As a result of a two-day meeting, the Fed raised yesterday the interest rate by 0.25% to 1.25%. The decision was expected, and the dollar reacted with sufficient restraint to it. The dollar began to strengthen later, when at 18:30 (GMT) the FRS press conference began, from which it became known that the Fed is planning another increase towards the end of the year, as well as cutting its budget, which is about 4.5 trillion US dollars. The portfolio of FRS assets rose to the current level from 800 billion dollars before the crisis, which was due to a number of bond purchase programs aimed at reducing long-term interest rates.

According to some economists' estimates, the reduction of assets by $ 675 billion by 2019 will be equivalent to raising the key short-term interest rate of the Federal Reserve by a quarter of a percentage point. The process of reducing the balance of the Fed will also lead to an increase in the yield of 10-year US Treasury bonds, which will be accompanied by the strengthening of the dollar.

Thus, the Fed once again confirmed its intention to tighten monetary policy in the US.

As is known, at the beginning of the month, the RB of Australia left the key interest rate unchanged at 1.50%. As it was said in the accompanying statement, "the strengthening of the Australian dollar will complicate the adjustment of the economy", and "the preservation of rates unchanged corresponds to the goals in relation to GDP, inflation". As noted in the RBA, the conditions for doing business in the country have improved; however, there are other risks for the country's economy, which restrain the RBA from tightening monetary policy. Slow growth rates of wages and incomes of the population of Australia, increased unemployment and low, according to the RBA, the growth rate of the country's GDP will restrain the RBA from tightening monetary policy.

The volatility of commodity prices, in particular iron ore, one of Australia's major export commodities, and their propensity to decline against the expected strengthening of the US dollar, also represents one of the significant risks to the Australian economy, which still retains the raw material features in many respects.

The Australian dollar has grown today after the release of data showing a sharp increase in employment and a drop in the unemployment rate. Thus, the unemployment rate in May fell to 5.5% from 5.7% in April. The number of employees increased by 42,000 (with a growth by forecast of 10,000). The Australian labor market data was optimistic and supported the Australian dollar. Nevertheless, the divergence of the directions of the monetary policy of the Fed and other world central banks supports the US dollar. This situation can also be attributed to the pair AUD / USD. If the Fed plans to raise the interest rate, the RBA intends to adhere to the current rate at least until the second half of 2018.

We are waiting for today news from the US, which will increase volatility in pairs with the US dollar, including in the pair AUD / USD. A number of important macro data will be published between 12:30 and 14:00 (GMT), among which the weekly report of the US Department of Labor, containing data on the number of initial applications for unemployment benefits. The forecast is expected to decrease to 242,000 versus 245,000 for the previous period, which should positively affect the US dollar. Also data on industrial production in the US for May and the use of production capacity will be published.

However, today and in the near future investors will still assess the results of the two-day meeting of the Fed and the increase in the interest rate in the US.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

Unlike other major currency pairs, the pair AUD / USD rose today during the Asian and European sessions, which was supported, among other things, by positive data from the Australian labor market published this morning.

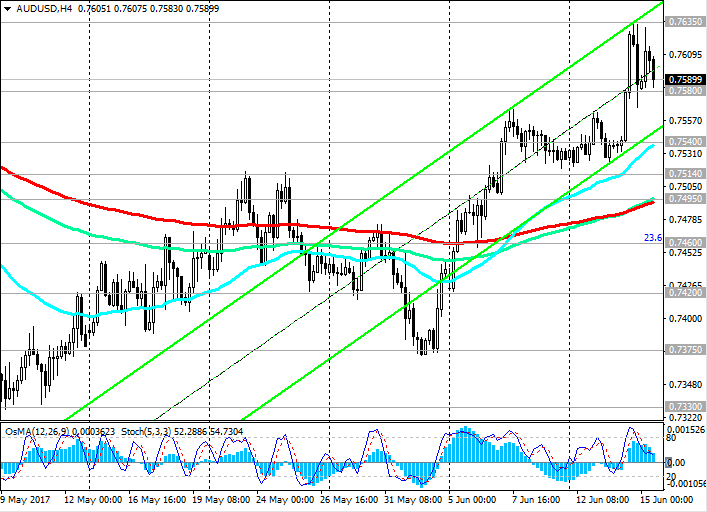

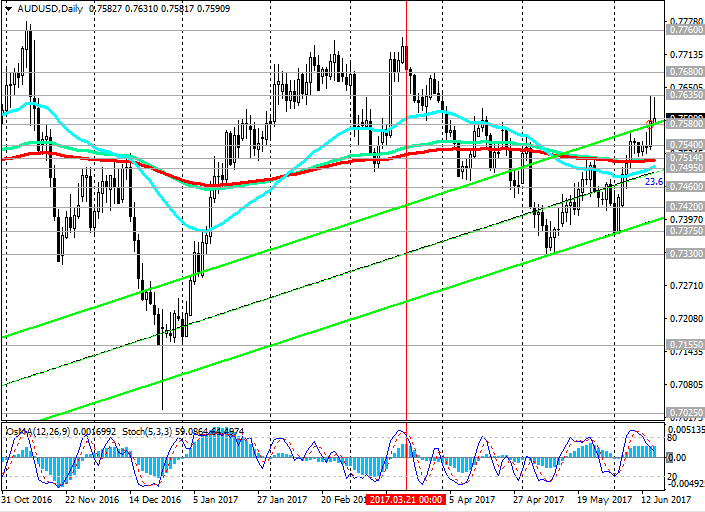

Nevertheless, it is worth paying attention to the indications of the indicators OsMA and Stochastics, which on the 1-hour, 4-hour, daily charts are deployed to short positions. On the general background of today's US dollar growth, the AUD / USD pair is likely to follow other dollar-denominated currency pairs. If in the course of the US trading session there are positive macro data on the US, it will probably become the trigger for the fall of the AUD / USD pair.

"First Swallow" will be a breakdown of the short-term support level 0.7580 (EMA50 on the 1-hour chart). The fall in the AUD / USD pair in this case may continue to the support level of 0.7540 (EMA200 on the 1-hour chart).

The breakdown of the support level of 0.7514 (EMA200 on the daily chart) will confirm the scenario for the fall of the pair AUD / USD. The closest target in case of further decline of the pair will be the levels of 0.7495 (EMA200 on the 4-hour chart), 0.7460 (Fibonacci level of 23.6%).

The following targets in case of breakdown of this support level - 0.7330 (November, May lows), 0.7155 (May, December minima of 2016). The minimum wave of the last global decline of the pair since July 2014 is close to the level of 0.6830.

If the pair AUD / USD maintains its positive dynamics, its growth will continue with the targets of 0.7635, 0.7680, 0.7760 (EMA144 on the weekly chart), 0.7840 (the Fibonacci level of 38.2% correction to the wave of the pair's decline since July 2014).

Support levels: 0.7580, 0.7540, 0.7514, 0.7495, 0.7460, 0.7445, 0.7420, 0.7375, 0.7330, 0.7300

Resistance levels: 0.7635, 0.7680, 0.7700, 0.7760

Trading Scenarios

Sell Stop 0.7570. Stop-Loss 0.7640. Take-Profit 0.7540, 0.7514, 0.7495, 0.7460, 0.7445, 0.7420, 0.7375, 0.7330, 0.7300

Buy Stop 0.7640. Stop-Loss 0.7570. Take-Profit 0.7680, 0.7700, 0.7760

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com