You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

HFT with Haim Bodek

Haim Bodek, former CEO of Trading Machines, a Prominent High Frequency Trading firm based in Connecticut, joins Merlin for a look into what has been happening in the HFT world. Haim takes a look at some of the significant changes which may ultimately change the landscape of the financial markets just like litigation did back in 1996! The duo also talk about Haim’s new class on HFT and system trading.

2014-08-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - PPI]

if actual > forecast = good for currency (for AUD in our case)

[AUD - PPI] = Change in the price of finished goods and services sold by producers. It's a leading indicator of consumer inflation - when producers charge more for goods and services the higher costs are usually passed on to the consumer.

==========

Australia PPI Gains 2.3% On Year In Q2

Final demand producer prices climbed 2.3 percent on year in the second quarter of 2014, the Australian Bureau of Statistics said on Friday - slowing from the 2.5 percent increase in the previous three months.

On a quarterly sequential basis, final demand producer prices dipped 0.1 percent after climbing 0.9 percent in the first quarter.

Trading the News: U.S. Non-Farm Payrolls (NFP) (based on dailyfx article)

U.S. Non-Farm Payrolls (NFP) are anticipated to increase another 231K in July, and a positive employment print may produce a further decline in the EUR/USD as it puts increased pressure on the Federal Reserve to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

The deviation in the policy outlook favors a bearish outlook for the EUR/USD as the European Central Bank (ECB) stands ready to implement more non-standard measures, and the NFP print may generate fresh 2014 lows in the euro-dollar should the release boost the interest rate outlook for the U.S.

The resilience in private consumption along with the marked rebound in economic activity may encourage firms to further expand their labor force, and a better-than-expected NFP print should produce a bullish reaction in the U.S. dollar as puts increased pressure on the Federal Open Market Committee (FOMC) to move away from its zero-interest rate policy (ZIRP).

However, the downturn in business confidence along with the rise in planned job cuts may produce further headwinds for the U.S. labor market, and a dismal employment report may undermine the bullish sentiment surrounding the reserve currency as it raises the Fed’s scope to retain the highly accommodative policy stance for an extended period of time.

How To Trade This Event Risk

Bullish USD Trade: NFPs Rises 231K+; Unemployment Holds at 6.1%

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Employment Print Falls Short of Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Remains at Risk for Further Decline as Long as RSI Holds Below 30

- Interim Resistance: 1.3580 (23.6% expansion) to 1.3600 Pivot

- Interim Support: 1.3300 Pivot to 1.3310 (78.6% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

June 2014 U.S. Non-Farm Payrolls

EURUSD M5 : 48 pips price movement by USD - Non-Farm Employment Change news event

AUDUSD M5 : 40 pips price movement by USD - Non-Farm Employment Change news event

The U.S. economy added another 288K jobs in June following a revised 224K advance the month prior, while the jobless rate unexpectedly narrowed to an annualized 6.1% from 6.3% in May. The better-than-expected NFP print propped up the greenback, with the EUR/USD slipping below the 1.3625 region, and the reserve currency retained the bullish reaction going into the end of the week as the pair closed at 1.3608.

The US dollar was the star during most of the week, although it lost some of its shine towards the end. Rate decisions in Australia, the UK, Japan and the Eurozone, Employment data, in Australia, Canada and US trade data are some of the highlight events on Forex calendar. Here is an outlook on the main market movers for this week.

The US dollar was on a roll in the past week: the excellent GDP report that showed 4% Q2 growth (annualized) and speculation about an upcoming rate hike (despite a not-too hawkish Fed) boosted the greenback. The below expectations Non-Farm Payrolls report took out some of the shine of the greenback, but the US economy continues doing well. In the euro-zone, inflation fell deeper, to 0.4%, and cast a dark cloud on not-too-shabby employment and consumption data. The pound continued falling on more weak data in what looks like a u-turn rather than a correction. Weak data in Japan helped USD/JPY move higher and weak Australian data finally sent the Aussie below 0.93. The kiwi and the loonie were not spared, but also managed to stage a recovery in an exciting week.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video August 2014

newdigital, 2014.08.02 12:08

Trading Video: Dollar, Euro and Equities Top Market Movers Next Week

The durability of two burgeoning fundamental themes will draw FX traders' attention this week: the permanence of the most recent swoon in risk trends and the dollar's charge on rate expectations. Following incredible momentum on both fronts this past week, tell-tale hesitation began to arise before terminal velocity was met. For the greenback, the NFPs and employment data may have knocked the currency off pace; and the lack of heavy event risk ahead may create trouble for bulls. Market-wide speculative positioning presents a much more comprehensive threat / opportunity. The transition from a backdrop of quiet congestion to one of trend development rests with on a particular bearing in sentiment. Will volatility hold out long enough to mark that evolution? We discuss these and other major trading themes in the Weekend trading video.

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: NeutralThe Australian Dollar faced heavy selling pressure last week, with prices dropping through the bottom of a range that contained price action since the beginning of June. The force behind the move lower came from external factors: an impressively strong second-quarter US GDP figure and an easing of the FOMC’s concern about persistently low inflation hinted Janet Yellen and company may move swiftly to raise rates after the QE3 asset purchase program is wound down in October.

The recovery may prove short-lived however as domestic factors return to the spotlight. The RBA monetary policy announcement seemingly ought to take top billing, but officials are unlikely to offer up anything unheard of in recent months. Another restatement of the commitment to hold rates unchanged for the foreseeable future may force a pause in the Aussie’s recovery, but the likelihood of another strong push lower will probably hinge on July’s employment figures. A net jobs gain of 13,200 is expected, marking a slowdown from the previous month’s 15,900 increase. Furthermore, Australian economic data has increasingly underperformed relative to consensus forecasts since mid-April, opening the door for a downside surprise. Such a result is likely to extend the perceived length of the standstill on the monetary policy front, undermining yield-based support for the Aussie and forcing prices lower in earnest.

10 Weekend Reads

• Opposable thumbs, upright posture, big brains, sophisticated language: What most effectively sets humans apart from other species? Our addiction to stories (Edge)

• .@HiddenCash Revealed: Making Generosity Go Viral (TechCrunch)

• SCOTUS: The Anti-Court Court (New York Review of Books)

• What Do Chinese Dumplings Have to Do With Global Warming? (NY Times)

• We All Got Trolled (Medium)

• Windhorst: LeBron’s mighty memory (ESPN) see also Playground basketball is dying (ESPN)

• The Miraculous Face Transplant of Richard Norris (GQ)

• Washington’s Economic Boom, Financed by You (NY Times)

• This is a spider’s brain on drugs (Priceonomics)

• Our 25 Favorite Unlocked New Yorker Articles (Longform)

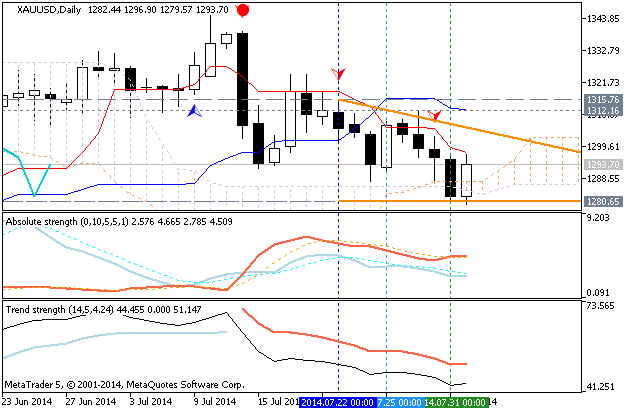

XAUUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: NeutralGold prices are lower for a third consecutive week with the precious metal off by 0.90% to trade at $1295 ahead of the New York close on Friday. The losses mark a 2.47% decline for the month of July and come amid renewed strength in the greenback with the Dow Jones FXCM Dollar Index breaking through trendline resistance dating back to the 2013 high on the back of a stellar 2Q GDP print and a more upbeat assessment of the economy from the Federal Reserve. However with a miss on the July employment report and a massive sell-off in broader equity markets, the gold bulls may not be ready to give up just yet.

The release of the second quarter GDP figures on Wednesday fueled a massive rally in the US Dollar after the print showed an annualized growth rate of 4% q/q, far surpassing expectations of a 3% read. The release also saw an upward revision to the 1Q print from -2.9% to -2.1% with personal consumption and also topping market estimates. The FOMC interest rate decision released later that day further exacerbated the dollar’s move with the policy statement citing a more cautiously optimistic assessment of the labor markets and inflation while explicitly noting the reasons for the sole descent from Mr Charles Plosser, “who objected to the guidance indicating that it likely will be appropriate to maintain the current target range for the federal funds rate for "a considerable time after the asset purchase program ends," because such language is time dependent and does not reflect the considerable economic progress that has been made toward the Committee's goals.” The developments saw interest expectations bought in with the greenback mounting an offensive that took to the dollar index to highs not seen since April as US Treasury yields moved higher.

The July NFP report came in short of market expectations with a print of 209K missing calls for a read of 230K with the headline unemployment rate ticking higher to 6.2% from 6.1%. Despite the uptick however, it’s important to note that the move was accompanied by a broadening of the labor force with the participation rate moving up to 62.9% from 62.8% and an upward revision to last month’s blowout print NFP print from 288K to 298K. With the dollar seemingly well supported here, topside advances in gold are likely to remain limited with the biggest variable for gold traders being the recent sell-off in risk assets. Looking ahead to next week, traders will be closely eying the slew of central bank rate decision on tap with the RBA, BoJ, ECB and BoE on tap. Look for broader market sentiment to steer gold prices with a more significant sell-off in stocks likely to help support the battered metal in the near-term.

From a technical standpoint, the July calendar month proved to be a textbook opening range play with the break of the initial monthly lows on the 14th shifting the bias to the short side mid-month. The end result saw gold close July AT THE LOWS before rebounding off near-term support on the back of Friday’s NFP miss. Support now stands at the 61.8% retracement of the June advance at $1280 and this level will now serve as our initial range low as we open up August trade. Key support and our bullish invalidation threshold rests just lower in the zone between $1260-$1270- a region which is defined by key longer-term Fibonacci ratios and has served as a major pivot in gold dating back to June of 2013. Resistance stands at last week’s high at $1312 and is backed by our bearish invalidation level at $1320/21. Friday’s rally has now pared the entire Thursday decline and with the USDOLLAR index looking to post an outside reversal candle at fresh three-month highs, the risk for a near-term continued push higher in Gold (lower in USD) to open the month remains. As such, while our broader outlook remains weighted to the downside we’ll maintain a more neutral tone heading into the start of the month pending a break of the initial July opening ranged. Bottom line: looking for an early-mid month rally to sell.

Gold (XAUUSD) Technical Analysis for the week of August 4, 2014

The gold markets as you can see fell during the course of the week, but overall found enough support just below the $1300 level to bounce and form something along the lines of a hammer. This hammer of course isn’t perfect, but it does tell us that the market still has a bit of a fight in it as far as keeping somewhat afloat. Ultimately, we believe that the market has back towards the $1350 level, and as a result we have no interest in selling. We think it could be choppy, but ultimately this market is fairly bullish.