1. What is Hedging and Why Is It Important?

Hedging in trading involves opening opposite positions to reduce risk in case of adverse market movements. When the market sharply changes direction, a hedging position can help offset losses from the original position, providing greater stability to the portfolio. With Nexus, traders can use various hedging modes to implement this strategy, depending on their specific needs and market behavior at the time.

2. Disabled Mode: No Hedging

In "Disabled" mode, Nexus operates without applying any hedging strategy. This mode suits traders who prefer to handle market movements without using additional risk mitigation. In this case, trades are opened and closed according to the expert advisor’s entry and exit strategy, without considering any opposite position to offset potential losses.

No-hedging mode is ideal for markets with strong and stable trends, where the likelihood of major fluctuations is lower. However, in volatile markets, it can be a risky option as there is no added protection against sudden changes in market direction.

3. Independent Mode: Individual Position Hedging

In "Independent" mode, Nexus allows hedging, but each trade is managed individually. This means that if a buy position becomes a losing one, Nexus will open a sell position on the same currency pair to offset the loss. Both positions are managed separately, with no influence over each other in terms of closing or adjustment.

This mode is useful for traders who want to hedge specific positions without compromising their entire trading strategy. By operating in independent mode, Nexus can apply individual hedges based on each trade's conditions, providing protection without affecting other open positions. However, the risk in this mode is that the trader may end up with multiple open positions in opposite directions, which could limit gains if the market remains in a narrow range.

4. Cooperative Mode: Collaborative Position Hedging

The "Cooperative" mode is the most advanced option in Nexus, designed for traders looking for a collaborative hedging strategy. In this mode, Nexus manages buy and sell positions together, aiming to maximize total profit and reduce losses at the global level rather than on each individual position.

When cooperative mode is activated, Nexus analyzes all open positions and, instead of simply opening a hedge for each losing position, calculates the necessary hedges to reduce overall portfolio risk. If the market changes direction, Nexus can close all positions together once a profit target is reached or when total loss is minimized.

This mode is ideal for volatile markets or unpredictable trends, as it offers a more structured and dynamic solution for risk management. Cooperative hedging allows Nexus to manage positions as a whole, optimizing the performance of the entire portfolio and avoiding unnecessary opposing positions.

5. How to Set Hedging Modes in Nexus

Setting the hedging mode in Nexus is a straightforward process done from the input panel. To select the desired mode, follow these steps:

- Open MetaTrader 5 and select the chart to which you want to apply Nexus.

- Go to Nexus’s input panel and find the "Hedging Mode" option.

- Select one of the three available hedging modes: Disabled, Independent, or Cooperative.

- Adjust other parameters according to your trading preferences and risk tolerance.

Once the hedging mode is set, Nexus will automatically apply the selected strategy to all open trades. It is recommended to perform backtesting to assess which hedging mode best suits your trading style and market conditions.

6. Advantages and Disadvantages of Each Hedging Mode

Each hedging mode in Nexus offers specific benefits and presents some disadvantages depending on the market and the trader's strategy. Below is a summary of the main advantages and disadvantages of each mode:

- Disabled Mode:

- Advantages: Simplifies the strategy, ideal for strong trends.

- Disadvantages: No protection in volatile markets; higher risk with sudden changes.

- Independent Mode:

- Advantages: Individual protection for each position; flexible hedging.

- Disadvantages: May accumulate opposing positions that limit gains if the market remains range-bound.

- Cooperative Mode:

- Advantages: Comprehensive risk management; optimizes profits and minimizes portfolio losses.

- Disadvantages: Greater complexity; may not be necessary in low-volatility markets.

7. Backtesting to Evaluate the Best Hedging Mode

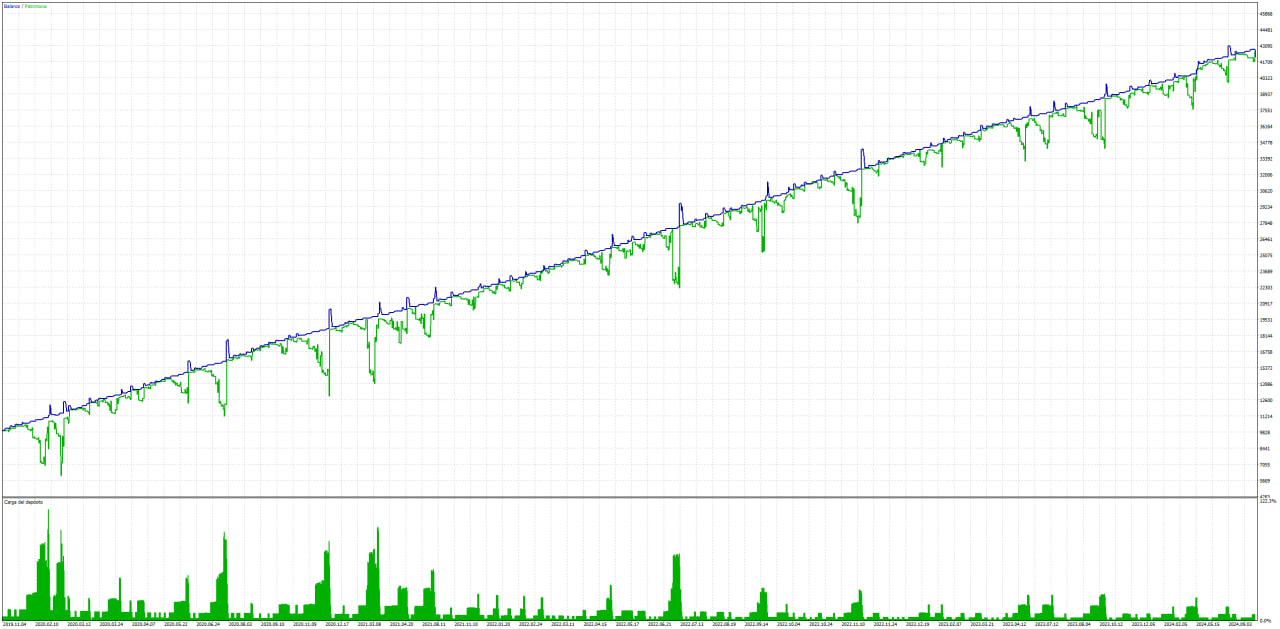

Before deciding which hedging mode to use, it is advisable to perform backtesting with Nexus to assess each strategy's performance under historical market conditions. These tests help identify which mode is most effective based on the currency pair and preferred timeframe. Additionally, backtesting provides a clear view of the hedging impact on risk and trade performance.

The cooperative mode, for instance, may be more effective on high-volatility currency pairs, while the disabled mode could work better in stable trends. Experimenting with different modes and analyzing backtesting results helps traders make informed decisions on how to manage their hedging strategies in Nexus.

Conclusion

The hedging modes in Nexus provide traders with a variety of options to manage risk and optimize trades. From the "Disabled" mode for simple strategies, to the "Independent" mode for specific position hedging, and the "Cooperative" mode for more advanced portfolio management, Nexus allows users to tailor hedging to different trading styles and market conditions.

Selecting the appropriate hedging mode and testing it through backtesting is essential for improving overall trading strategy performance. With Nexus, traders have a powerful and flexible tool that facilitates efficient hedging, enabling them to face market volatility in a controlled and calculated way.

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

⚠️ NEW MQL5 GROUP: https://www.mql5.com/en/messages/01c72081307dda01

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🗒 FULL USER GUIDE: https://www.mql5.com/en/blogs/post/759068