The dollar continued to decline during today's Asian session. At the beginning of the European session on Thursday, the DXY dollar index futures were trading near 97.04, 20 pips below the opening price of today's trading day and 56 pips below the opening price of the current week.

The Fed expectedly lowered the rate by 0.25% to 1.75% last Wednesday. At the same time, Fed leaders signaled that there was likely to be no further rate cut before the end of this year. At the same time, Fed Chairman Jerome Powell at a subsequent press conference again recognized the state of the US economy as strong, despite partial weakness in some sectors.

“There are many risks left, but I have to say that the risks seem to have weakened”, Powell said.

Now market participants will follow the publication on Thursday (at 12:30 GMT) of data on consumer and personal expenses and reports on employment and business activity in the manufacturing sector on Friday (at 12:30 and 14:00 GMT).

The American economy, despite the difficulties, looks more stable in comparison with other major world economies, which will lead to continued demand for US stock market assets and the dollar.

The political situation in the EU itself is quite tense, Britain’s exit from the EU is still surrounded by uncertainty, and the likelihood that the United States and China will not be able to consolidate their trade truce is still high.

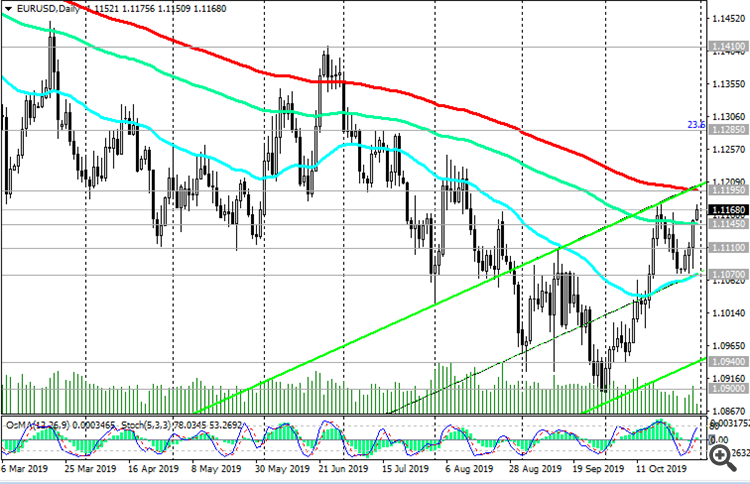

One way or another, EUR / USD is trading at the beginning of today's European session near the mark

1.1170, 18 pips above today's open price. Despite the corrective growth, the long-term negative dynamics of this currency pair remains.

In the case of the resumption of negative macroeconomic information, indicating a slowdown in the European economy, Eurodollar will resume decline.

On a positive impulse received from the Fed meeting, EUR / USD broke through a strong resistance level of 1.1145 (EMA144 on the daily chart) and continued to grow during today's Asian session, reaching 2-month highs near 1.1175.

Nevertheless, growth above the level of 1.1195 (EMA200 on the daily chart) is unlikely.

Return to the area below the level of 1.1145 will cause the resumption of the downward trend.

Support Levels: 1.1145, 1.1110, 1.1070, 1.1000, 1.0940, 1.0900, 1.0850

Resistance Levels: 1.1195, 1.1240, 1.1285

Trading Recommendations

Sell by market. Sell Limit 1.1190, 1.1200. Sell Stop 1.1140. Stop-Loss 1.1220.

Take-Profit 1.1110, 1.1070, 1.1000, 1.0940, 1.0900, 1.0850