WTI: decrease of reserves in US oil storage facilities is expected

As the American Petroleum Institute (API) said on Wednesday evening, US oil inventories rose by 1 million barrels last week. Gasoline stocks fell by 1.7 million barrels, while distillate stocks increased by 1.5 million barrels.

This is negative information for oil quotes, which are again declining after corrective growth the day before.

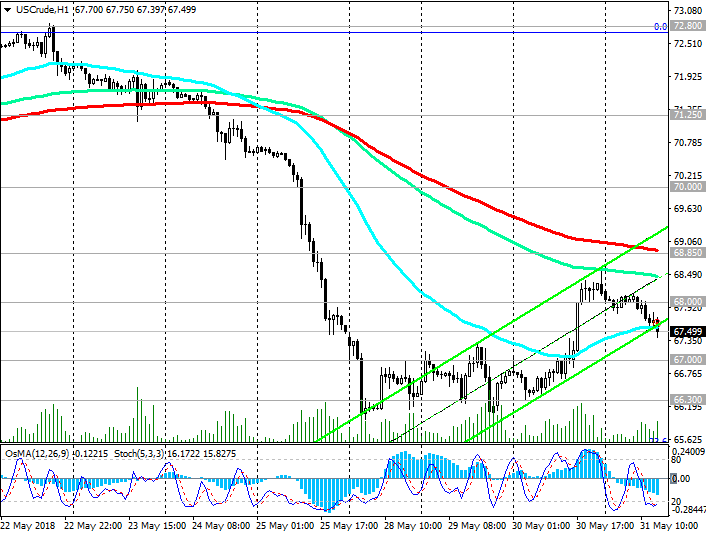

At the beginning of the European trading session on Thursday, the price of WTI crude oil fell below the psychological level of 68.00 dollars per barrel.

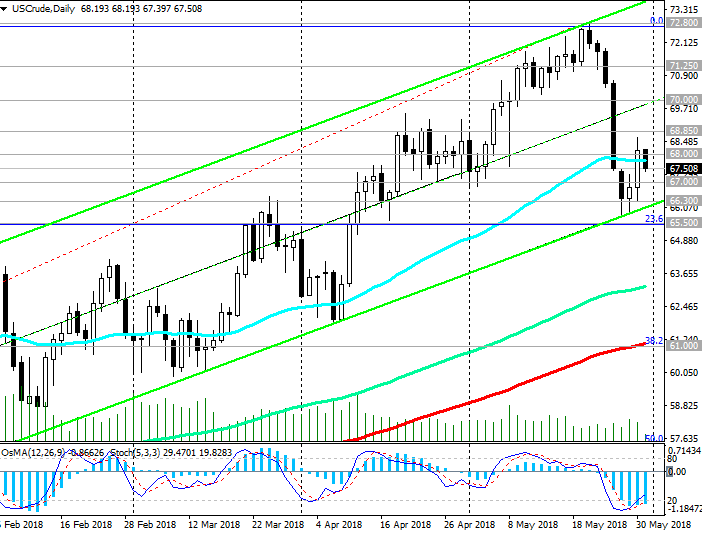

After reaching an annual maximum near the $ 73.00 per barrel level last week, prices fell by 10% over the next 5 trading days, coming close to $ 66.00 per barrel.

The fall in oil prices was triggered by expectations that OPEC might increase oil production in June.

Last Friday, Saudi Arabia and Russia announced plans to soften the terms of the OPEC + agreement and increase oil production. The OPEC + agreement on production reduction came into force in January 2017, and since then oil prices have risen by about 35%. The agreement expires at the end of 2018.

Earlier in May, Brent oil prices broke through the level of $ 80 per barrel, and this happened for the first time since 2014.

Now, due to an increase in production of 1 million barrels per day, prices may fall by about $ 15 per barrel.

On Friday, a weekly report from the American oilfield service company Baker Hughes was released, according to which the number of active oil drilling rigs in the US increased again and currently stands at 859 units (against 844 in the week before last). The growth of this indicator is another negative factor for the oil market and for oil prices.

On Thursday, oil market participants are waiting for the publication of weekly data from the US Department of Energy, which will be released at 14:30 (GMT). It is expected that oil and oil products stocks fell by 1.2 million barrels last week. If the data is confirmed, then it will support oil prices.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 67.00, 66.30, 65.50

Resistance levels: 68.00, 68.85, 70.00, 71.25, 72.80, 74.00, 75.00

Trading Scenarios

Sell Stop 67.30. Stop-Loss. 68.20. Take-Profit 67.00, 66.30, 65.50

Buy Stop 68.20. Stop-Loss 67.30. Take-Profit 68.85, 70.00, 71.25, 72.80, 74.00, 75.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com