According to the latest data from the Fed, published yesterday at the end of the trading day, consumer credit growth in the US slowed in April and was the lowest since August 2011. Consumer lending in the US in April rose by $ 8.20 billion, thus increasing by 2.58% compared with the same period last year.

Thus, from the US continue to receive macro data with values below the forecast. Thus, the dollar significantly weakened in the foreign exchange market after the data on non-farm employment (NFP) was published last Friday, which turned out to be much worse than the forecast (+138,000 compared with April and against the forecast of +184,000).

Low inflation in the US on the back of weak growth in wages, consumers spending also significantly reduce the likelihood of a rate hike in the US more than 2 times this year.

Earlier on the part of the leaders of the Fed received signals about the readiness of the Fed to raise 3 or even 4 times the interest rates in the US this year. At the same time, most market participants expect an increase in the interest rate at a meeting of the Fed on June 13-14 with a probability of more than 90%.

Today there is a very volatile day full of important political and economic events. Thus, at 11:45 (GMT), the ECB publishes its decision on the key rate. Forecast - the rate will remain at the same level of 0%. The ECB deposit rate for commercial banks is also likely to remain unchanged at -0.4%.

Inflation in the Eurozone is below the target level of the ECB (slightly less than 2.0%), the rate of economic growth is still very weak, according to the ECB. Most likely, the head of the ECB, Mario Draghi, will once again "cool the fervor" of investors putting on the growth of the euro at a subsequent press conference, reminding that it is still "very early" to abandon the current extra soft monetary policy.

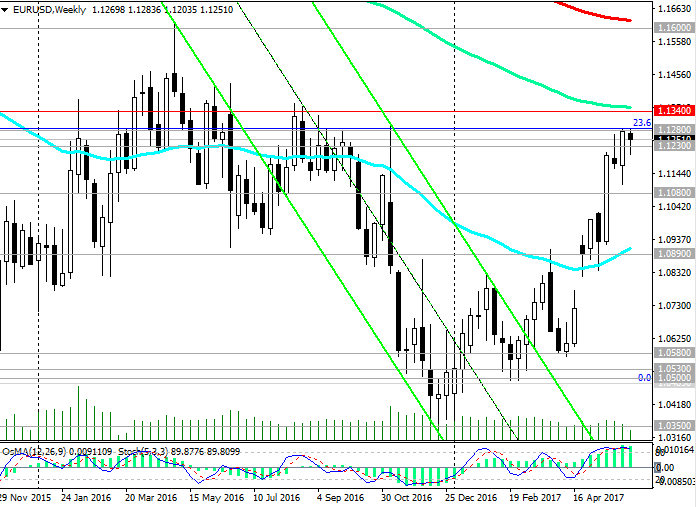

In this regard, the further growth of the EUR / USD pair above the level of 1.1280 (Fibonacci level of 23.8% of the corrective growth from the lows reached in February 2015 in the last wave of the global decline of the pair from the level of 1.3900) looks very doubtful.

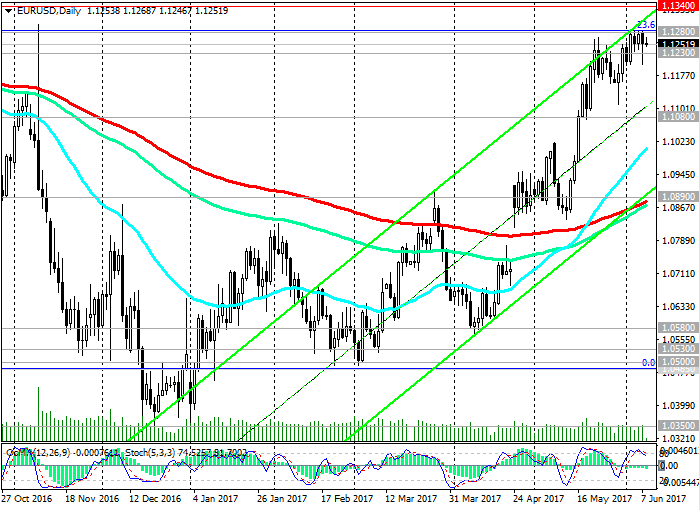

At the moment, the EUR / USD pair is trading at the top of the rising channel on the daily chart, and its positive dynamics persists. However, it is worth paying attention to the indications of technical indicators, which on the 4-hour and daily charts turned to short positions, signaling an overdue downward correction.

In case of breakdown of the short-term support level 1.1230 (200-period moving average on the 1-hour chart), the pair EUR / USD decline may continue to support level 1.1080 (200-period moving average on the 4-hour chart).

While the dollar is weak, a deeper decline in the EUR / USD pair is not expected. Only after the return to the zone below the key support level 1.0890 (200-period moving average and the bottom line of the uplink on the daily chart) can we return to consideration of short medium-term positions.

If, on the part of the ECB, only weak signals come about the possibility of considering the issue of curtailing the QE program, then the euro will strengthen sharply in the foreign exchange market.

In case of breakdown of the local maximum and the resistance level of 1.1280, the targets will be the levels of 1.1340 (144-period moving average on the weekly chart), 1.1600 (200-period moving average on the weekly chart), 1.1785 (Fibonacci level of 38.2%).

Support levels: 1.1245, 1.1230, 1.1185, 1.1155, 1.1120, 1.1100, 1.1080, 1.1000, 1.0950, 1.0890

Resistance levels: 1.1280, 1.1340, 1.1600

Trading recommendations

Sell Stop 1.1220. Stop-Loss 1.1290. Take-Profit 1.1200, 1.1185, 1.1155, 1.1120, 1.1100, 1.1020, 1.1000, 1.0950, 1.0900

Buy Stop 1.1290. Stop-Loss 1.1220. Take-Profit 1.1300, 1.1340, 1.1400, 1.1600