After some decline during the Asian session, the dollar today resumed its growth. Ambiguous data on the US labor market for June, published on Friday, caused a surge in volatility in the foreign exchange market. And yet, despite the fact that unemployment rose in June from 4.3% to 4.4%, and the average hourly earnings in the US for June was 0.2% (the forecast was 0.3%), in general, the data On the labor market in the US can be called strong. The NFP indicator in June was 225,000 (against the forecast of 179,000). The dollar strengthens in the foreign exchange market, and oil prices decline.

Additional pressure on oil prices had an increase in oil production in the US last week. According to the Energy Information Administration of the country, oil production in the US last week increased to 9.33 million barrels per day from 9.25 million barrels a day a week earlier. Oil production at the same time exceeded the level of the previous year by almost 11% and returned to its 10-month maximum.

Published on Friday, data from the oil service company Baker Hughes, also indicated an increase in drilling activity in the industry. So, the number of oil drilling rigs in the US increased last week by seven units to 763 units, which is more than 2.1 times higher than a year ago. Against the backdrop of a sharp increase in oil production in the US, which alleviates OPEC's efforts to stabilize the balance in the oil market, OPEC is considering setting restrictions on oil production in Nigeria and Libya.

But, at the same time, Saudi Arabia plans to spend $ 300 billion on oil and gas projects in the next 10 years, the head of Aramco said today. Last week, by the way, Saudi Arabia reported that it reduces official oil prices for Asia.

Despite the agreements to limit oil production, the struggle for its share in the oil market does not stop. Especially, after the US begins to fill successfully the vacant niches in the oil market with a growing supply of US shale oil.

World oil production is still high, oil reserves remain at historical highs, but the demand for oil is not growing.

Most likely, oil prices will continue to decline in the short term. The next weekly official data on oil reserves in the US will be released on Wednesday (14:30 GMT). If the data indicates an increase in inventories, then this will have additional pressure on oil prices.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

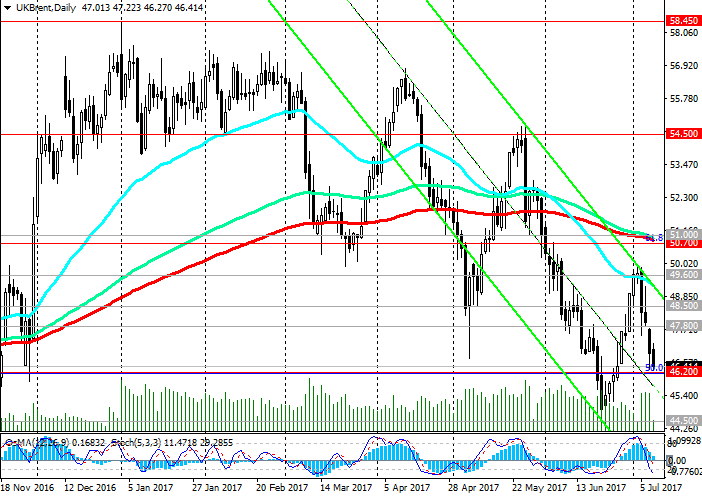

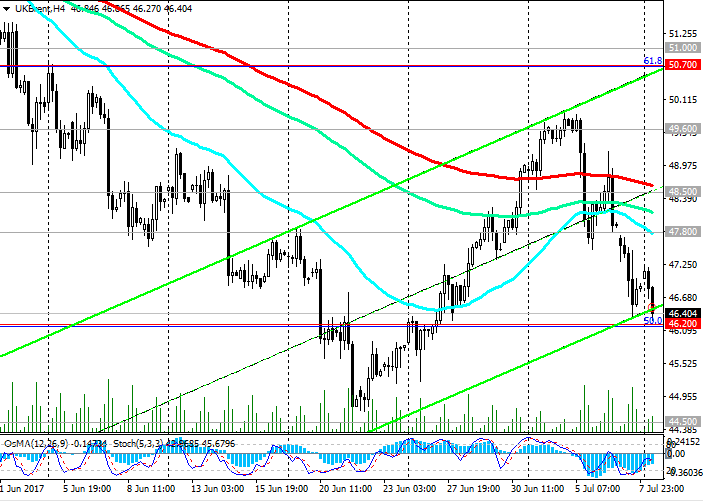

The price for Brent crude oil was down 2.8% on Friday, coming close to $ 46.30 per barrel. At the beginning of today's European session, the price for Brent crude is again traded near this mark, remaining under pressure. Last week, the price could not develop an upward movement above resistance level 49.60 (EMA50 and the upper limit of the descending channel on the daily chart). Over the last 3 trading sessions, the price has lost more than 7%, and having broken short-term support levels of 48.50 (EMA200 on the 4-hour chart), 47.80 (EMA200 on the 1-hour chart), continues to decline in the downlink on the daily chart with immediate targets at levels Support 46.20 (Fibonacci level 50% correction to the decline from the level of 65.30 from June 2015 to the absolute minimums of 2016 near the mark of 27.00), 44.50 (lows of the year). The more distant target is the level 41.70 (the Fibonacci level of 38.2% and the lower boundary of the descending channel).

Strengthening the foreign exchange market dollar also contributes to lower commodity prices and oil prices. Only if the price is restored above the level of 48.50 can you consider the long positions again. The trend again changed to negative, and negative moods continue to dominate the oil market.

Support levels: 46.20, 45.50, 44.50, 41.70

Resistance levels: 47.80, 48.50, 48.80, 49.60, 50.70, 51.00

Trading Scenarios

Sell Stop 46.25. Stop-Loss 46.88. Take-Profit 46.00, 45.50, 44.50, 43.50, 41.70

Buy Stop 46.88. Stop-Loss 46.25. Take-Profit 47.25, 47.80, 48.50, 49.60, 50.00, 50.70, 51.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com