Today, global stock indexes are growing. The stabilization of oil prices renders support to the stock market. In recent days, there has been a sharp drop in energy prices.

The price of WTI oil last week fell by more than 20% from the February high. Fears of investors regarding the further decline in prices remain against the background of an overabundance of oil supply in the world.

Despite OPEC measures to limit production, world oil reserves in the world remain at high levels. A sharp fall in oil prices led to a decline in key indices.

The last three days the price of oil is recovering. Oil Brent went up today by 1.4% to 46.20 dollars per barrel. The sub-index of the oil and gas sector StoxxEurope 600 rose by 0.9%.

Other major European stock indices (CAC40, DAX30, EuroSTOXX50) are also growing today. The growth of European indices is also promoted by the growth of shares of European banks after on Sunday the authorities of Italy announced that they are ready to spend 17 billion euros in the process of liquidation of two regional creditors.

EuroSTOXX50 grew today by 0.7% in the first three hours since the beginning of the European trading session to the level of 3575.0.

Positive macro data, received from Germany at the beginning of the European trading session, also contributed to the growth of the indexes DAX30, EuroSTOXX50.

The index of economic expectations in Germany in June was 106.8 (forecast was 106.4), the German business sentiment index in June was 115.1 (forecast was 114.4), the current conditions in Germany in June 124.1 (forecast Was 123.3).

Now investors are waiting for data from the Eurozone on inflation, which will be published later on Friday. Annual inflation in June is expected to slow in Italy, Spain, France, Germany and the Eurozone as a whole to 1.2% from 1.4% in May, reaching its lowest level in 2017. If the forecast is justified, then the ECB's predilection for the reduction of the QE program is expected to decline even more.

As you know, in early June, the ECB kept its benchmark interest rate at 0%. The QE program, in which the ECB monthly buys up European assets worth 60 billion euros, also remained unchanged. The ECB Governing Council stated that the curtailment of the QE program has not yet been planned and is even ready to increase the volume of the quantitative easing program if necessary.

And this is a positive factor for the European stock market.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

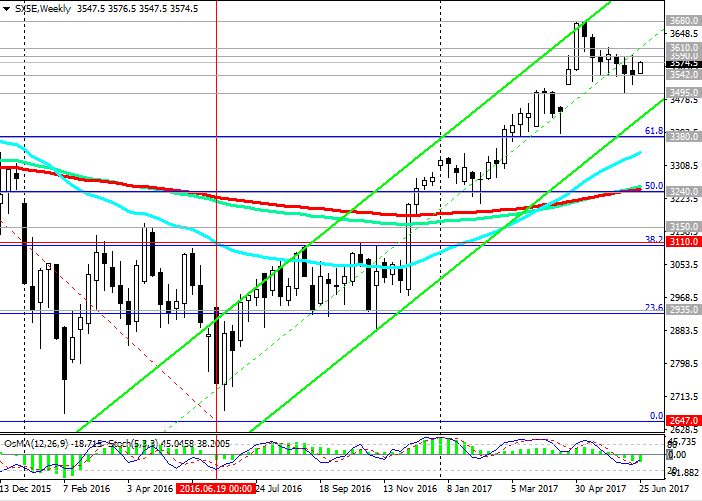

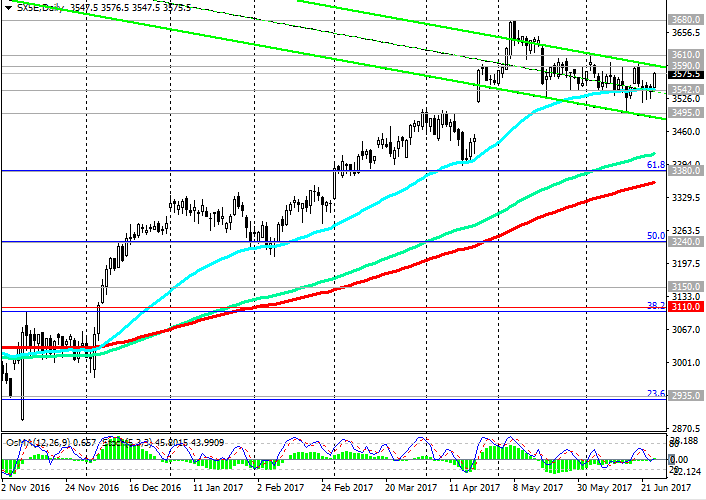

And yet, despite today's growth, the EuroStoxx50 index remains under pressure, gradually decreasing in the descending channel on the daily chart. Only in case of breakdown of resistance levels 3590.0 (the top line of the descending channel on the daily chart), 3610.0 (June highs) can we speak about restoring the positive dynamics of the EuroStoxx50 index and its further growth.

The reverse scenario is connected with the breakdown of the support level 3542.0 (EMA50 on the daily chart, EMA200 on the 4-hour chart) and the further decrease of the EuroStoxx50 index with the immediate target at the support level of 3495.0 (the lower border of the descending channel on the daily chart and the April highs observed on the eve of the presidential election in France).

And at the same time, the medium-term positive dynamics of the EuroStoxx50 index remains, while the index is above the key support level of 33.80 (EMA200 on the daily chart and Fibonacci level 61.8% correction to the wave of growth since June 2016).

In case of breakdown of the level 3610.0, the growth of the EuroStoxx50 index may resume within the uplink on a weekly chart. At least, the ECB's tendency to continue the extra soft monetary policy promotes this.

Support levels: 3542.0, 3495.0, 3380.0

Resistance levels: 3590.0, 3610.0, 3680.0, 3700.0

Trading Scenarios

Sell Stop 3540.0 Stop-Loss 3580.0. Take-Profit 3510.0, 3495.0, 3435.0, 3380.0

Buy Stop 3580.0. Stop-Loss 3540.0. Take-Profit 3590.0, 3610.0, 3680.0, 3700.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com