You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.29 13:21

Forex snapshot

Pound regains lost groundSterling has pulled back some of the losses it incurred this week as traders await the US GDP report at 1.30pm (London time).

The pound is trading at $1.6728, up 0.1% on the day after mixture of short covering and bargain hunting helped sterling. The main focus of the day is the US gross domestic product report, and the consensus is for a decline of 0.6%. This will give a good indication of what the Federal Reserve will do next.

The pound has been in a downward trend versus the US dollar this week as softer-than-expected updates from the UK dragged on the pound. Bad weather in the US was blamed for the poor growth during the first three months of the year. A strong GDP report could see the pound head lower towards the $1.66 level; to the upside we could target the 100-hour moving average of $1.6804.

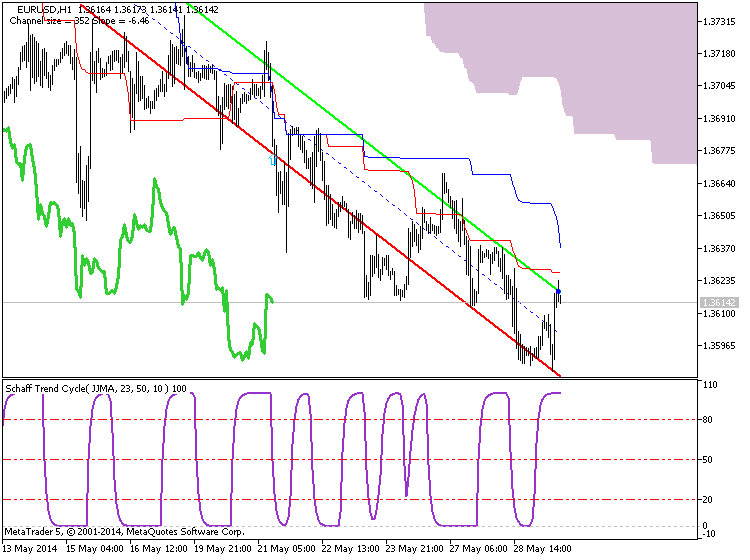

Euro higher ahead of US GDPThe euro is back above the $1.36 level, up 0.18% on the day as dealers look ahead to the GDP report from the US.

As I mentioned previously, the euro has been in a downward spiral versus the US dollar for the past three weeks, as there is speculation that the European Central Bank will introduce a stimulus package to tackle deflation in the eurozone.The euro is trading at $1.3615 as traders square up their books before the US reveals its preliminary GDP report, and analysts are expecting a decline of 0.6%. If the report is worse than expected we could target $1.3660, however a strong growth report could drive the euro to $1.3550.

Different indicators and all the sea, but still convenient to trade "horizon".

The horizon is better visually visible support and resistance levels.

Personally, my opinion.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.29 10:16

Trading the News: U.S. Gross Domestic Product (GDP) (based on dailyfx article)

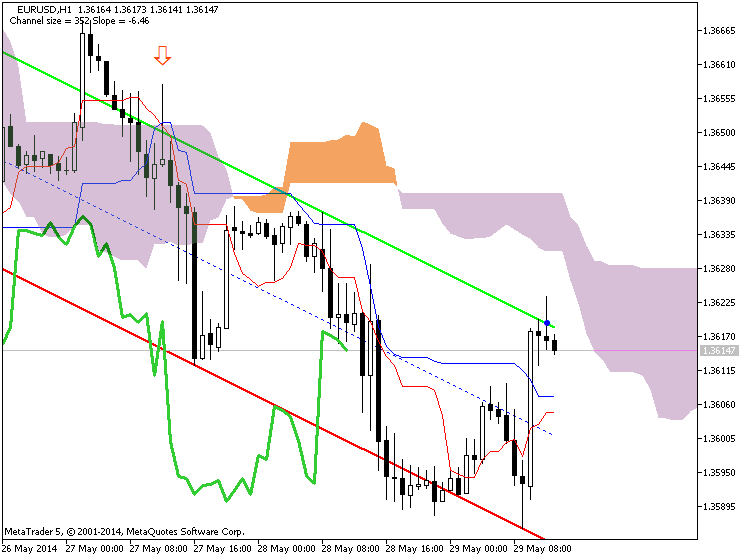

The preliminary U.S. 1Q GDP report may spur a near-term rebound in the EUR/USD as the growth rate is expected to contract 0.5% during the first three-months of 2014.

What’s Expected:

Why Is This Event Important:

Indeed, a marked downward revision may undermine the near-term rebound in the dollar as it gives the Federal Reserve greater scope to further delay its exit strategy, and the greenback may struggle to hold its ground ahead of the next policy meeting on June 18 should the data print drag on interest rate expectations.

Subdued wage growth paired with sticky inflation raises the risk of seeing a larger-than-expected contraction in the U.S. economy, and a dismal print may spark a rebound in the EUR/USD as the dampens the prospects for a stronger recovery in 2014.

Nevertheless, the resilience in private sector consumption paired with the ongoing improvement in the labor market may generate an upbeat GDP report, and a positive development may trigger fresh monthly lows in the EUR/USD as it raises the outlook for the U.S. economy.

How To Trade This Event Risk

Bearish USD Trade: U.S. Economy Contracts 0.5% or Greater

- Need to see green, five-minute candle following the release to consider a short dollar trade

- If market reaction favors a bearish dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: 1Q GDP Exceeds Market Forecast- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

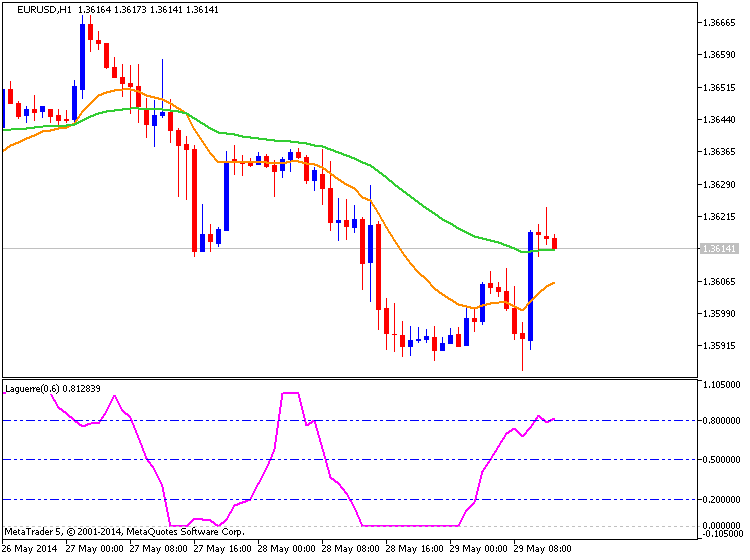

Potential Price Targets For The ReleaseEUR/USD Daily

The preliminary 4Q GDP showed a downward revision in the growth rate, with the world’s largest economy expanding an annualized 2.4% during the last three-months of 2014, while Personal Consumption increased 2.6% during the same period after climbing 2.0% in the third-quarter. Despite the weaker-than-expected GDP print, the EUR/USD failed to hold above the 1.3800 handle during the U.S. trade, with the pair ending the day at 1.3798.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.29 14:50

U.S. GDP Contracts 1.0% In First Quarter

Primarily reflecting a downward revision to private inventory investment, the Commerce Department released a report on Thursday showing that U.S. gross domestic product decreased in the first three months of 2014.

The report showed that GDP decreased by 1.0 percent in the first quarter compared to the initial estimate for a 0.1 percent uptick. Economists had been expecting the revised data to show a somewhat smaller contraction of about 0.5 percent.

EURUSD M5 : 14 pips range price movement by USD - GDP news event :

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video May 2014

newdigital, 2014.05.30 07:19

Trading Video: Neither S&P 500 Rally Nor EURUSD Tumble Find Easy Momentum

There are fewer and fewer mature trends in the financial market that have been able to avoid meaningful correction. The S&P 500 remains one of the most prominent. This pillar of risk appetite continues to forge new record highs after a five year run; but it is doing so on a steady drop in participation and without a convincing backdrop of momentum. Meanwhile, the FX market is showing greater levels of doubt and even outright concern through carry pairs, high-risk Emerging Market currencies and even the more stalwart crosses. As the market awaits the definitive word on sentiment, Forex traders will have to keep on their toes as monetary policy speculation picks up in the upcoming week on heavy-hitting event risk like Thursday's ECB decision and Friday's NFPs. We take a look at the markets and its opportunities in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.30 14:52

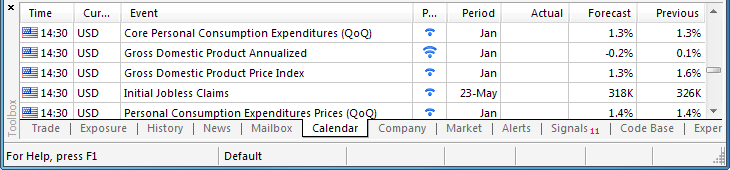

2014-05-30 12:30 GMT (or 14:00 MQ MT5 time) | [USD - Personal Consumption Expenditure]

if actual > forecast = good for currency (for USD in our case)

[USD - Personal Consumption Expenditure] = Change in the price of goods and services purchased by consumers, excluding food and energy

==========

U.S. Personal Spending Shows Unexpected Decrease In April

While the Commerce Department released a report on Friday showing that U.S. personal income rose in line with economist estimates in the month of April, the report also showed an unexpected drop in personal spending for the month.

The report showed that personal income rose by 0.3 percent in April following a 0.5 percent increase in March. The increase marked the fourth straight month of growth and matched expectations.

On the other hand, the Commerce Department said personal spending edged down by 0.1 percent in April after surging up by 1.0 percent in March. The modest decrease surprised economists, who had expected spending to rise by 0.2 percent.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.05.30

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 13 pips price movement by USD - Personal Consumption Expenditure news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.30 16:48

2014-05-30 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

if actual > forecast = good for currency (for USD in our case)

[USD - Chicago PMI] = Level of a diffusion index based on surveyed purchasing managers in the Chicago area

==========

Chicago Business Barometer Shows Unexpected Increases In May

With demand strengthening as the economy continued to recover from the weather-related slowdown, MNI Indicators released a report on Friday showing that its reading on Chicago-area business activity unexpectedly rose to a seven-month high in May.

MNI Indicators said its Chicago business barometer climbed to 65.5 in May from 63.0 in April, with a reading above 50 indicating an increase in activity. The increase surprised economists, who had expected the barometer to dip to 61.0.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.05.30

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 12 pips price movement by USD - Chicago PMI news event