XAG/USD: precious metals are getting cheaper amid plans of the Fed

After last Wednesday the Fed announced an increase in the key interest rate, precious metals continued to go down in the foreign exchange market. The index of the dollar WSJ rose above the level of 88.60, to the level of 88.75 on Monday. The American Central Bank made it clear that it could once again raise rates in 2017, and also planned to reduce its balance by $ 4.5 trillion later this year.

According to the CME Group, futures on interest rates by the Fed show that the probability of another increase in Fed rates this year is about 47% (against 41% last week).

Rising rates usually support the dollar, making it more attractive to investors. Higher interest rates also lead to the sale of precious metals, which do not bring interest income. At the same time, the costs of their acquisition and storage are growing.

President of the Fed-New York William Dudley said on Monday that he was "very confident" of "long-term" economic growth in the US, which is the third longest in the history of the United States. American stock markets are growing steadily. The weakening of the hype surrounding US President Trump, the stabilization of the political situation in the Eurozone after the presidential and parliamentary elections in France, also contribute to reducing political risks and prices for precious metals.

Nevertheless, further strengthening of the dollar clearly lacks an additional positive momentum.

Some weaker than expected macro data from the US, some people question the Fed's determination to further tighten the monetary policy in the US. Perhaps, the statements of a number of representatives of the Federal Reserve scheduled for this week will once again give confidence to investors who are betting on the growth of the dollar.

For example, on Tuesday, scheduled speeches by the president of the Fed-Boston Eric Rosengren, executive director of the Federal Reserve Bank of Dallas Robert Kaplan and Deputy Chairman of the Federal Reserve Stanley Fischer. On Friday, Fed Governor Jerome Powell and FRS President St. Louis James Bullard will deliver a speech.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

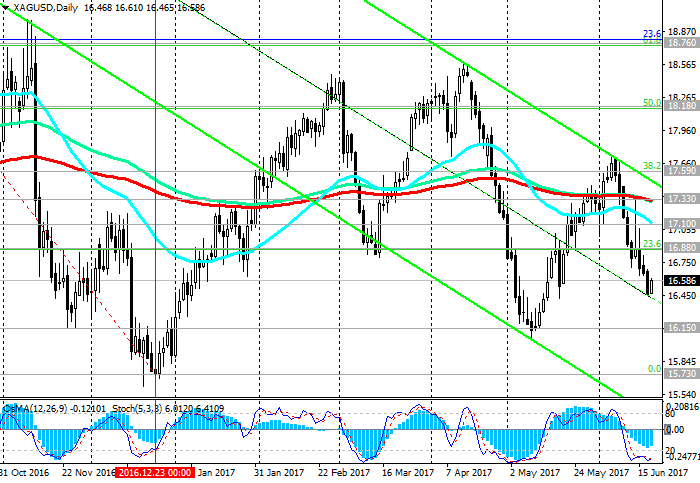

Meanwhile, the price of silver has been steadily declining for the past two weeks. Today, with the opening of the trading day, the price of silver is growing, however, the non-negative tenedency remains. The pair XAG / USD broke through the important support levels of 17.33 (EMA200, EMA144 on the daily chart), 17.10 (EMA200 on the 4-hour chart), 16.88 (Fibonacci level of 23.6% of corrective growth to the pair decline since August 2016 and level of 20.60) and Continues to decline in the descending channels on the 4-hour, daily, weekly charts with immediate targets near the levels of 16.15, 15.73 (low in 2016)

The lower boundary of the channels passes below the level of 15.73 (the minimums of 2016). This mark and will be the goal in case of further strengthening of the dollar in the foreign exchange market and the decline of the pair XAG / USD for the next 3-4 weeks.

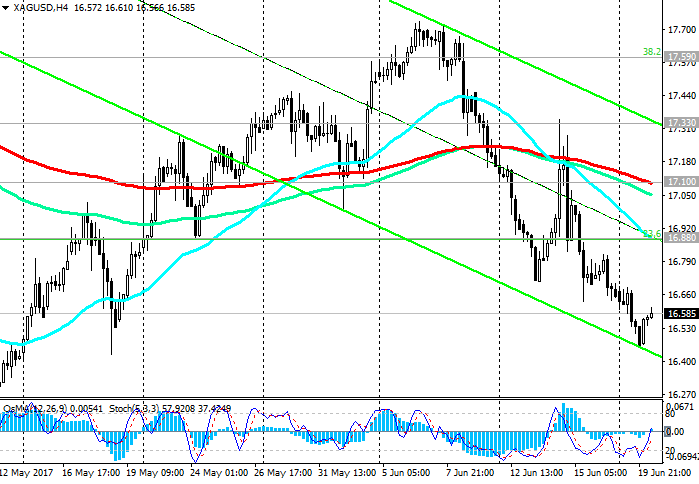

Indicators OsMA and Stochastics on the 1-hour, 4-hour charts went to the buyers side, signaling a possible short-term upward correction with targets near the level of 16.88.

More distant goals in the case of the resumption of the growth of the pair XAG / USD - the levels of 17.33 (May highs), 17.59 (Fibonacci level 38.2%). Here, the top line of the descending channel passes on the 4-hour, daily and weekly charts.

More distant medium-term goals in the case of further growth of the XAG / USD pair - the levels of 18.18 (Fibonacci 50% and EMA200 on the weekly chart and April highs), 18.76 (Fibonacci level 61.8%).

So far, negative dynamics prevails.

Support levels: 16.30, 16.15, 15.73

Resistance levels: 16.88, 17.10, 17.33, 17.59, 18.18, 18.76

Trading scenarios

Sell Stop 16.45. Stop-Loss 16.70. Take-Profit 16.25, 16.15, 15.73

Buy Stop 16.70. Stop-Loss 16.45. Take-Profit 17.00, 17.10, 17.33, 17.59, 18.17, 18.48, 18.76

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com