According to economists' forecast, in 2021 in advanced economies, fiscal and monetary policies will remain stimulating, which will help accelerate economic recovery after the pandemic, but, in turn, will increase inflationary risks.In this regard, the demand for gold as a defensive asset, including against inflation, is likely to grow again despite the fact that the price of gold has been declining in the previous 4 months.

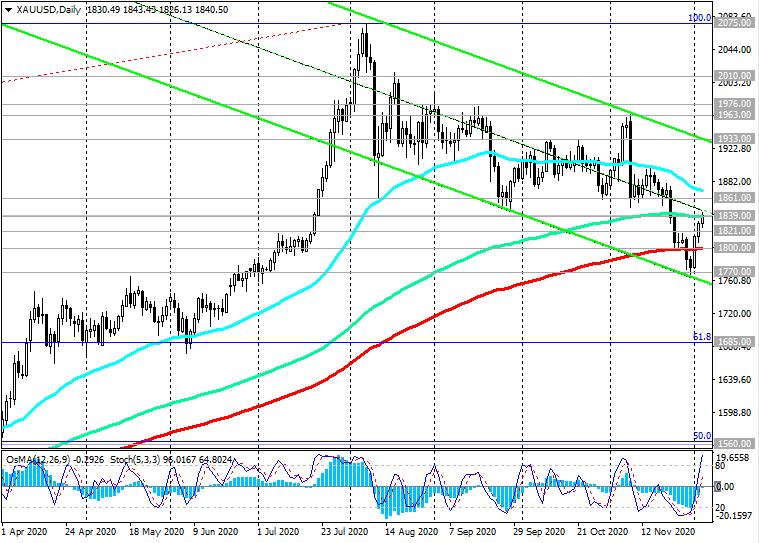

At the beginning of this month, an increase in gold quotes is observed. Thus, the XAU / USD pair is traded at the beginning of today's European session close to the important resistance level and the 1839.00 mark, which is 3.5% higher than the local 4-month low reached at the end of November near the 1770.00 mark (see " Technical Analysis and Trading Recommendations").

In case of a breakdown of the resistance level of 1861.00, the growth of XAU / USD will accelerate.

Today investors will be watching the publication (from 12:30 to 15:00 GMT) of a block of important macro statistics for the US.

Yesterday's publication of the ADP report on employment in the private sector of the US economy disappointed investors. The report reflected an increase in new jobs of 307,000, 93,000 less than expected, signaling persistent challenges in the labor market.

Today, market participants await the publication of a data set from ISM on business activity in the services sector for November, as well as statistics on the volume of primary and secondary jobless claims in the US.

Another portion of negativity may increase investors' concerns about the recovery of the world's largest economy, putting pressure on stock indices and increasing demand for defensive assets, in particular gold.

*) for trading, I choose THIS BROKER and use VPS (to get a bonus, enter the promo code - zomro_17601)

**) my signals