We encourage you to study EA on its own until you know the tendencies of how it behaves relative to price movement.

The straightforward, versatile tool that any investor can use.

Important

Also, make sure to test and optimize Expert Advisor parameters for your specific broker. The EA optimal parameters for the same symbols can differ with different brokers.

It can be is impossible to find strategies that will work well in all market environments and it works always.

Why?

From a mathematical point of view the amount of price bars combinations is endless.

“History never repeats itself but it rhymes,” said Mark Twain

Who Can Use Spider Bot?

Beginners and experienced Forex traders may benefit from software to make their trading decisions.

What you should know about Spider Bot?

Here we go!

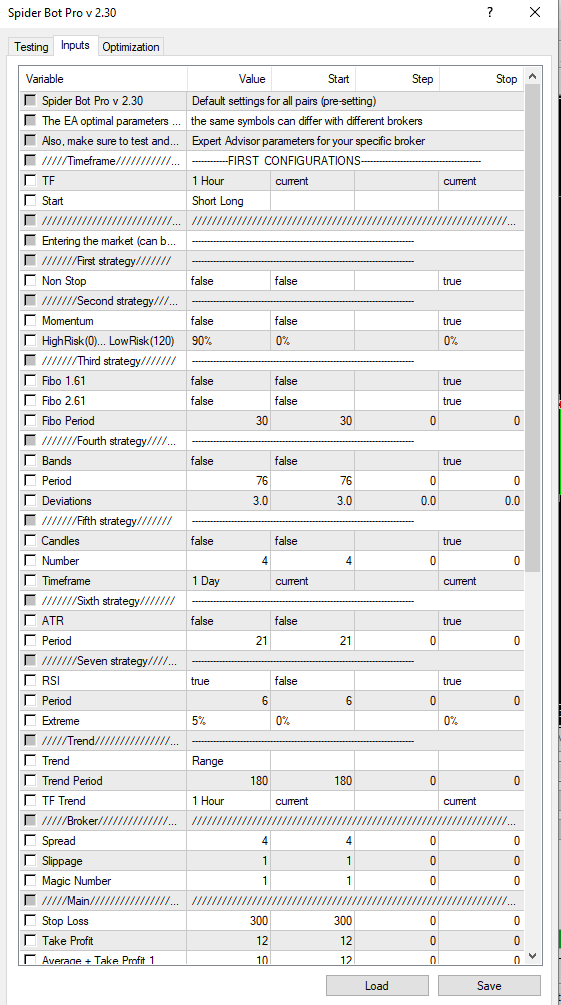

Inputs

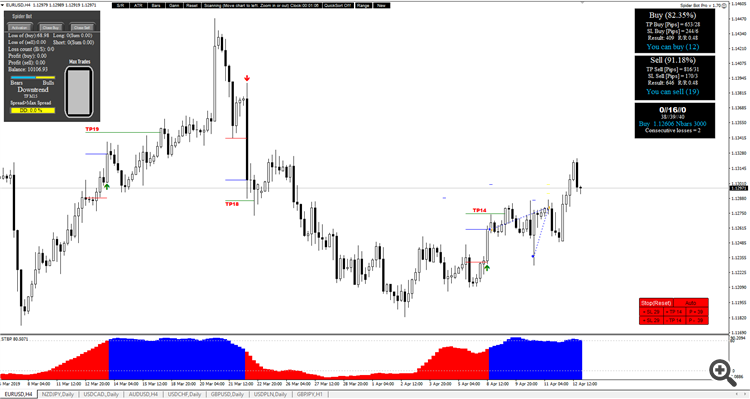

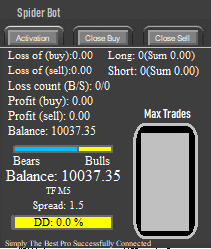

Information on chart

Information Off (Alt+1)

Information On (Alt+2)

TF (timeframe)

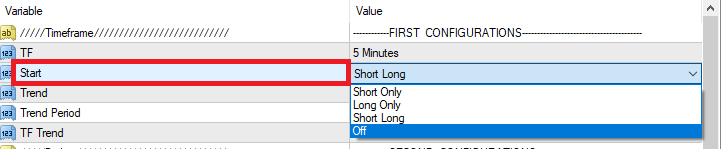

Start

...you can trade with the setting to Off

If

Open the first order or set a pending order, the rest is to be done by the advisor according.

Examples:

semi-automatic trade

with

Simply The Best Pro

with

Center of Gravity v 3.00 home ( available on request after adding ratings in the Reviews section https://www.mql5.com/en/market/product/36338)

or

Center of Gravity Modification

https://www.mql5.com/en/code/19698

Entering the market

You can combine and add Trend

Not optimized default settings defaults

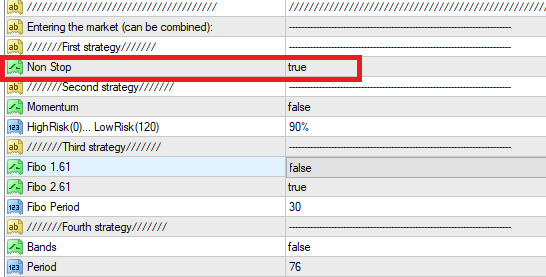

First strategy

Non Stop (high risk)

Non Stop + Trend (medium risk)

The required experience on the market

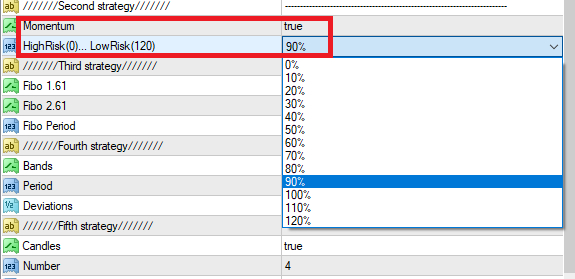

Second strategy

Momentum

Based on the Momentum indicator

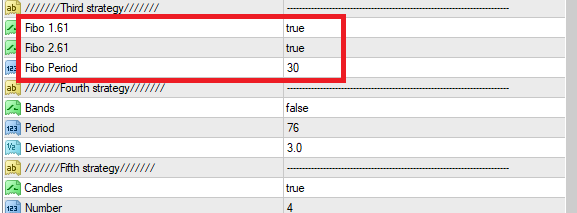

Third strategy

Fibo 1.61

Fibo 2.61

Opening the position

if(Close[1]>161 && Open[1]<161 && 161>100)

sell

if(Close[1]<161 && Open[1]>161 && 161<100)

buy

and

if(Close[1]>261 && Open[1]<261 && 261>100)

sell

if(Close[1]<261 && Open[1]>261 && 261<100)

buy

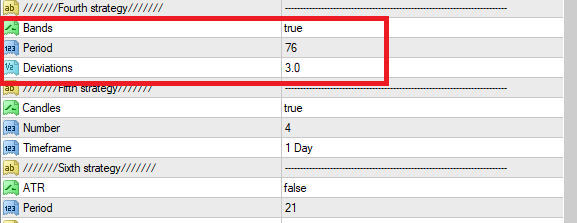

Fourth strategy

Bands

if(Close[1]>MODE_UPPER && Open[1]<MODE_UPPER )

sell

if(Close[1]<MODE_LOWER && Open[1]>MODE_LOWER)

buy

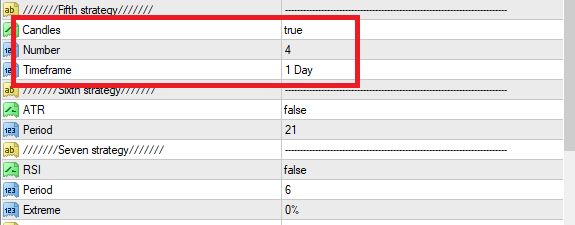

Fifth strategy

Candles

See https://www.mql5.com/en/market/product/15339# (AMD statistic - Free)

Opening the position if numer=4 (D1)

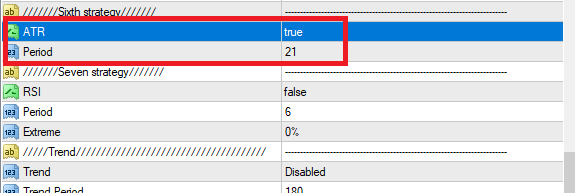

Sixth strategy

ATR

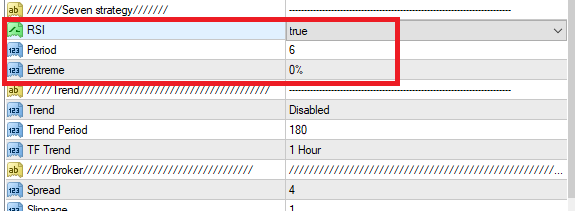

Seven strategy

RSI

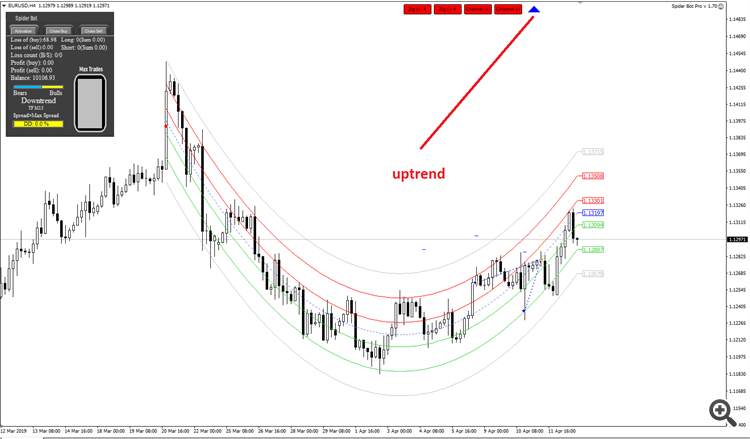

Trend

Price Action

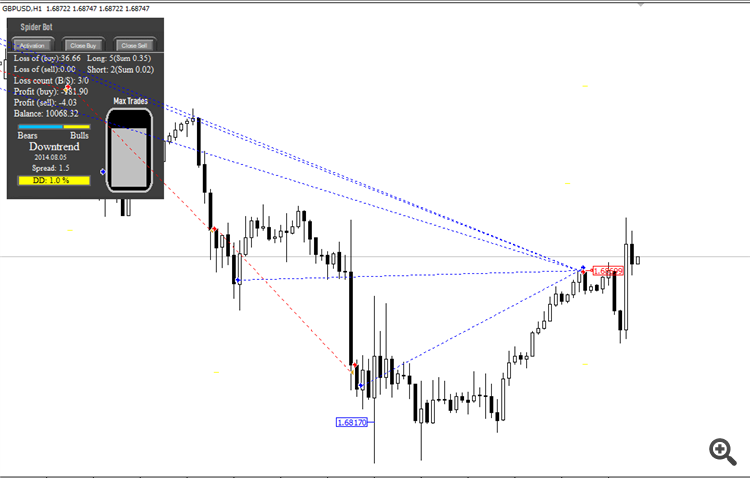

Trend based on the indicator ZigZag

for(int x=0;x<=3;x++){

if(ZigZag(x,period)>ZigZag(x+2,period) && ZigZag(x,period)>ZigZag(x+1,period)){uptrend}

if(ZigZag(x,period)<ZigZag(x+2,period) && ZigZag(x,period)<ZigZag(x+1,period)){downtrend}

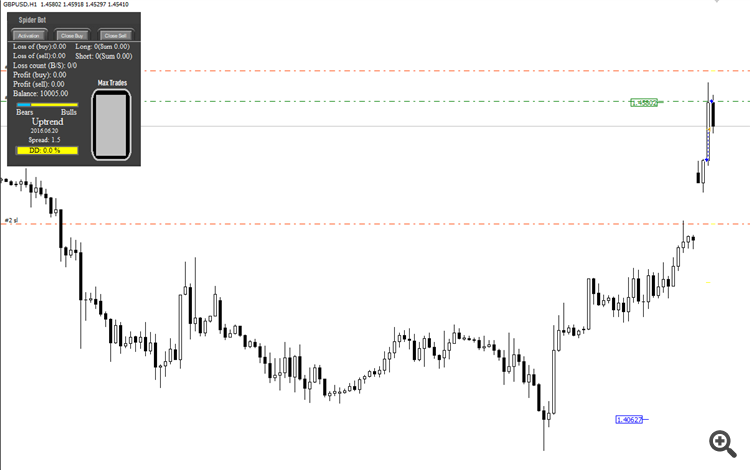

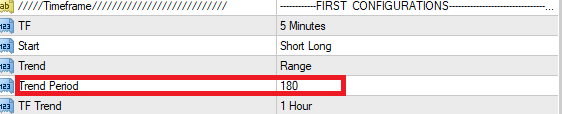

Range

Trend based on the range

uptrend = blue price (on chart) + Period (at the time in pips)

downtrend = green price (on chart) - Period (at the time in pips)

Trend Period

for Price Action and Range

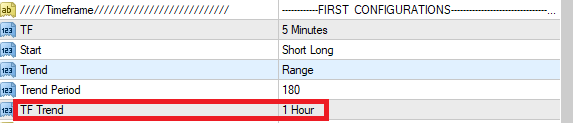

TF Trend

the choice of Time Frame for trend

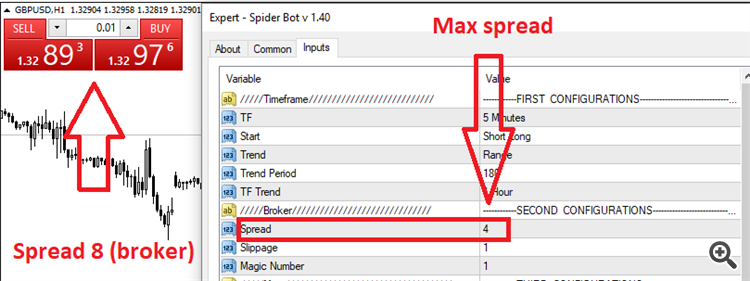

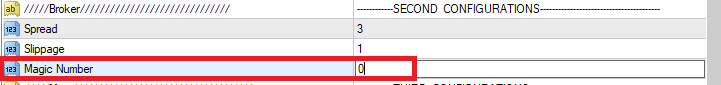

Spread

for 5 digits 2.5 not 25

Slippage

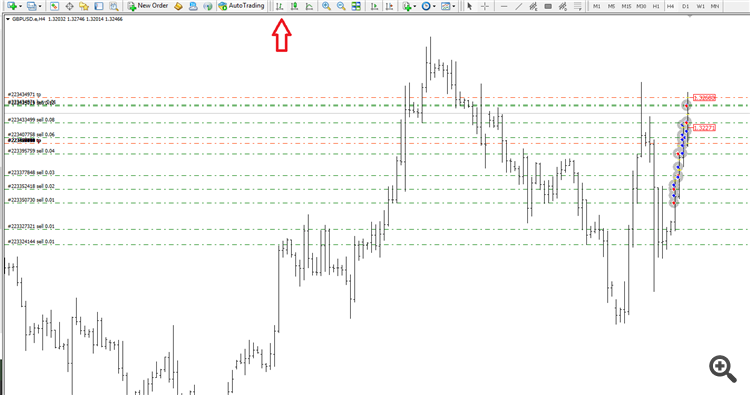

Magic Number

The Expert uses the magic numer to identify its trades

Stop Loss

Stop Loss in pips

Take Profit

TakeProfit in pips

for the first order

Average + Take Profit 1

average order price + Take Profit (trades<5)

Average + Take Profit 2

average order price + Take Profit (trades>=5)

Lots

initial lot

Max Lots

maximum volume

Multiplier

for

MN1, MN2 and Recovery

What is important !

1.2, 1.3... multiplier to increase your lot size (MN1)

1.2, 1.3... multiplier to reduce your lot size (MN2)

1.2, 1.3... multiplier to increase your lot size (Recovery)

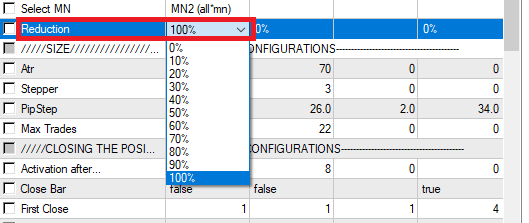

Reduction

after gradual closure, the lots reduction

0-100%

MN2 only

Run

Profit for Run One

What is Run?

Partial closing of the grid for the final profit (Profit for Run One)

maybe on an example:

Start Run

Balance = 10000 USD

Profit for Run One = 20 USD

First partial closure

What we have?

-36.70+34.52 = - 2.18

No required $ 20

continue…

Next partial closure

What we have?

-70.31+54.27 = - 16.04

No required $ 20

continue…

Next partial closure

What we have?

-103.71+79.44 = - 24.27

No required $ 20

continue…

Next partial closure

What we have?

-58.57+86.59 = 28.02

Required $ 20? Yes!!!

continue…

We close the rest of the orders

and here is the result

+20.83 USD

ATR

open position if ATR < X pips

Stepper

quantity positions without the multiplier 1=1+multiplier; 2=1+1+multiplier etc

PipStep

the minimum distance between orders

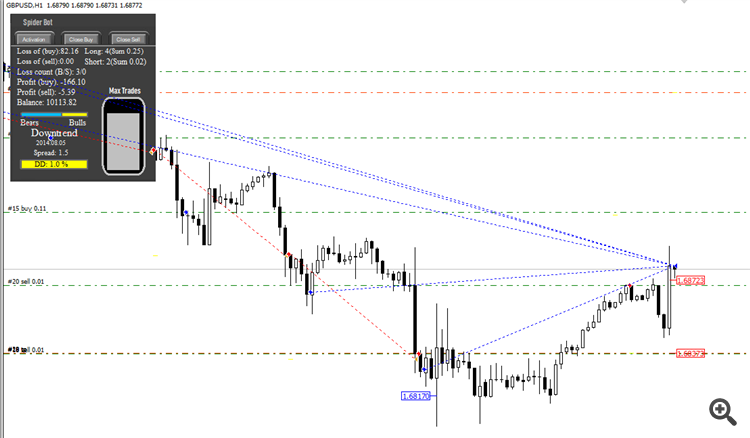

Max Trades

the maximum number of position

Activation after

quantity positions without gradual closure

Close Bar

if false

Bid>red price on chart = closing of long positions

Ask<red price on chart = closing of short positions

if true

Close[1]>red price on chart = closing of long positions

Close[1]<red price on chart = closing of short positions

or

Close[1]=Take Profit on chart

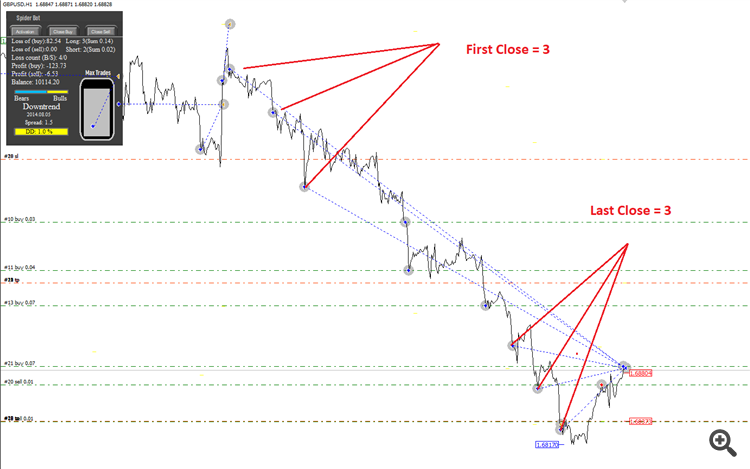

First Close

closing the positions (first)

Last Close

closing the positions (last)

There are still

leave open positions

First Close = 3

Last Close = 3

There are still = 0

First Close = 1

Last Close = 1

There are still = 4

First Close = 2

Last Close = 1

There are still = 4

if Select MN=Recovery

Max Take Profit (recalculation)

maximum Take Profit for orders (when there is a loss)

How does this work?

Please see the file below