Oil prices rose about 1% on Thursday on news of the OPEC+ agreement and continued to rise during the Asian session on Friday. As a result of the session on Thursday, Brent crude oil futures rose in price by almost 1% to $ 48.71 per barrel, WTI crude oil futures closed trading with an increase of 0.8% at $ 45.64 per barrel.

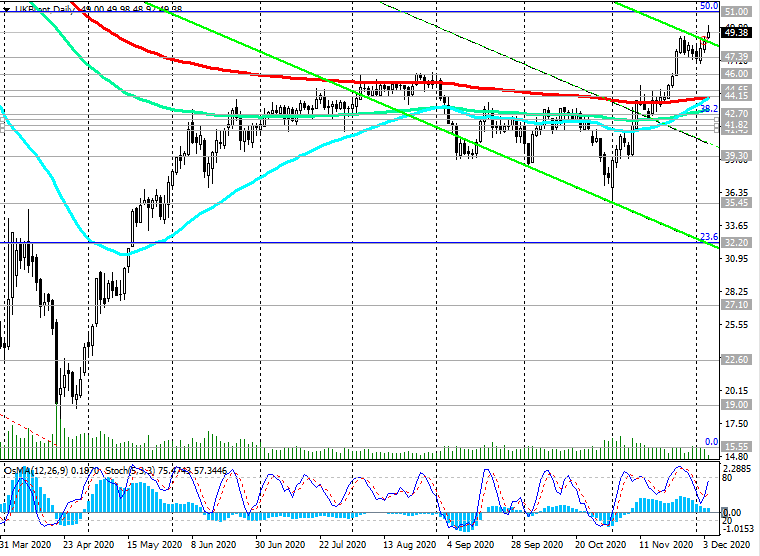

At the start of today's European session, Brent crude is trading near $ 49.38 a barrel, 0.60 pips / dollar below today's and new 9-month highs of 49.98 (see " Technical Analysis and Trading Recommendations")

It is also worth noting that the rise in oil prices is taking place against the background of the growth of world stock indices and the weakening of the dollar, which also contributes to the strengthening of oil prices, despite the decision of OPEC+ to increase production. As the dollar weakens further and the global economy recovers, oil prices, quoted in US dollars, are also likely to continue to rise. And, conversely, with a significant deterioration of the epidemiological situation in the world, which will be accompanied by regular lockdowns and the strengthening of the dollar's position as a defensive asset, oil prices, with a high probability, will also begin to decline again. The current and expected growth in oil production will also, eventually, put downward pressure on oil quotes.

Today, oil market participants will be watching the publication (at 18:00 GMT) of the weekly data of oilfield services company Baker Hughes on the number of active rigs in the United States.

On the week before last, their number was 241 (against 231, 236, 226, 221, 211, 205, 193 in the previous reporting periods). It is obvious that the number of rigs in the US is growing again, which is a negative factor for oil prices. The next growth is likely to have a negative impact on oil quotes, but, most likely, only in the short term.

The focus of the participants of the entire financial market today will be the publication at 13:30 (GMT) of the most important monthly data on the US labor market.

If the Labor Department data is strong, it will lead to increased optimism in the stock market, which could put pressure on the dollar, which is perceived as a safe-haven asset. Weak data from the labor market will force investors to expect further stimulus measures from the Federal Reserve.

But in any case, when data from the US labor market is published, a surge in volatility is expected in trading not only in USD, but throughout the entire financial market, especially if the data will differ greatly from the forecast values.

*) for trading, I choose THIS BROKER and use VPS (to get a bonus, enter the promo code - zomro_17601)

**) my signals