Soaring energy prices that have increased inflationary pressures, weakening consumer confidence and negative real wage growth in the Eurozone make the ECB's task of finding a balance between stimulating weakened economic activity and containing inflationary pressures much more difficult. As the head of the European Central Bank, Christine Lagarde, recently stated, “the longer the conflict (in Ukraine) lasts, the higher the economic costs will be, and the more likely we will find ourselves in worse scenarios.”

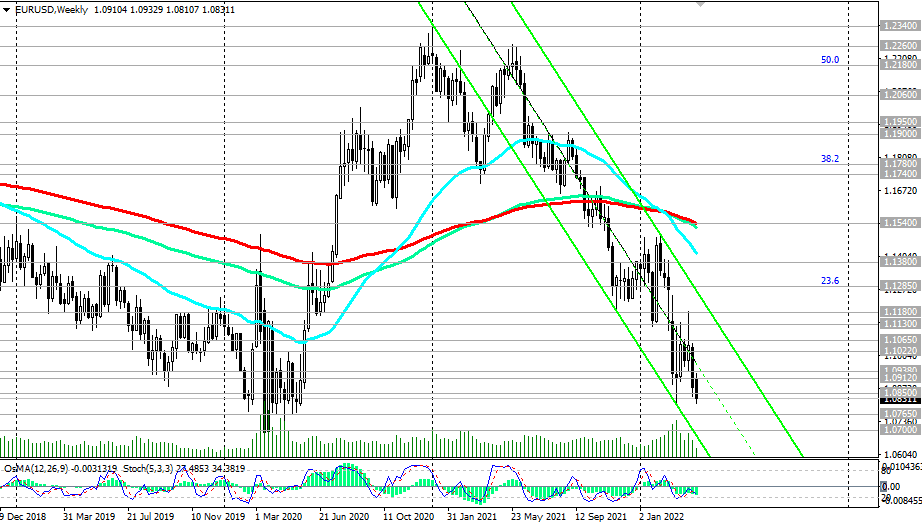

Thus, given the prospect of increasing divergence in the curves reflecting the monetary policy of the Fed and the ECB, we should expect a further decline in EUR/USD (with immediate targets at the levels of 1.0765, 1.0700 - see Technical analysis and trading recommendations).

Recall that the ECB decision on the rate will be published on Thursday at 11:45 (GMT), and at 12:30 the ECB meeting will begin, and it, apparently, will be of the greatest interest to market participants.

Today, volatility will rise again at 12:30 (GMT), when US producer price indices with March values will be published, as well as at 14:00 and 15:15, when the Bank of Canada interest rate decision will be published and its press conference will begin.

Support levels: 1.0800, 1.0765, 1.0700, 1.0500, 1.0350

Resistance levels: 1.0850 1.0912 1.0938 1.1000 1.1022 1.1065 1.1130 1.1180 1.1200 1.1285 1.1300 1.1380 1.1500 1.1540 1.1740

*) see also “ Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex