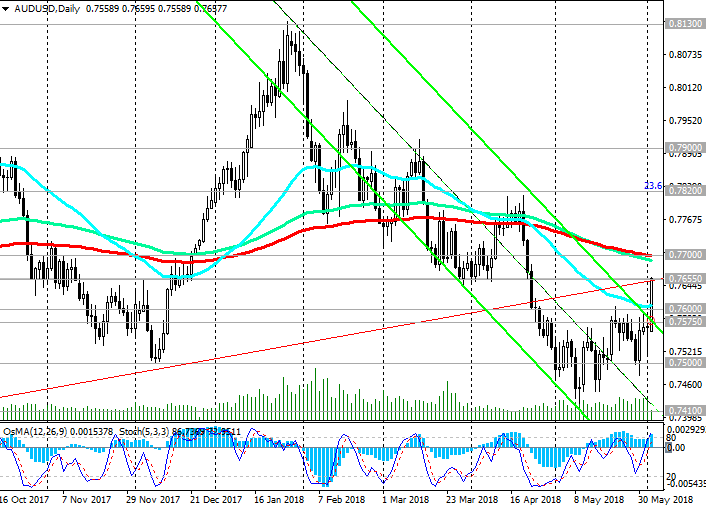

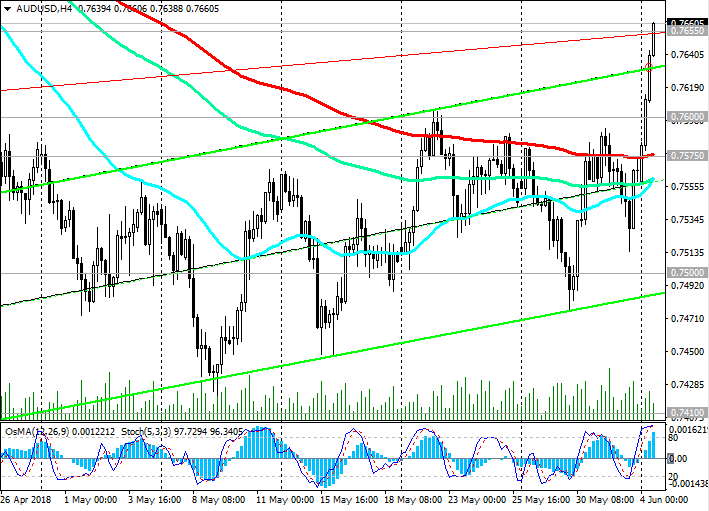

AUD/USD: despite corrective growth, downward dynamics predominate

According to data released by the US Department of Labor on Friday, the number of jobs outside agriculture increased by 223,000 in May (forecast was +188,000), while unemployment fell to 3.8 percent, the lowest level since 1969.

The number of jobs in the US has been growing for 92 months in a row, which is the longest such period in the history of such statistics.

The growth in demand for labor should positively affect wages, which are still growing at a moderate pace. The average hourly earnings in the US in May grew by 2.7% (in annual terms).

The US dollar recovered with support for strong employment data for May, which made it more likely to accelerate the rate of interest rate increase in the coming months.

The probability that the Fed will raise the interest rate by 0.25% to 2.0% at a meeting to be held June 12-13 is almost 100%, according to the CME Group.

However, more interest for investors will be represented by the text of the Fed's accompanying statement about the prospects of monetary policy and the probability of more accelerated rates of its tightening. 3 planned Fed rate increases this year are already taken into account in the quotes of the US dollar.

If the Fed signals about a high probability of 4 rate increases this year, then the dollar's growth will resume.

Meanwhile, there is a decline in the US dollar after its growth on Friday against the backdrop of strong data from the US labor market.

The Trump administration does not show signs of concern about the possible start of a trade war. "When the deficit of foreign trade is almost 800 billion dollars a year, one can not afford to lose a trade war", Trump wrote on his twitter page on Saturday. "The USA has been ripped off by other countries for years, it's time to take on the mind," he added.

Meanwhile, the Australian dollar received support in the morning from the publication of positive macro statistics, according to which, retail sales in Australia in April rose by 0.4% (forecast was + 0.2%), companies' profit in Australia in the 1st quarter increased to + 5.9% (the forecast was + 3.0% and + 2.8% in the previous quarter).

Nevertheless, key indicators such as the Australian labor market and consumer incomes remain weak.

So, the unemployment rate in Australia is 5.6% (in March this level was 5.5%), and the growth rate of salaries in Australia remain near record lows. Thus, the growth of wages in Australia in the first quarter of 2018 amounted to + 2.1% (in annual terms). The Reserve Bank of Australia pays much attention to this indicator when deciding on the interest rate.

Low wage growth rates may prompt the Reserve Bank of Australia to not change interest rates for a longer period of time.

On Tuesday (01:30 GMT), the RBA takes a decision on the rate, which since mid-2016 is at a record low level of 1.5%. Deputy Governor of the RBA Debell said that interest rates will not be raised until consumers' incomes rise.

Economists believe that the first increase will take place only in 2019. However, interest rates may remain unchanged for an even longer time, given the weak wage growth and the slowdown in the Australian economy.

It is likely that on Tuesday the rate will remain at the same level of 1.5%.

"The Board does not see any weighty arguments in favor of adjusting the key interest rate in the short term," - said in one of the latest statements of the RBA.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 0.7600, 0.7575, 0.7500, 0.7410, 0.7300

Resistance levels: 0.7655, 0.7700, 0.7820, 0.7900, 0.8000

Trading Scenarios

Sell Stop 0.7640. Stop-Loss 0.7710. Take-Profit 0.7600, 0.7575, 0.7500, 0.7410, 0.7300

Buy Stop 0.7710. Stop-Loss 0.7640. Take-Profit 0.7750, 0.7820, 0.7900, 0.8000

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com