rising inflation trend. The reading was above market forecast of a 0.2% increase. The increase was led by higher food prices and greater retailer and wholesaler profit margins. On a yearly base, producer prices increased 2.1%, the biggest rise in more than two years. US producer prices are expected to gain 0.1% this time.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. US consumer sentiment declined to 81.8 and in May from 84.1 in April mainly due to lower rating in the current conditions index, down to 95.1 from 98.7 in April. Analysts expected the index to rise to 84.7. The outlook component also slipped to 73.2 from 74.7. However, overall data indicates consumer sentiment continues to its positive trend despite recent financial market volatility. US consumer moral is expected to rise to 83.2.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.07 20:07

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Bearish- Australian, Chinese Economic Data to Reinforce RBA Policy Standstill

- Firming Bets on Fed Stimulus Withdrawal Likely to Hurt Aussie Dollar

Domestically, the spotlight will be on May’s Employment data and

a round of Chinese economic indicators. The former is expected to show

hiring slowed, with the economy adding 10,000 jobs compared with the

14,000 increase in April. The jobless rate is expected to tick higher

to 5.9 percent. Australian economic data has increasingly

underperformed relative to expectations since mid-April, hinting

economists are overestimating the economy’s performance and opening the

door for downside surprises.

Meanwhile, Chinese news-flow has markedly improved over recent weeks, suggesting expected improvements in May’s trade, industrial production, retail sales and inflation figures

may prove larger than what is implied by consensus forecasts. Taken

together, this may reinforce the monetary policy standstill telegraphed

in last week’s RBA rate decision, putting the onus on external factors

to drive price action. On the macro front, Federal Reserve policy speculation remains in focus. As we’ve discussed previously,

the fate of the FOMC’s effort to “taper” QE asset purchases with an

eye to end the program this year – paving the way for interest rate

hikes – has been a formative catalyst for the markets this year. Last

week’s supportive ISM data set, upbeat Fed Beige Book survey and

marginally better-than-expected expected US jobs report sets the stage

for continued reduction of monthly asset purchases and increasingly

unencumbered speculation about outright tightening to follow. The week

ahead brings further evidence by way of May’s Retail Sales and PPI figures as well as June’s preliminary University of Michigan Consumer Confidence

print. Improvements are expected on all fronts.

Furthermore, US

economic data has looked increasingly rosier relative to forecasts over

the past two months, meaning surprise risks are tilted to the upside.

That stands to narrow the Aussie’s perceived future yield advantage in

the minds of investors. Firming bets on US stimulus withdrawal may

likewise drive broader risk aversion. Needless to say, all of this bodes

ill for the currency.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.08 15:36

Forex Fundamentals - Weekly outlook: June 9 - 13The dollar pushed higher against the other major currencies on Friday after the nonfarm payrolls report for May indicated that the U.S. labor market is continuing to gradually improve.

The Department of Labor reported that the U.S. economy added 217,000 jobs last month, just under expectations for jobs growth of 218,000, while April's figure was revised to 282,000. The unemployment rate remained steady at a five-and-a-half year low of 6.3%.

EUR/USD initially touched a two-week high of 1.3677 following the release of the data, before pulling back to 1.3642 late Friday. For the week, the pair was 0.34% higher.

The U.S. jobs report came one day after the European Central Bank unveiled a package of measures to avert the threat of persistently low inflation in the euro area, briefly sending the single currency to four month lows of 1.3502 against the dollar, before later erasing the day’s losses.

The ECB cut the main refinancing rate in the euro area to a record low 0.15% and imposed negative deposit rates on commercial lenders, in a bid to stimulate lending to businesses.

The bank also implemented a new Long-Term Refinancing Operation, designed to help banks lend to small companies and said it would "intensify" its preparatory work on the 'asset-backed security' market.

The ECB acted after a report showed that the annual rate of inflation in the euro zone slowed to 0.5% in May, far below the ECB’s target of close to but just under 2%.

The dollar inched higher against the yen on Friday, with USD/JPY at 102.47 at the close of trade, recovering from session lows of 102.12 struck immediately after the jobs data was released.

The dollar was also higher against the pound and the Swiss franc, with GBP/USD slipping 0.11% to 1.6801 and USD/CHF rising 0.24% to 0.8933.

Elsewhere Friday, the Canadian dollar ended slightly lower against the U.S. dollar following the release of a lackluster domestic jobs report.

Statistics Canada reported that the economy added 25,800 jobs in May, above expectations for 25,000, but gains were due to the creation of part time positions, while the unemployment rate ticked up to 7.0% from 6.9% in April.

USD/CAD touched highs of 1.0948 before settling at 1.0931 late Friday.

In the week ahead, investors will be looking ahead to Thursday’s U.S. retail sales report for further indications on the strength of the economic recovery. A rate review by New Zealand’s central bank and the latest U.K. jobs report will also be in focus.

Monday, June 9

- Markets in Australia are to remain closed for a national holiday.

- Japan is to release revised data on first quarter growth, as well as reports on the current account and bank lending.

- Canada is to publish data on housing starts.

- Japan is to release data on tertiary industry activity.

- Australia is to publish private sector data on business confidence, as well as official data on home loans.

- China is to produce data on consumer and producer prices.

- In the euro zone, France is to publish data on industrial production. Elsewhere in Europe, Switzerland is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.K. is to release data on industrial and manufacturing production.

- Japan is to publish the latest reading of its BSI manufacturing index.

- Australia is to release private sector data on consumer sentiment.

- The U.K. is to publish data on the change in the number of people employed and the unemployment rate, as well as data on average earnings.

- The Reserve Bank of New Zealand is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision. The bank is also to hold a press conference to discuss the monetary policy decision.

- Japan is to produce data on core machinery orders.

- Australia is to release data on the change in the number of people employed and the unemployment rate, and a private sector report on inflation expectations.

- The euro zone is to release data on industrial production, while the ECB is to publish its monthly bulletin.

- Canada is to publish data on new house price inflation, while Bank of Canada Governor Stephen Poloz is to speak at an event in Ottawa.

- The U.S. is to release the weekly report on initial jobless claims, in addition to data on retail sales and import prices.

- BoE Governor Mark Carney is to speak at an event in London.

- New Zealand is to release private sector data on manufacturing activity.

- The Bank of Japan is to announce its benchmark interest rate and publish its monetary policy statement, which outlines economic conditions and the factors affecting the bank’s decision. The announcement is to be followed by a press conference.

- China is to release data on industrial production and fixed asset investment.

- Canada is to publish data on manufacturing sales.

- The U.S. is to round up the week with data on producer price inflation and preliminary data on consumer sentiment from the University of Michigan.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.10 09:01

2014-06-10 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

- past data is 7

- forecast data is n/a

- actual data is 7 according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

==========

Australia Business Confidence Index Flat In May - NAB

An index measuring business confidence in Australia was relatively unchanged in May, the latest survey from National Australia Bank revealed on Tuesday - showing a score of 7, the same as in April.

The index for business conditions dipped into negative territory, sliding to -1 from 0 a month earlier.

NAB economist Alan Oster said the readings were a surprise, especially in light of the drastic spending cuts unveiled in the latest budget.

"This is a little surprising given consumer reactions to the budget and the persistently soft business conditions that firms are reporting," Oster said.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 15 pips price movement by AUD - NAB Business Confidence news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video June 2014

newdigital, 2014.06.10 11:45

Markets Weekly Market Update 10/06/2014

Markets Weekly Market Update going through technical analysis on EURUSD,

GBPUSD, USDJPY, USDCHF, AUDUSD and XAUUSD. No trade calls or

recommendations are made in this video

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.10 19:11

Aussie Moves Higher with Help from Domestic & China’s Data

The Australian dollar rallied against its US peer and erased losses

versus the Japanese yen today with help of rather positive domestic

business confidence and good economic data from China.

The business confidence index of National Australia Bank remained unchanged in May. The report commented on this:

Other Australian reports were not as good, with no growth in the number of home loans in April (even though analysts predicted an increase by 0.3 percent) and the drop of job advertisements. The Aussie was still able to make a move higher with support of positive data from China, the biggest Australia’s trading partner.

AUD/USD went up from 0.9275 to 0.9295 as of 16:07 GMT today after

falling to 0.9257 earlier. AUD/JPY near the opening level of 92.29

following the drop to 94.94.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.08 15:41

AUD/USD Fundamentals - weekly outlook: June 9 - 13The Australian dollar rose to a more than two-week high against its U.S. counterpart on Friday, after the highly-anticipated U.S. nonfarm payrolls report for May came in broadly in line with market expectations.

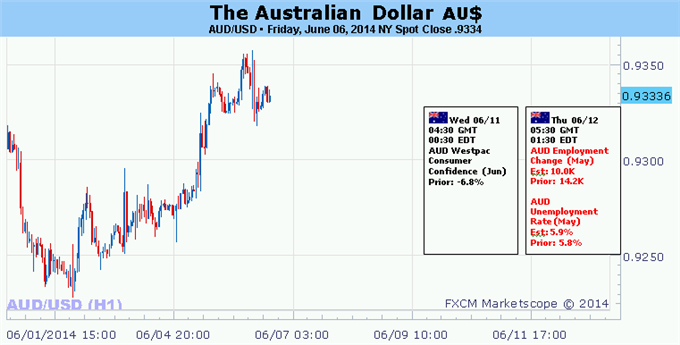

AUD/USD hit 0.9358 on Friday, the pair’s highest since May 19, before subsequently consolidating at 0.9334 by close of trade on Friday, down 0.06% for the day but 0.25% higher for the week.

The pair is likely to find support at 0.9256, the low from June 5 and resistance at 0.9358, the high from June 6.

The Department of Labor said Friday that the U.S. economy added 217,000 jobs last month, just under expectations for jobs growth of 218,000. The unemployment rate remained steady at a five-and-a-half year low of 6.3%.

The data disappointed some market expectations for a more robust reading but indicated that the U.S. economy continued to shake off the effects of a weather-related slowdown over the winter, bolstering the outlook for the broader economic recovery.

Meanwhile, in Australia, official data released Wednesday showed that the Pacific nation’s economy grew at a rate of 1.1% in the first quarter, above expectations for an expansion of 0.9%.

On Tuesday, the Reserve Bank of Australia left its benchmark interest rate at 2.5% in a widely expected move and said that "on present indications, the most prudent course is likely to be a period of stability in interest rates."

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the Australian dollar in the week ending June 3.

Net longs totaled 21,527 contracts, compared to net longs of 15,848 in the preceding week.

In the week ahead, investors will be looking ahead to Thursday’s U.S. retail sales report for May for further indications on the strength of the economic recovery.

Australian employment data for May due Thursday will also be closely-watched.

Monday, June 9

- Markets in Australia are to remain closed for a national holiday.

- Australia is to publish private sector data on business confidence, as well as official data on home loans.

- China is to produce data on consumer and producer prices. The Asian nation is Australia’s largest trade partner.

- Australia is to release private sector data on consumer sentiment.

- Australia is to release data on the change in the number of people employed and the unemployment rate, and a private sector report on inflation expectations.

- The U.S. is to release the weekly report on initial jobless claims, in addition to data on retail sales and import prices.

- China is to release data on industrial production and fixed asset investment.

- The U.S. is to round up the week with data on producer price inflation and preliminary data on consumer sentiment from the University of Michigan.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.12 09:46

2014-06-12 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]- past data is 10.3K

- forecast data is 10.3K

- actual data is -4.8K according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

Australia Unemployment Rate Stable In May

The unemployment rate Australia remained stable for the third consecutive month in May, a report from the Australian Bureau Of Statistics showed Thursday.

The unemployment rate came in at 5.8 percent in May, the same rate as in April and March. Compared to a year ago, the unemployment rate rose 0.3 percentage points in May.

The number of unemployed people rose by 3,200 over the month to 717,100 in May. Out of the total, the number of unemployed looking for full-time work rose 9,000 to 529,700 and for part-time it decreased 5,900 to 187,400.

The number of employed people fell 4,800 over the month to 11,564,600. The number of full-time employees rose 22,200 while number of part-time employees fell 27,000 in May.

However, the participation rate fell to 64.6 in May from 64.7 in April.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 33 pips price movement by AUD - Employment Change news event

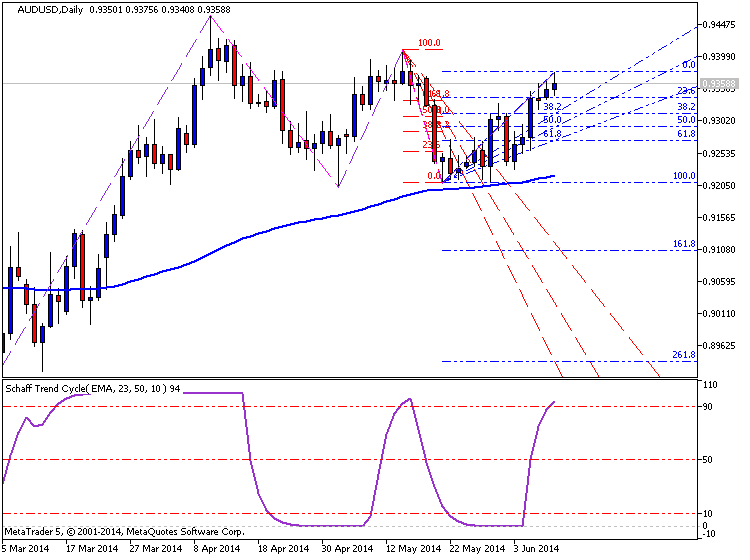

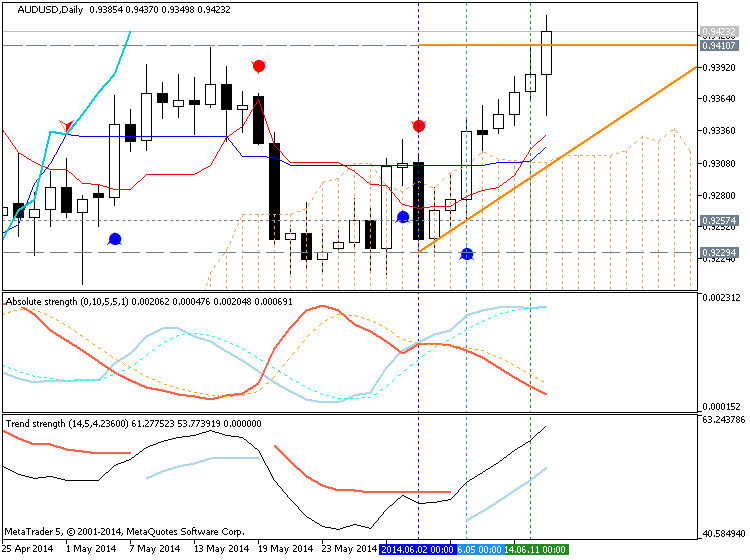

D1 price crossed Sinkou Span A line to be above Ichimoku cloud/kumo, and it was stopped by 0.9346 resistance level.

If not so we may see the ranging market condition.

- Recommendation for long: watch D1 price for breaking 0.9346 resistance levels on close bar for possible buy trade

- Recommendation to go short: n/a

- Trading Summary: ranging

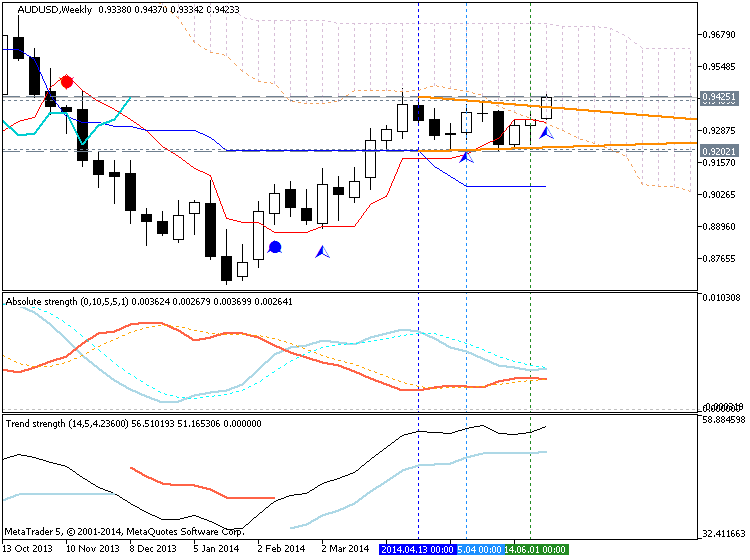

D1 price broke 0.9346 resistance. If you placed buy stop order at 0.9346 price so you will get 77 pips for now :

Next resistance is on W1 chart: 0.9425

Seems, the breakout is going on for D1 timeframe and for W1 timeframe as well.

It is very similar situation for some other pairs - breakout or breakdown for D1 timeframe.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price crossed Sinkou Span A line to be above Ichimoku cloud/kumo, and it was stopped by 0.9346 resistance level.

H4 price is on bullish ranging between 0.9318 support and 0.9358 resistance levels..

W1 price is moving along virtual border between primary bullish and primary bearish (Sinkou Span A line) with flat market condition.

If D1 price will break 0.9346 resistance level so the primary bullish will be continuing.

If not so we may see the ranging market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-06-08 02:30 GMT (or 04:30 MQ MT5 time) | [CNY - Trade Balance]

2014-06-09 16:00 GMT (or 18:00 MQ MT5 time) | [AUD - RBA Gov Stevens Speech]

2014-06-10 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2014-06-10 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-06-11 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Westpac Consumer Sentiment]

2014-06-12 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

2014-06-12 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-06-13 05:30 GMT (or 07:30 MQ MT5 time) | [CNY - Industrial Production]

2014-06-13 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-06-13 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart