At tomorrow's meeting, the RBNZ may again raise the interest rate, as expected by 0.75%, and also speak in favor of further interest rate increases at the next meetings (we wrote about this in detail in our previous review NZD/USD: in the area of key resistance levels) .

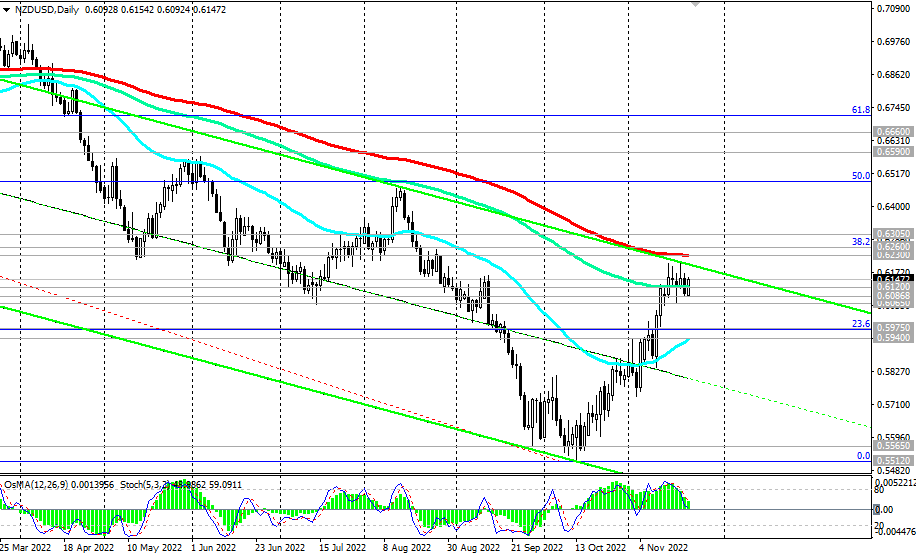

In the meantime, the NZD/USD pair continues to develop an upward correction, moving towards the key long-term resistance level 0.6230. From a technical point of view, and also taking into account the growth potential of the US dollar, in the area of this resistance level, we expect a rebound and some stabilization in the area of 0.6200, 0.6100 marks.

In the alternative scenario, NZD/USD will continue to rise towards the next long-term resistance level 0.6305. Its breakdown, in turn, significantly increases the chances of NZD/USD returning to a long-term bullish trend.

*) For upcoming events of this week, see Key economic events of the week 11/21/2022 – 11/27/2022

Support levels: 0.6120, 0.6086, 0.6065, 0.5975, 0.5940, 0.5900, 0.5860, 0.5600, 0.5565, 0.5512, 0.5470

Resistance levels: 0.6200, 0.6235, 0.6260, 0.6305

- see details -> https://www.instaforex.com/ru/forex_analysis/327800/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading