Dear friends, let's stay in touch

Current dynamics Gold

Gold quotes are correcting downward, trading at around 1888.0.

In the context of global uncertainty in world markets, due to concerns about the second wave of COVID-19, gold has turned from a stable defensive asset into an ordinary speculative one.

Since the beginning of March this year, gold has been the only indicator of stability and the first choice for preserving investment capital. However, judging by the recent dynamics, the asset has become too prone to panic fluctuations and no longer protects. The reaction to the macroeconomic data from China only confirms this. The composite PMI, which rose to 55.1 points in September, and the PMI in the manufacturing sector, which rose to 51.5 points, not only did not contribute to the growth of gold, but also provoked a decline.

Correlation with the US dollar is also broken. In recent days, it turned from the reverse phase into a direct one, and the asset increasingly repeats fluctuations in the US dollar. This may serve as a signal that investors do not view gold as a defense, but see it as a common volatile and speculative asset.

Support and resistance levels

On the local chart of the asset, the downward correction continues to form the classic "triangle" trend continuation pattern. Technical indicators are in the state of a local sell signal. Regardless, the global bottom-up scenario looks preferable.

Resistance levels: 1902.62, 1973.0

Support levels: 1853.0, 1750.0.

And at this the review came to an end. I wish you profitable trades, remember that your success should not depend on any one trade, you need to try to be in the black at the distance, and for this it is enough to earn only 3 out of 10 trades, how? - your reward to risk ratio should be more than one to three. Therefore, always remember about the 📈

risk (use EasyTradePad for easy calculate risk and placing orders) , consider it correctly and then your trading will be successful! Wish you a successful trading day your SeniorTrader.

In order not to miss the following market overview, as well as to be aware of the news of the project SeniorTrder 🤝 add me in friends list in mql5 and Subscribe to our telegram channel 👉Telegram Channnel https://t.me/SeniorTrader_Channel

Tools that I use in trading

Easy Trade Pad

Free version https://www.mql5.com/en/market/product/54895 (work only EURUSD)

Full version https://www.mql5.com/en/market/product/47587

iPump indicator

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

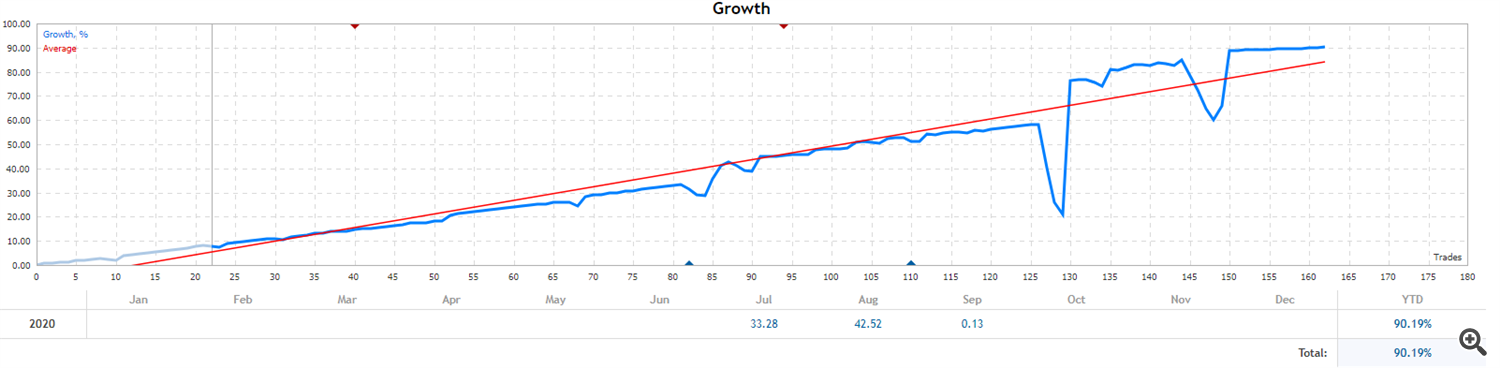

EA Pump and Dump Pro

EA Pump and Dump Pro -multifunctional Expert Advisor using trading tactics - buying in areas of strong oversold, selling in overbought areas.

https://www.mql5.com/en/market/product/51395

https://www.mql5.com/en/market/product/51395

Using averaging and piramiding strategy for overclocking a deposit.

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy with fix stop loss ( safe strategy).

The entry point is looked for based on several indicators using trend control.

#XAUUSD 30.09.2020 Fundamental and Technical Analysis