Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.07 17:44

Forex Weekly Outlook August 10-14 (based on forexcrunch article)Last week the US major jobs report registered another solid gain of 215,000 positions, indicating the US employment is on the right track. Despite the lower than expected jobs increase, wages continued to climb, unemployment rate remains unchanged and the jobs gain show solid growth, giving green light for the Fed to raise rates in September. However, September rate hike is not a sure thing. Low inflation cools growth and may postpone the Fed’s longed for decision.

- Dennis Lockhart speaks: Sunday, 16:25. Federal Reserve Bank of Atlanta President Dennis Lockhart will speak in Atlanta. By calling the Fed to hike rates Lockhart gave a clear sign that the Fed is preparing for a policy shift. Market volatility is expected.

- Eurozone German ZEW Economic Sentiment: Tuesday, 9:00. German analysts’ sentiment weakened in July to 29.7 from 31.5 in June. The reading was lower than the 30.6 estimated by economists. Current conditions edged up to 63.9 points from 62.9 points in June. Economic sentiment declined to the lowest level in eight months amid, the Greek debt crisis and weaker than expected industry data. Meanwhile, euro zone economic sentiment fell to a seven-month low of 42.7 in July from 53.7 in June. Sentiment is expected to rise to 31.1 this time.

- UK Employment data: Wednesday, 8:30. The number of people claiming unemployment benefit in June increased by 7,000 to 804,200, contrary to analysts’ forecast of a 8,900 decline. However, wages continued to increase. Average weekly earnings including bonuses edged up at an annual pace of 3.2% between April to June, and by 2.8% excluding bonuses, the fastest rate in five years. June’s setback suggests the UK’s recovery is still fragile and more measures are required to boost growth. The number of job seekers is expected to grow by 2,100.

- US Retail sales: Thursday, 12:30. U.S. retail sales unexpectedly declined in June amid a slowdown in purchases of automobiles and other goods. Retail sales contracted 0.3% the worst reading since February, following May’s revised rise of 1.0%. Excluding automobiles, gasoline, building materials and food services, retail sales declined 0.1% after a 0.7% increase in May. Other disappointing data such as Jun’s employment report and the fall in business confidence suggest the US recovery might have stalled in June. This could impact the Fed’s rate hike decision in September. U.S. retail sales is expected to grow by 0.5% , while core sales are expected to gain 0.4% in July.

- US Unemployment claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits rose by 3,000 to a seasonally adjusted 270,000 last week, broadly within market forecast. Meanwhile, the four-week moving average for new claims declined by 6,500 claims to 268,250. Continuing jobless claims fell by 14,000 to a seasonally adjusted 2.26 million during last week. The number of jobless claims is expected to reach 272,000.

- Eurozone German GDP data: Friday, 6:00. Germany’s economy expanded 0.3% in the first quarter after a 0.7% gain in the previous three months. Analysts expected a higher growth rate of 0.5%. A slowdown in global trade and weaker consumer spending caused this decline. Meanwhile the Euro-Area growth quickened more than expected in the first quarter, rising 0.4% with France outperforming Germany with a 0.6% expansion rate. Germany is expected to expand by 0.5% in the second quarter.

- US PPI: Friday, 12:30. U.S. producer prices climbed more than expected in June amid a rebound in gasoline prices and a rise in other goods. Producer prices increased 0.4% following a 0.5% gain in the previous month indicating the manufacturing sector is stabilizing and inflation strengthens. In the 12 months through June, PPI declined 0.7% after dropping 1.1% in May. Meanwhile, core PPI edged up 0.3% following a 0.1% decline in the prior month. PPI is expected to rise by 0.1% this time.

- US Prelim UoM Consumer Sentiment: Friday, 14:00. U.S. consumer moral declined more than expected in July, falling to 93.3 from 96.1 in June. The reading was below market forecast of 96 points. Consumer outlook declined to 85.2 from 87.8 from the prior month. Inflation expectation edged up to 2.8% from the prior 2.7%, while the survey’s five-to-10-year inflation outlook was at 2.7% from 2.6%in the previous month. U.S. consumer sentiment is expected to reach 93.5 in August.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.08 10:14

Fundamental Weekly Forecasts for US Dollar, AUDUSD, GBPUSD. USDJPY and GOLD (based on dailyfx article)

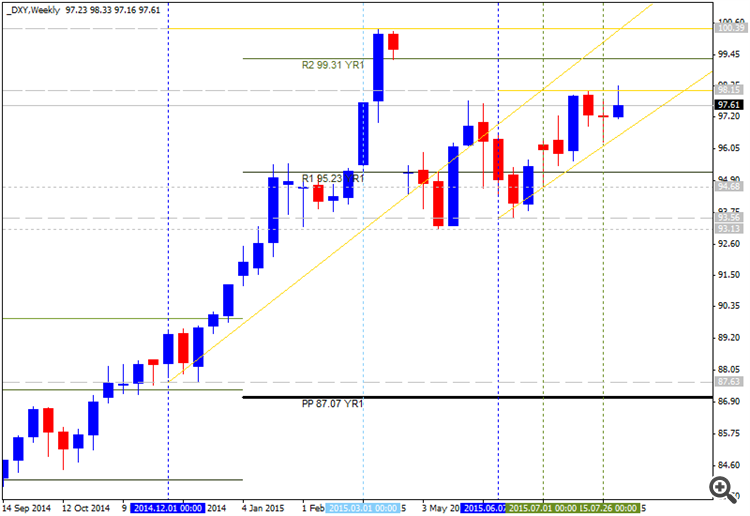

US Dollar - "This week docket isn’t shabby for market movers – retail sales, UofM sentiment survey, upstream inflation reports, small business optimism and a July labor conditions aggregate – but none of the offerings carry the mark of a decisive view changer. With the market still not fully pricing a Fed hike until January while the Fed sees two this year, there is premium to tap. Yet, it will be difficult to tap this week."

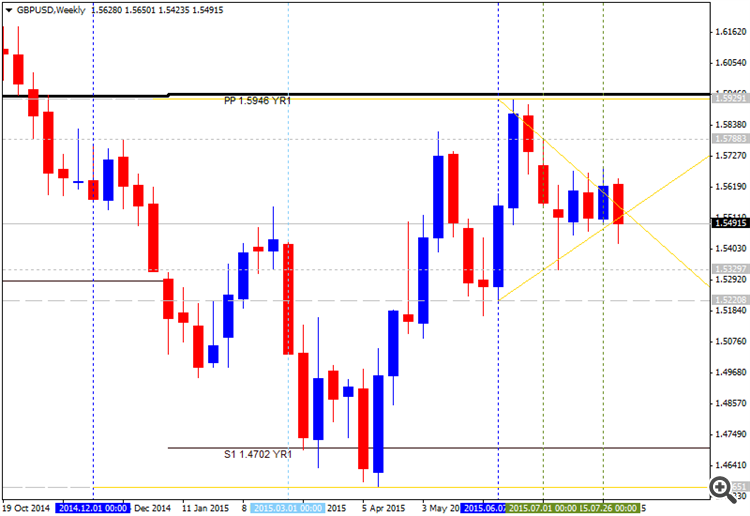

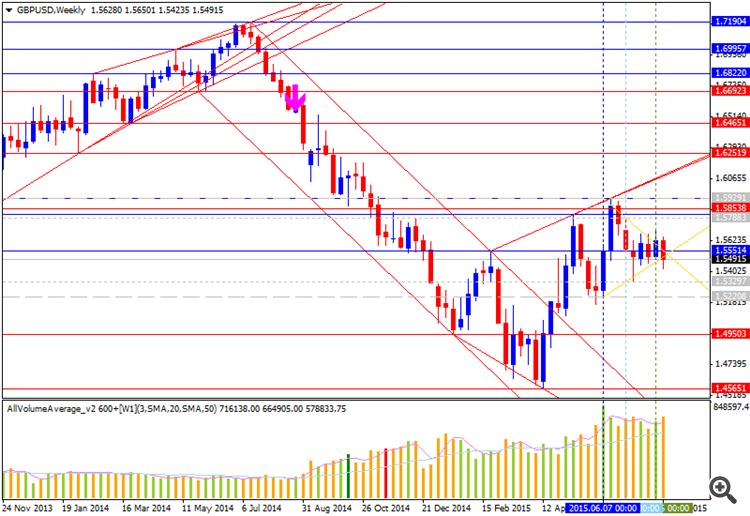

GBPUSD - "Upcoming UK Jobless Claims figures will be of special interest as Bank of England Governor Mark Carney made clear that interest rate policy will depend on economic data. Current consensus estimates predict that the Claimant Count Rate—the percentage of eligible workforce participants claiming unemployment benefits—remained near multi-decade lows through July. Just as importantly, economists expect that Average Weekly Earnings growth remained near its highest in five years through June. Downside surprises in either could force fairly important losses in the British Pound."

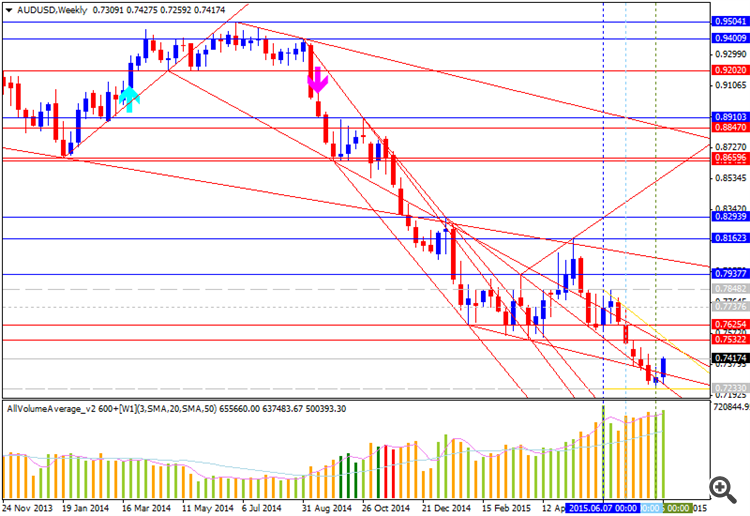

AUDUSD - "A handful of Chinese releases is also noteworthy. July’s Retail Sales and Industrial Production numbers are due to cross the wires. As with the US, data flow out of the behemoth East Asian economy has improved in recent months. At minimum, this hints that the probability for particularly dour results that raise concerns about negative spillover to Australia is comparatively low relative to the alternative."

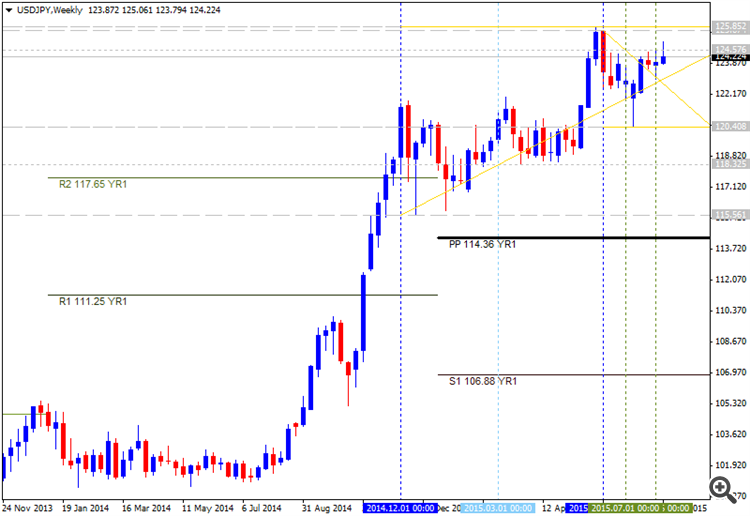

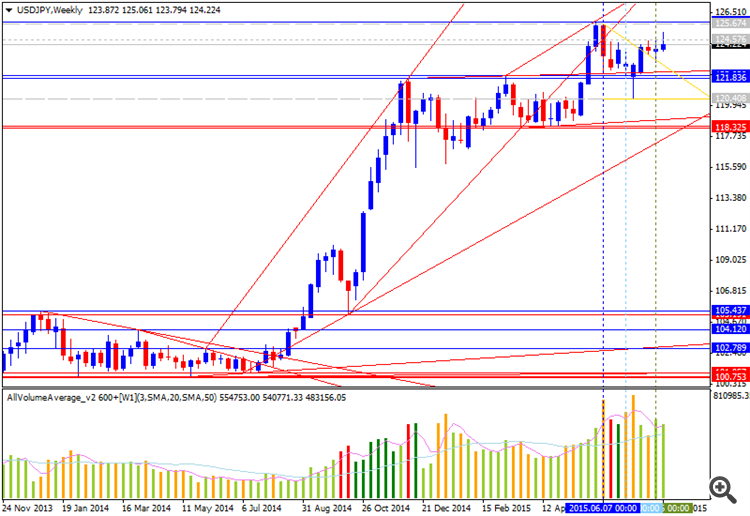

USDJPY - "With USD/JPY snapping back from a fresh weekly of 125.06, the lack of following-through behind the NFP reaction raises the risk for a larger pullback, and the exchange rate may face a further consolidation in the days ahead should we see another mixed batch of data prints coming out of the U.S. economy. On the other hand, key developments pointing to a stronger recovery may put the dollar-yen on a more bullish course and may spur a test of 2015 highs (125.84) as the Fed keeps the door open for a September liftoff."

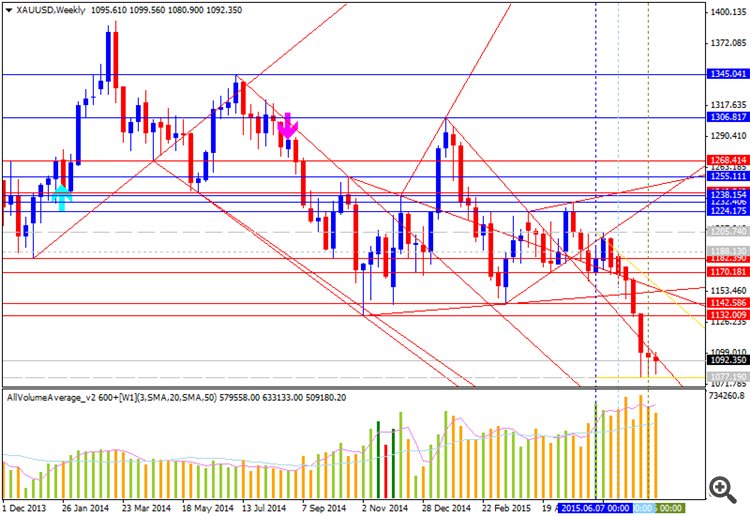

GOLD - "From a technical standpoint gold has continued to hold above critical support into 1067/70 where the median-line off the 2014 high converges on basic trendline support dating back to June 2006 and the 100% extension of the decline off the yearly high. Weekly momentum has also continued to hold above the 30-threshold and as noted last week, gold remains vulnerable for a near-term recovery while above this region. Note that although prices are lower for a seventh consecutive week, gold has been unable to test the 5-year low made back on July 24th. Key resistance remains at 1145/50 with only a break above the upper median-line parallel off the yearly high invalidating the broader downside bias (bearish invalidation~ 1175). A break of the lows targets the 2010 low at 1044 backed by a key longer-term Fibonacci confluence lower down at 975/80."

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video August 2015

Sergey Golubev, 2015.08.08 20:54

Trading Video: Will US Stock Indexes and the Dollar Finally Break This Week? (based on dailyfx article)

- The Dow marked an important technical break this past week, but US equities are slow to follow 'risk trends'

- NFPs wouldn't resolve the data-dependent view for interest rate expectations, leaving USDollar range bound

- Summer trading conditions are conspiring to keep markets anchored and we should adapt our trading approach

'Data to leverage the US Dollar seems far less capable than key Euro-area GDP figures and Chinese economic event risk for the Euro and Aussie Dollar respectively. We discuss what lies ahead and the proper strategy calibrations in this weekend Trading Video.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.09 07:36

Morgan Stanley Next Week Forecast - USD, EUR, JPY, GBP, AUD (based on efxnews article)

USD: Bullish

"We stick to our bullish USD view. Recent comments from Fed Governor

Lockhart suggest that September is still very much in play, and as

markets bring the timing of the first hike forward, this should support

USD."

EUR: Bearish

"The EUR has been difficult to trade recently given that European

stories such as Greece or the ECB have gone away from the market’s

focus. Instead we expect EURUSD to trade lower on more optimism on the

Fed. The US side of the story will dominate trading this pair."

JPY: Neutral

"We remain bullish on JPY for a few reasons. First, we continue to see

signs of domestic reflation that could bring the BoJ closer to

tightening. Second, with commodity currencies falling, the risk environment may be

pressured, which will also support JPY. The main risk here would be a

China stimulus which supports risk and weighs on JPY."

GBP: Neutral

"The inflation report was more dovish than the market was expecting,

causing GBPUSD to move below 1.55. For the path

of GBPUSD over coming weeks we put most emphasis on the USD side. With

Lockhart putting a September rate hike firmly in the market’s mind now,

as rate expectations rise, this should support the USD side."

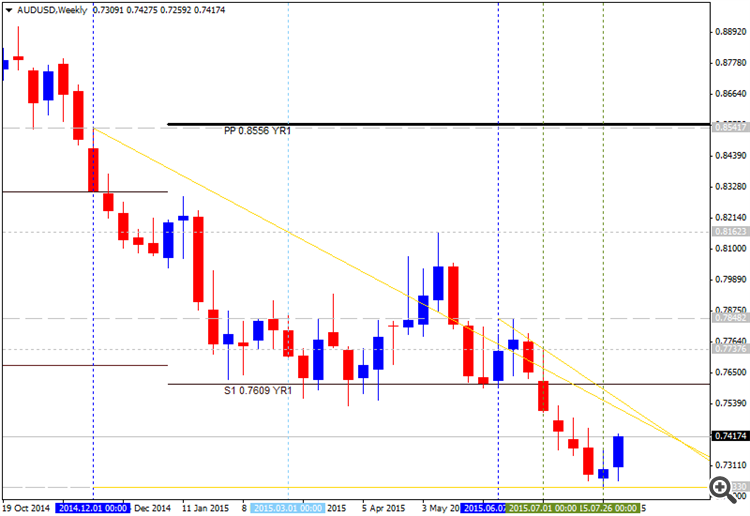

AUD: Bearish

"Commodities are likely to weigh on AUD, and we retain our medium term

bearish AUD view. However, we see two possible legs of support in the

near term. First, the RBA has raised the bar for cuts, and as the market

digests this, the currency may benefit. Second, any growth supportive

fiscal stimulus in China would likely benefit AUD the most within the

G10 space. We would look to sell on rallies."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.10 08:01

The Royal Bank of Scotland - After the BoE’s "Super Thursday" (based on efxnews article)

-

"While headline employment slightly missed relative to consensus, the

unemployment rate held steady and underemployment rate edged down

further."

- "After the BoE’s “Super Thursday” left the impression that an early 2016 hike (long our base case) is more likely than a late-2015 rate hike, the FOMC appears to reclaiming the top spot on the G10 “hawkish league table” that it held for much of late 2014 and early 2015, and we think that can continue to benefit the USD."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.10 17:09

Barclays for EURUSD - The Decision Is Taken (based on efxnews article)

Barclays evaluated the recent NFP data and made the conclusion that FOMC has already decided about what to tell during the next meeting. Barclays watched the job data and established the correlation between job market and FOMC decisions concerning the inyerest rate to be changed.

- "We believe, in line with the FOMC’s rhetoric, that the expected path of the fed funds rate for the next couple of years is probably more important than the actual date of the lift-off. In that regard, wage developments will continue to be monitored by markets to assess the speed of the normalization cycle."

- "We maintain high conviction in further EURUSD downside in the context of steadily improving US data and a likely September Fed rate hike that remains underpriced."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.11 06:56

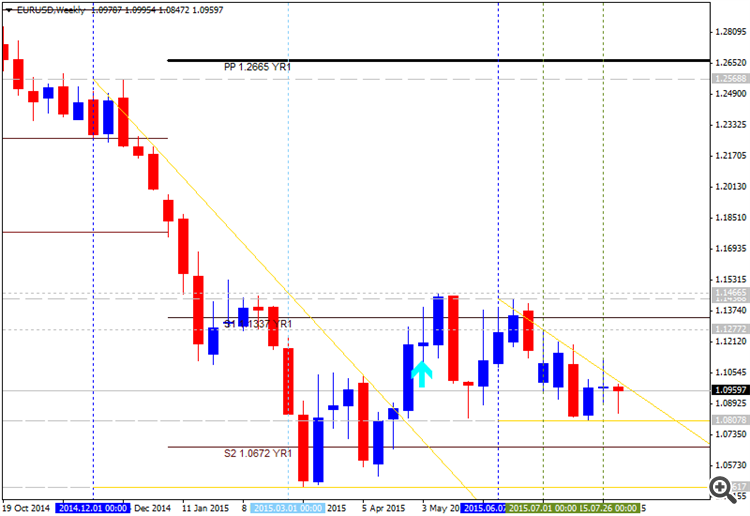

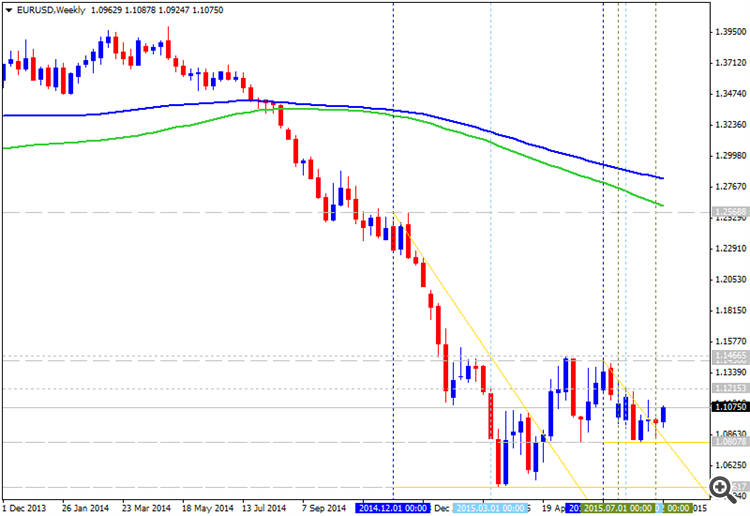

JP Morgan for EUR/USD: ranging within daily triangle support/resistance (based on efxnews article)JP Morgan estimated the false breakout by bouncing back starting to range between very strong support/resistance levels. Market refused to make necessary breaks to established good stable trend, says JP Morgan.

- "Market keeps on bouncing back and forth in a range between 1.1071 (daily triangle resistance) and 1.0772/44 (daily triangle support/int. 76.4 %), which needs to be broken to receive fresh directions."

- "A break above 1.071 would on the other hand be needed to open the door for a minimum recovery to 1.1288."

- "A break below the main T-zone at 1.0772/44 would re-open Pandora's Box in terms of resuming the long-term downtrend. In this case 1.0072 (76.4 % of the 2000-2008 rally) would only be a minimum target."

Thus, JP Morgan descovered 2 very strong s/r levels:

- daily ascending triangle with 1.1071 resistance;

- daily descending triangle with 1.0772/44 support.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.11 12:26

Skandinaviska Enskilda Banken - Intraday For EUR/USD and USD/CNH (based on efxnews article)

Skandinaviska Enskilda Banken (SEB - Swedish financial group with

headquarters in Stockholm/Sweden) is continuing intra-day forecast. For

now - we are having some analysis for EUR/USD and USD/CNH:

EUR/USD

"The pair moved a tad higher (1.1042) than expected before turning around

and falling back lower. A close at current levels (or lower) will

create yet another 55d ma band rejection indicating that the sellers

still are in control. A sustained break below 1.0926 will sharply up a

bearish outlook calling for a swift continuation down to the recent low

area."

USD/CNH

"Today’s extremely impulsive move higher has cancelled out the idea that

the move up from the 2014 low point was a three wave upside corrective

move. Today’s break above 6.3014 makes such a wave count obsolete and

instead warns of creating either a more complex upside correction

pattern (theoretically targeting the 6.48-area) OR a having entered a

third of a third wave (allowing for considerably higher levels over the

medium term horizon)."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.12 08:09

EUR/USD - bulls in control (based on forexlive article)

EURUSD was up and down again for ranging on the back of the China surprise and the news that Greek creditors reached a deal. The price reached the border between bearishand bullish trend and stopped near some key resistance levels such as 1.1113/1.1215/1.1466.

The bulls market is under control as there are few strong resistance levels on the way for the price to be reversed. For example, 200-SMA value is located at 1.25 on weekly chart and at 1.1466 on daily chart so the price should go quite a long way through many levels on the way to possible reversal. Any fundamental news events may move the pair to be down or increase the choppy situation for the downtrend to come later for this pair.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.13 08:18

BofA Merrill about doubts concerning the ability of the USD to rally further (based on efxnews article)

Bank of America Merrill Lynch is dispalling the doubts about the

ability of the USD to rally further and about the EURUSD to resume the

bearish market condition. Strong USD skeptics are providing some arguments that USD can not be more stronger than now:

- The Fed do not like stronger USD for rate hike.

- EU data was improved because of ECB QE.

- Long-term movement for EURUSD pair is estimated to be 1.25 anyway soon or later.

Yes, positive Eurozone data surprises, and negative US data surprises, but skeptics are missing 2 additional main arguments:

-

"According to our estimates from a production

function, US total factor productivity (TFP) has been growing the

fastest in the G10 group. In contrast, TFP growth has been negative in

the Eurozone."

- "The Eurozone economy has by far the most negative output gap in the G10 group."

Thus, according to BofA Merrill, the USD will become more stronger compare with EUR and we will see the price as 1.04/1.05 by the end of this year anyway.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bearish condition for ranging between the following s/r levels:

Chinkou Span line is located below the price indicating the ranging market condition by direction.

D1 price - ranging within key levels:

W1 price is on bearish market condition with secondary ranging between 1.0807 (W1) support level with 1.0461 as the next target, and 1.1466 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0847 support level on close D1 bar so the bearish trend to be continuing for the week with secondary ranging market condition up to 1.0807 as a next bearish target.

If D1 price will break 1.0807 support level on close D1 bar so we may see good bearish breakdown of the price movement with next target as 1.0461.

If D1 price will break 1.1113 resistance level so the price will be reversed to the primary bullish market condition.

If not so the price will be on ranging between the levels.

SUMMARY : bearish

TREND : ranging bearish