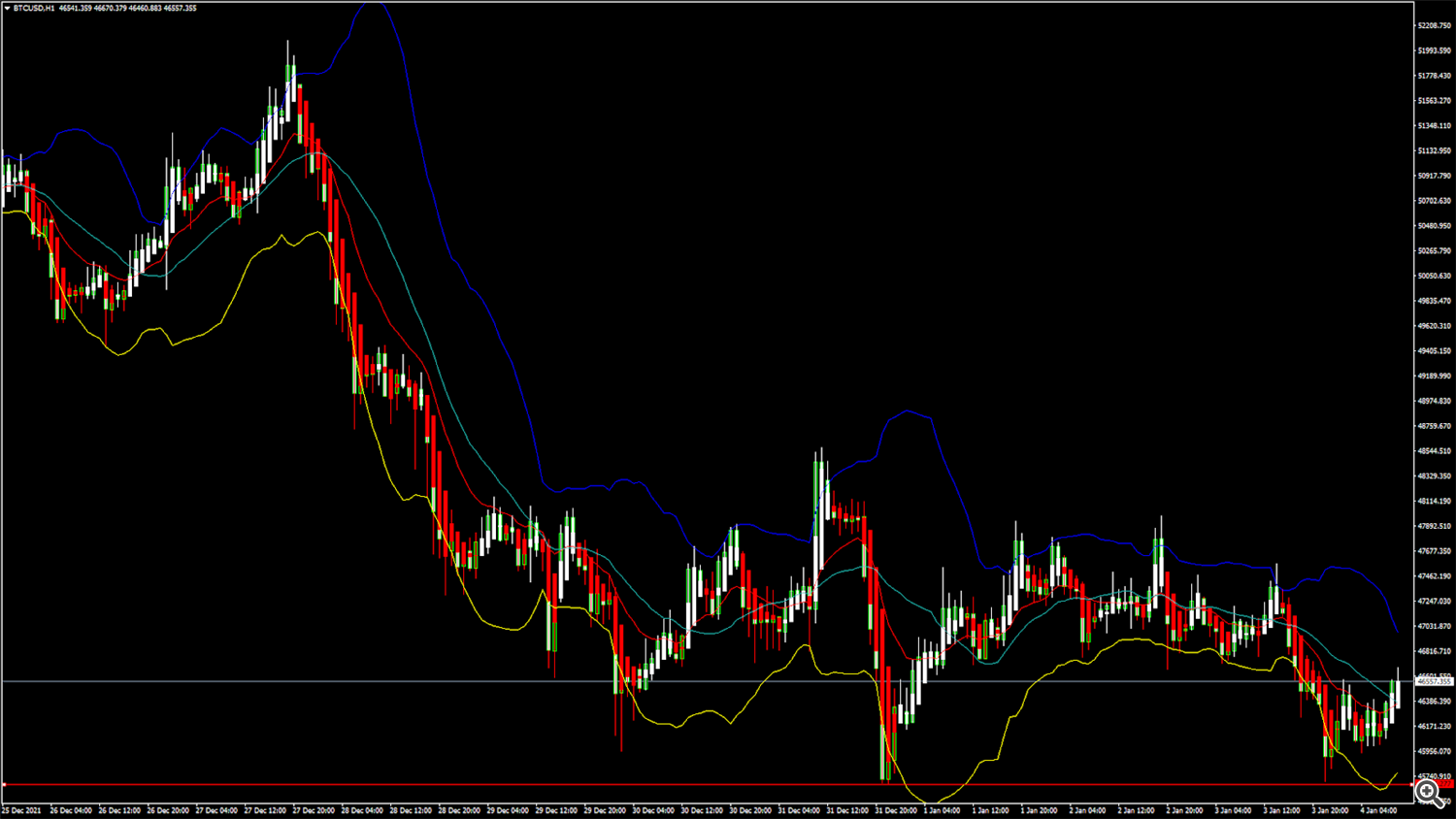

BTCUSD: Double Bottom Pattern Above $45,000

Bitcoin started this week on a bearish tone, and the price continued to slide touching a low of $45,725 on 3rd January, after which we can see some fresh buying in bitcoin markets globally.

Some pullback action can be observed in the European trading session today, and the prices of BTCUSD are ranging above the $46,000 handle.

We can clearly see a double bottom pattern above $45,000, which signifies the end of a downtrend and a shift towards an uptrend.

Both Stoch and StochRSI are indicating an OVERBOUGHT level, meaning that in the immediate short-term, a decline in the prices is expected.

With global cryptocurrency markets staging mixed trading signals we will have to wait before entering into any buying positions in bitcoin.

The relative strength index is at 52 indicating a NEUTRAL market and a move towards a market consolidation phase.

Bitcoin is now moving below its 100 hourly simple and exponential moving averages.

The average true range is indicating a lesser market volatility which means that markets are due to enter into a consolidation phase.

- Bitcoin trend reversal is seen above $45,000

- Williams percent range is indicating an OVERBOUGHT level

- The price is now trading just above its pivot levels of $46,489

- All moving averages are giving a NEUTRAL market signal

Bitcoin: Bullish Reversal Above $45,000 Confirmed ..More info: blog FXOpen