Introduction and study path

"The Forex Exchanger" project is based on the simple concept of what the Forex market really is: a market of currencies exchanges.

I always considered that one of the most profitable ways of trading the Forex market is one of the few logical things to do with it: buying currencies when they got too sold and selling currencies when they got too bought.

Of course the overbought/oversold concept (from this moment I will call it OBOS) is too easy and reductive to describe the logic behind the strategy but it's surely a good starting point.

As most traders should know, using an OBOS approach can give pretty beautiful entries but also too much drawdown in case the expected movement does not happen.

For this reason I always spent a lot of time and big effort on studying consistent methods to catch the best probability entries for having the price pushing in trade's favor: basically it consists in waiting for a good strength of price pushing in the entry direction before taking it.

Simple to say but not simple to do, or at least, not always...

Even if the entries are as accurate as possible it can happen that the market moves against them. Fortunately there are some things that can help the strategy to better recover the loss, like averaging the price with additional entries, but it means that will be necessary to increase expositions and risk.

Considering the basic idea of OBOS, the fact that the market will reverse is mathematical: we are trading Forex, not Cryptos.

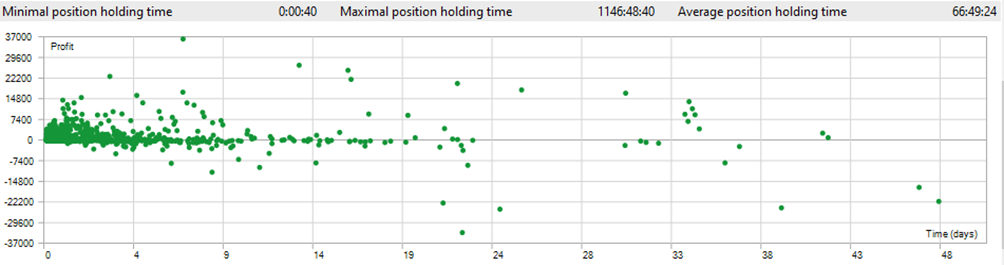

The market’s reverse is mathematical but it's impossible to predict when, for this reason the most important and delicate thing is to averaging the price in a logical and smart way and only if there will be good probability setups.

More logic and smart we are in managing that, less time we will stay on market and less drawdown we will suffer: this is the key.

All profit targets are shaped on each pair characteristic and will not be equal between two different or in two different times. This makes the strategy totally adjustable to different situations and pairs, working considering both their intrinsic characteristics and volatility and temporary behaviors.

Optimizations approach

I used a lot of different precautions for making this strategy less influential from external factors like: different brokers, news release, spread, slippages and so on.

I know very well that there are developers that love to optimize their EAs statistically forcing them in order to provide the best equity possible but this has never been my goal and will never be!

What they are doing is basically shaping the EA to perform perfectly in the past. It's useful only for presenting (and boosting sales of their products) but not for making a strategy more robust (which I hope needs to be the main goal for every trader in the world).

Anyway I'm not here to discredit other people's jobs but to give mine the value it deserves.

For achieving good consistency I used some important details like:

-

Checking of high timeframes setup scenarios.

-

Usage of indicators on lower timeframes with big period values to reduce the noise of the markets and retrieve solid and clear information.

-

Totally ignored news in the past (I will never consider them in the future but I could take manual intervention due to political and economical world situations: nothing that an algorithm can ever predict!)

-

Used ATR and never points/pips. (This is quite obvious when working on multiple symbols that have totally different characteristics, volatility, average ranges and tick values!)

I found a lot of interesting things that worked fine for multiple years on the whole forex market (28 pairs, no exotic pairs considered).

I always make optimizations step by step, focusing on “optimizing concepts rather than parameters".

It means that, for example, I will never try to make optimizations about RSI periods value trying 10,11,12,13,14,15,16 and so on, finding the one that performed better in the past: it’s no sense.

I would prefer to check if RSI worked better than another oscillator or which rules set of RSI worked better over others for catching and analyzing a particular scenario: this is what can be considered a smart optimization and this is always the approach I force in my mind when I study and build a strategy.

Estimated performance

Let me start by saying that every performance estimation for an investment is based only on past performance, and as that, it needs to be considered until a certain level and not as an exact prediction of the future: this seems logical for someone but not for all people.

The real difficulty for all strategies is not to shape them to trade perfectly in the past, but to make the strategy itself able to adjust to different market scenarios and to “survive” in very different situations.

As already explained previously, all tests and optimizations on this strategy were focused not in having the maximum profits by that, but finding a good balance of all these factors: profit factor, maximum drawdown, average holding of trades, linear regression of equity line, expected % of yearly growth compared to max % drawdown and others.

The result is simple: combining all factors I can have more reliable tests without choosing the “most profitable” strategy, but the most stable and sustainable one.

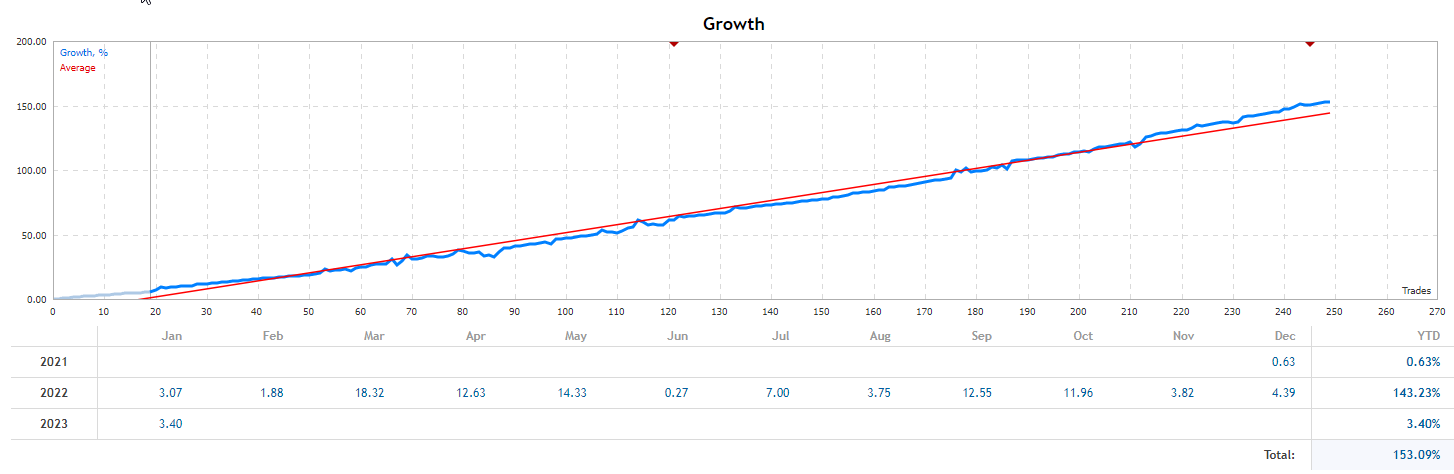

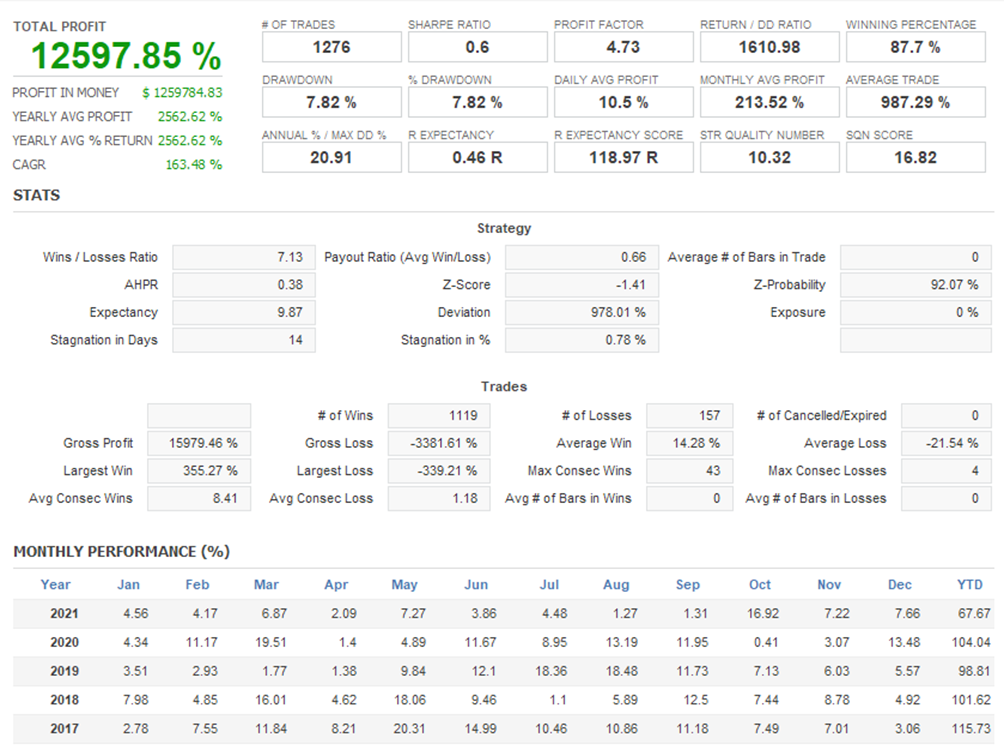

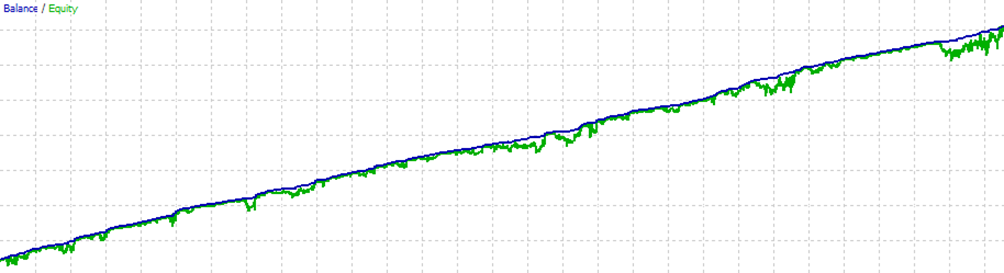

Following are some screenshots of the strategy backtest for the last 5 years.

Summary of performance

Balance and equity

Positions holding

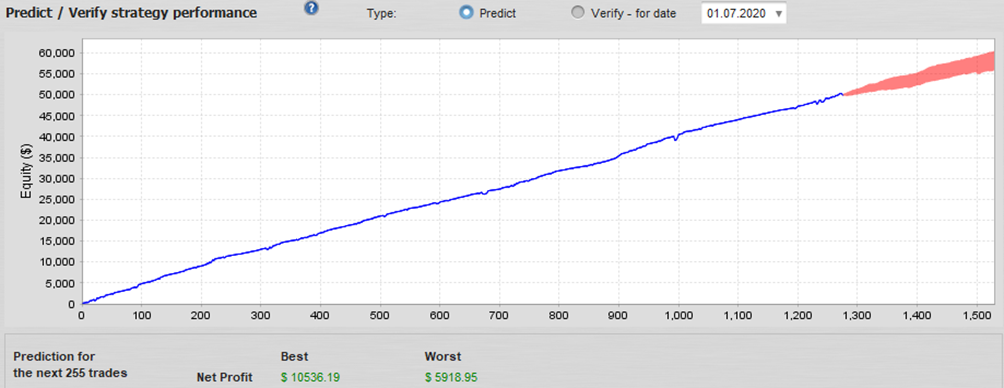

Monte Carlo prediction

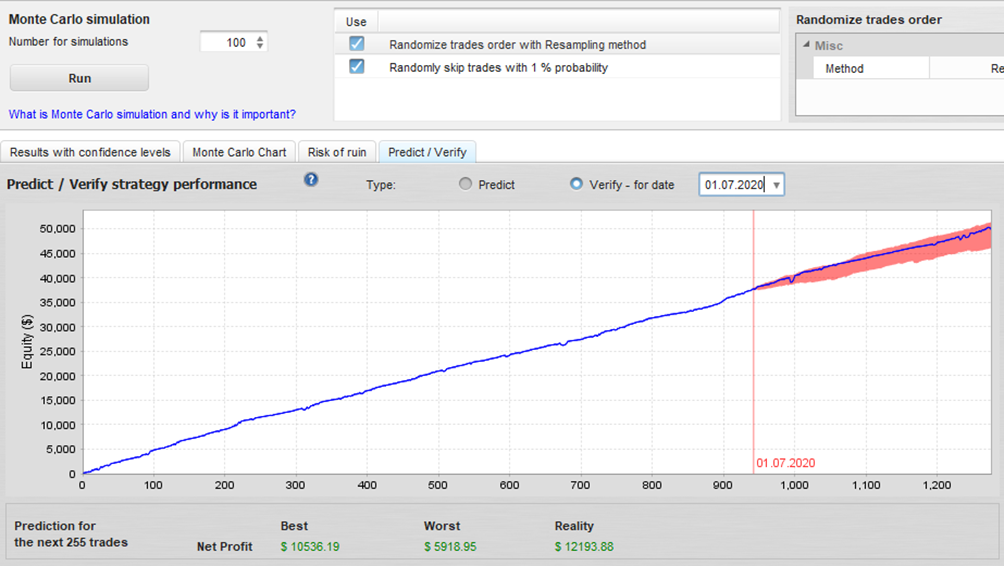

Monte Carlo verification

Expected growth is based on the risk set. All above tests are done with a “moderate” risk factor.

In my opinion that option is the best compromise for having an interesting ratio between growth and risk.

Using this option the expected profit for each month will be around 6-7% and yearly growth around 80-120% (deviations can occur both up or down for a lot of different factors that cannot be predicted).

The maximum drawdown will be for the most of time below 30%.

F.A.Q.

Q: Is this strategy suitable for which type of investor?

A: This is surely a strategy suitable for long-run investment. Its main goal is to provide consistent profits on a monthly (and above) basis. Analyzing the results on a daily or weekly basis is meaningless (this is true for almost all investments in the world).

Q: Is this strategy overfitted or overoptimized?

A: Absolutely not. All optimizations I did on this strategy (and all my strategies generally) are focused on “optimizing concepts rather than parameters”. I already explained before what I mean for this.

Q: How much drawdown can I have?

A: Of course it depends on the risk set. Anyway even if the used setting is for drawdown maximum 30%, be aware that it will be lower for the most of time, with few possibilities to be greater than it.

Q: Do I have new trades every day?

A: No, because markets do not allow many edges and for trading (and earning money) consistently it's needed to wait for good probability setups.

Expert advisor (MT5): https://www.mql5.com/en/market/product/76773

Real account monitoring: https://www.mql5.com/en/signals/1416185

Telegram channel: https://t.me/theforexexchanger