Watch how to download trading robots for free

Find us on Twitter!

Join our fan page

Join our fan page

You liked the script? Try it in the MetaTrader 5 terminal

- Views:

- 6404

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Basics:

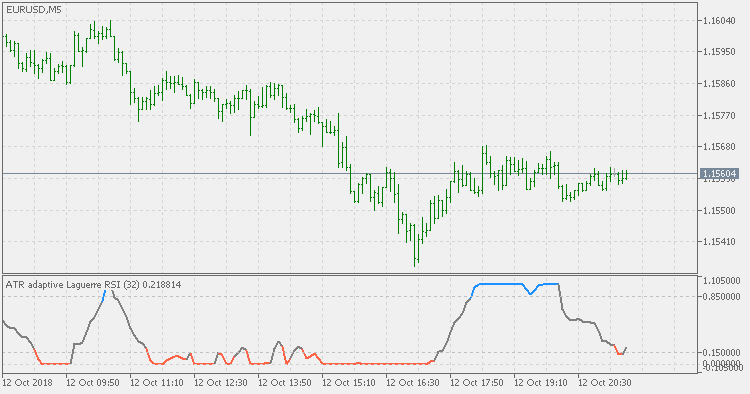

The Laguerre RSI indicator created by John F. Ehlers is described in his

book "Cybernetic Analysis for Stocks and Futures".

This version:

Instead of using fixed periods for Laguerre RSI calculation it is using ATR (Average True Range) adapting method to adjust the calculation period. It makes the RSI more responsive in some periods (periods of high volatility), and smoother in oder periods (periods of low volatility).

Usage:

You can use it (in combination with adjustable levels) for signals when color of the Laguerre RSI changes.

Efficiency ratio directional with levels

Efficiency ratio directional with levels

Efficiency ratio directional with self adjusting levels

Step average - std based

Step average - std based

Step average - standard deviation based

ATR adaptive smooth Laguerre RSI

ATR adaptive smooth Laguerre RSI

ATR adaptive smooth Laguerre RSI

ATR adaptive smooth Laguerre RSI (dlvl)

ATR adaptive smooth Laguerre RSI (dlvl)

ATR adaptive smooth Laguerre RSI with dynamic levels