DJIA: the indices rose after the publication of inflation data

After Friday's weak data on retail sales and inflation in the US were published, the main US stock indexes rose. As the US Department of Labor reported on Friday, the consumer price index (CPI) remained unchanged in June compared to the previous month (0.0% in June, + 1.6% in annual terms, vs forecast +0.1% and +1.7%, respectively). Retail sales in June, according to the data presented, fell by 0.2% compared to May (sales were expected to increase by 0.1%). These data are key for the Fed in the matter of making an interest rate decision.

Investors bought shares and bonds on Friday, as weak data on retail sales and inflation suggest that the Federal Reserve is unlikely to raise interest rates and reduce assets in the coming months. Against the background of purchases of 10-year US Treasury bonds, their profitability declined from 2.319% to 2.298% after the publication of macro data.

The S & P500 index rose 0.5% on Friday to 2459.00 points. The Dow Jones Industrial Average index increased by 0.4% to 21637.00 points. Last week was the most successful for both indices from the end of May. So, S&P500 for the week gained 1.4%, and DJIA grew by 1%.

On Friday, the reporting season for US banks began, the results were published by Citigroup Inc., J.P. Morgan Chase & Co., Wells Fargo & Co. and PNC Financial Services Inc. Hopes for high financial results of companies for the 2-nd quarter also support the US stock indexes.

Shares of US banks over the past three weeks have risen in price. Also last week, shares of technology companies in the United States grew. The subindex of the technology sector of the S & P500 grew by 3.8%, showing the best weekly result in 2017.

Now, after the publication of the data, the probability of an increase in the rate in December, according to the CME Group, fell below the level of 50%. President of the Federal Reserve Bank of Dallas Robert Kaplan on Thursday made it clear that he would like to wait for the acceleration of inflation before raising interest rates again. It is likely that the Fed in the future may be more prudent approach to raising rates. If the Fed again adheres to mild rhetoric regarding monetary policy, it will stimulate the US stock market to further growth.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

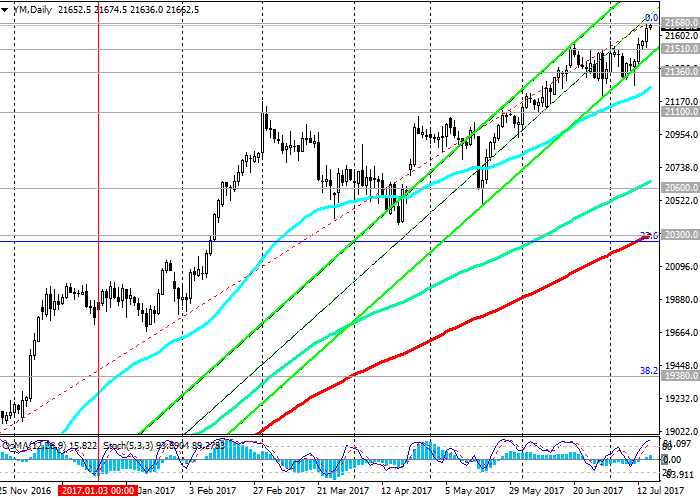

DJIA updated its annual highs on Friday and reached a new absolute maximum near the mark of 21680.0. The DJIA index continues to grow steadily, starting from February 2016 and trading in the ascending channels on the daily and weekly charts.

So far, the index is trading above the key support level of 20300.0 (EMA200 on the daily chart, as well as the Fibonacci level of 23.6% correction to the growth in the wave from the level of 15660.0 after rebounding in February this year to the collapse of the markets since the beginning of the year. The maximum of this wave and the Fibonacci level 0% is near the mark of 21536.0), its medium-term positive dynamics is preserved. The long positions in the DJIA index trade are relevant.

Against the background of low inflation in the US and the Fed's predilection, in connection with this, to a cautious approach in the matter of further interest rate hikes, the further growth of the DJIA index is likely.

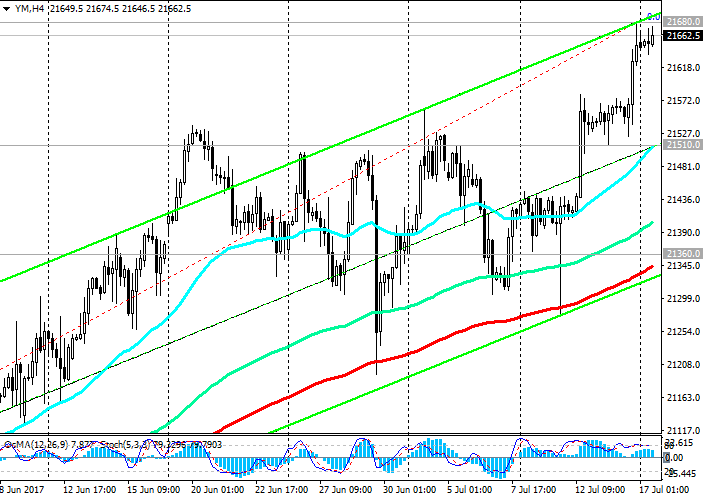

Only in case of breakdown of the support level of 21360.0 (EMA200 on the 4-hour chart) can we again return to consideration of short positions on the DJIA index. And only in case of breakdown of the support level of 19380.0 (Fibonacci level of 38.2%) can we speak about the breakdown of the bullish trend.

Support levels: 21510.0, 21360.0, 21100.0, 20600.0, 20300.0

Resistance levels: 21680.0, 22000.0

Trading Scenarios

Buy Stop 21690.0. Stop-Loss 21500.0. Take-Profit 21700.0, 21800.0, 22000.0

Sell Stop 21500.0. Stop-Loss 21690.0. Take-Profit 21360.0, 21100.0, 21000.0, 20600.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com