As expected by many market participants, at the last Wednesday meeting, the Bank of Canada kept the current monetary policy and key interest rate unchanged at 1.75%.

"The recent escalation of the trade conflict has increased uncertainty regarding economic prospects", the central bank said. At the same time, the leaders of the bank believe that the slowdown in economic growth in Canada is temporary, expecting an improvement in economic activity in the country and referring to the “acceleration in the 2nd quarter”.

The recent decision of the White House to remove duties on Canadian steel and aluminum "will have a positive impact on Canadian exports and investment", because it increased the likelihood of ratifying the revised North American Free Trade Agreement (NAFTA).

On Friday (12:30 GMT), an increase in volatility in the USD / CAD trades is expected due to the publication of important macro statistics for the US and Canada. It is expected that Canadian GDP grew by 1.3% in the 2nd quarter after weak growth in the first three months of the year. Some economists believe that growth in the 2nd quarter could exceed the central bank estimate and be 2% or higher.

At the same time, the April data on consumer spending in the United States, which will also be released at the same time, may adversely affect investors' expectations regarding the US economy if the data are weak after weak data on industrial production and retail sales in the United States, published earlier.

If weak macro data starts to come in from the USA, then the probability of a decrease in the Fed's interest rate will increase. Investors already estimate the likelihood of a rate cut in 2019 at 83% versus 64% a month ago.

It is also necessary to take into account that on the last trading day of the week and month many market participants will want to take profits in long positions in the US dollar, which will cause its decline.

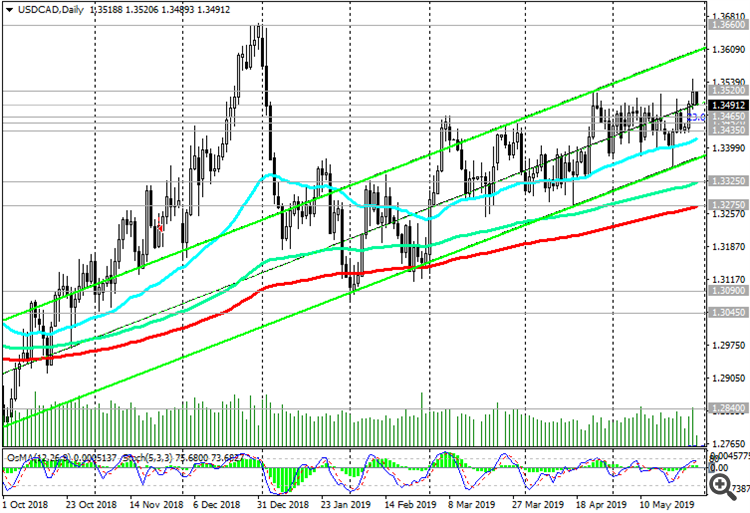

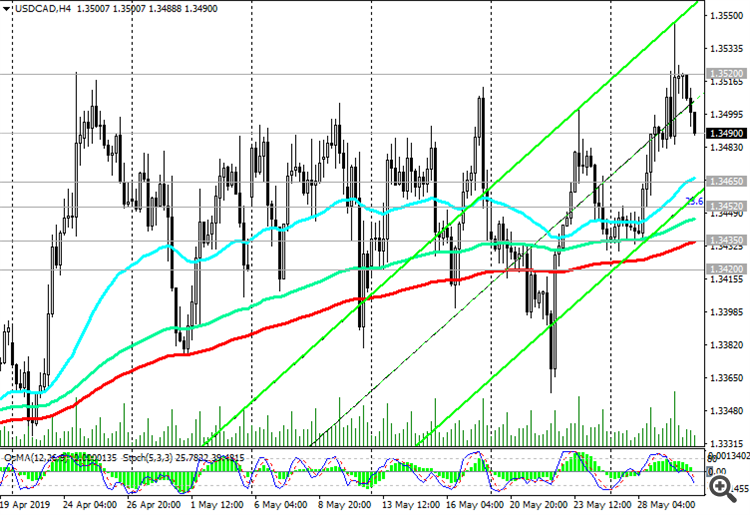

Thus, next month, a corrective decline in the USD / CAD pair may start with targets at the support levels of 1.3452 (Fibonacci level 23.6% of the downward correction to the pair growth in the global uptrend from September 2012 and 0.9700), 1.3435 (ЕМА200 on the 4 -hourly chart), 1.3420 (EMA50 on the daily chart).

The breakdown of the level 1.3420 will provoke a deeper decline to the support levels of 1.3325 (ЕМА144), 1.3275 (ЕМА200 on the daily chart). Above the key levels 1.3325, 1.3275, USD / CAD maintains a long-term positive trend.

A return to the zone above the local resistance level of 1.3520 will be a signal for the resumption of long positions with targets at the resistance levels of 1.3660 (2018 highs), 1.3790 (2017 highs).

Support Levels: 1.3465, 1.3452, 1.3435, 1.3420, 1.3325, 1.3275

Resistance Levels: 1.3520, 1.3600, 1.3660, 1.3790

Trading Scenarios

Sell Stop 1.3480. Stop Loss 1.3530. Take-Profit 1.3465, 1.3452, 1.3435, 1.3420, 1.3325, 1.3275

Buy Stop 1.3530. Stop-Loss 1.3480. Take-Profit 1.3600, 1.3660, 1.3790