After the tension in relations between North Korea and the United States declined and against the background of positive data on retail sales received from the US, the dollar regains its positions in the foreign exchange market, and the demand for safe haven assets, including precious metals, is declining.

A few hours after China supported sanctions against Pyongyang imposed by the United States, North Korea refused to threaten to attack the United States.

As reported yesterday by the US Department of Commerce, July data on retail sales exceeded expectations, an increase of 0.6% against the forecast (0.4%). Data on retail sales supported the further strengthening of the dollar and encouraged the buyers of the dollar, putting on its further growth.

Today, the focus of traders will be the publication (18:00 GMT) of the protocol from the July Fed meeting to understand the prospects for monetary policy in the US.

In recent weeks, Fed officials have talked about the weakness of inflation and uncertainty in fiscal policy. Published on Friday, inflation data increased fears that the price dynamics did not meet the expectations of the Fed. The consumer price index (CPI) in July rose by 0.1% compared to June, and by 1.7% compared to July of the previous year (the target level of annual inflation established by the Federal Reserve is 2%).

The protocols, apparently, will also contain information on the continuation of the discussion on inflation, which remains weak and, in the opinion of some leaders of the Fed, may become a hindrance to further tightening of monetary policy in the US.

This year, the Fed will hold three more meetings devoted to monetary policy: September 19 - 20, October 31 - November 1, and December 12 - 13. After the September and December meetings, the Fed will publish its new economic forecasts, while Fed Chairman Janet Yellen will hold a press conference.

According to the CME Group, investors are taking into account the 53% chance of raising the Fed's interest rates in the price this year. Before the release of data on retail sales, they estimated such a probability of 37%.

As is known, in the conditions of increase in the rate the price for precious metals, including silver, falls, as the cost of its acquisition and storage is growing.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

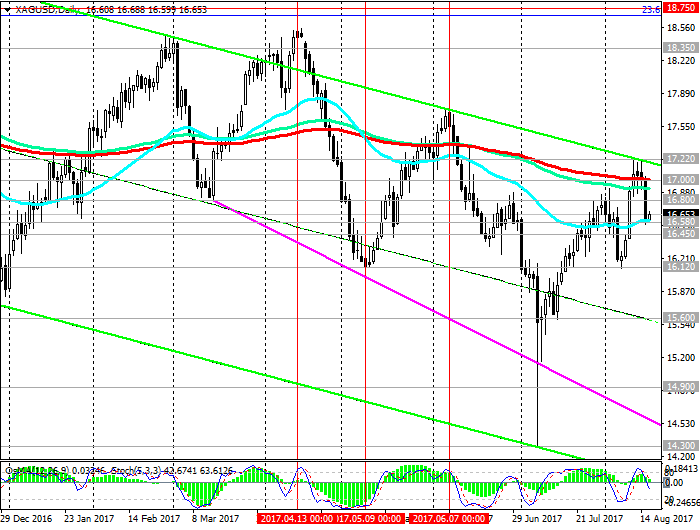

The pair XAG / USD was unable to develop an uptrend above the resistance level of 17.22 (August highs and the top line of the descending channel on the daily chart). Having broken the key level 17.00 (EMA200 on the daily chart), XAG / USD is falling deeper into the descending channel on the daily chart.

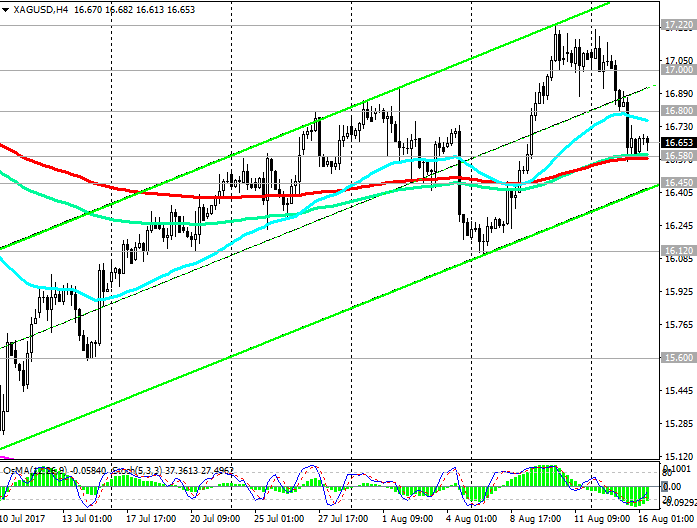

At the moment, XAG / USD is trading at the support level of 16.58 (EMA200, EMA144 on the 4-hour chart). A break of this level will signal the continuation of the downward movement.

While XAG / USD is below the level of 17.00, the downside dynamics prevails.

In case of breakdown of the local support level of 16.12 (August lows), the pair XAG / USD will go into the downward channel on the daily chart towards its lower boundary with the targets of 15.60, 14.90, 14.30 (July lows), 13.65 (minimum of the global wave of the pair XAG / USD decline September 2012).

Support levels: 16.58, 16.45, 16.12, 15.60, 15.25, 14.90, 14.30, 13.65

Levels of resistance: 16.80, 17.00, 17.22

Trading scenarios

Sell Stop 16.55. Stop-Loss 16.70. Take-Profit 16.45, 16.38, 16.12, 15.60, 15.25, 14.90, 14.30

Buy Stop 16.70. Stop-Loss 16.55. Take-Profit 16.80, 17.00, 17.22

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com