Against the background of the weakening of the US dollar and the rise in commodity prices, the NZD / USD pair has significantly increased over the past 1.5 weeks. Despite the growth of expectations of an increase in the interest rate in the US, the US dollar demonstrates a large-scale decline in the foreign exchange market. According to the CME Group, investors are expecting an increase in the Fed's key rate at a meeting scheduled for June 13-14 at 78.5% against 59% in mid-April. The probability of an increase in the rate in July is 80.0%, in September 86%. Nevertheless, the US dollar is losing all acquisitions since November 8, when the new US president was elected. The index of the dollar WSJ, reflecting the value of the US dollar against 16 other currencies, decreased by 0.1% to 88.60.

The NZD / USD pair also rose on the eve of the publication of forecasts for milk powder prices for the New Zealand company Fonterra, the largest dairy producer in the country. As you know, milk powder is the main export item of New Zealand. It is expected that the forecast of Fonterra for milk powder prices will rise to 6.75 US dollars per kilogram.

In addition, on Thursday (02:00 GMT), the budget of the New Zealand government is published for the fiscal year 2017-2018. It is expected that the budget will show a moderate surplus and reflect the good state of the national economy. The growth of the budget surplus and the New Zealand economy leads to an increase in expectations about the increase in the key interest rate of the central bank of New Zealand, which will positively affect the New Zealand dollar.

Nevertheless, the RBNZ stated that it will keep its stake on the same level due to the uncertainty surrounding the US economic and foreign trade policy up to Q3 2018.

If the Fed starts a gradual increase in the rate in the US, then the hours of the balance will be steadily and gradually tilt in favor of the US dollar. The difference between the monetary policies of RBNZ and the Fed will remain the main fundamental factor in favor of the US dollar in the next few months.

From the news for today, we are waiting for data from the US, which are published between 12:55 and 14:00 (GMT). Business activity indices (PMI) in the US manufacturing and service sectors for May (preliminary release) should show a slight increase (53.0 and 53.1, respectively). Also today, comments Fed representatives - Neil Kashkari and FOMC member Patrick Harker, at 13:00, 19:00 and 21:00, respectively.

At 22:45 (GMT), the main articles of New Zealand's foreign trade balance for April will be published, which is expected with a decrease in surplus (NZ $ 268 million versus NZ $ 332 million in the previous month). In this case, the New Zealand dollar may decline.

Tomorrow, the attention of traders will be focused on the publication (18:00 GMT) of the protocol from the last meeting of the committee on open market operations of the Fed ("FOMC minutes"), which may contain indications of the future of US monetary policy. Volatility, as always, is expected at this time high for all dollar pairs.

Technical analysis

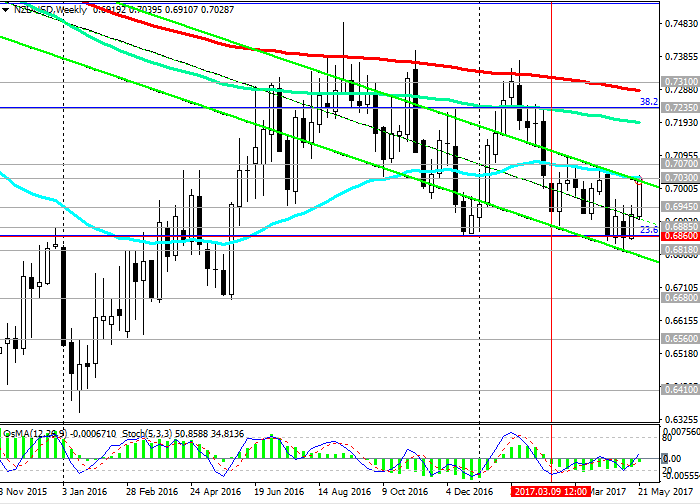

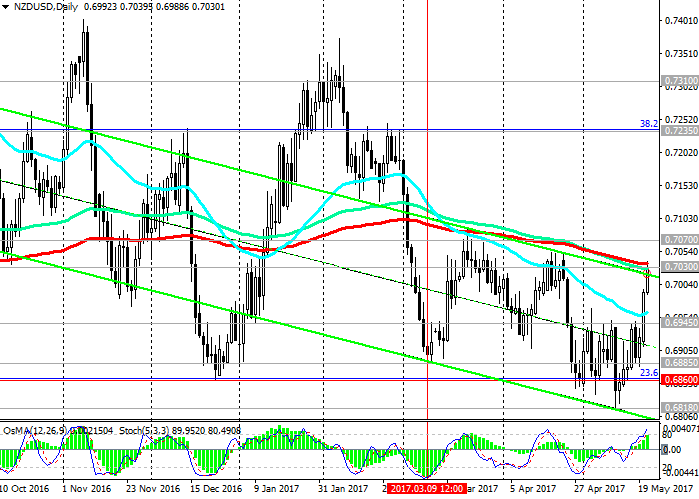

As a result of growth during the last three trading sessions, the NZD / USD pair came close to the resistance level 0.7030 (EMA200, EMA144 on the daily chart, the upper limit of the descending channel on the weekly chart). A little below this level, near the mark of 0.7000, the upper limit of the descending channel passes on the daily chart. It's not easy to pass this level to NZD / USD pair.

Only in case of fastening above the resistance level 0.7070 (EMA200 on the monthly chart) can consideration of long medium-term positions in the NZD / USD pair.

The most likely rebound from the current level of 0.7030. As the political tension in the US decreases, the US dollar will begin to recover in the foreign exchange market. In this case, the high probability of a rapid increase in the interest rate in the United States will again come to the fore, and this is a strong fundamental factor in favor of the US dollar.

The return of the pair NZD / USD under the support level 0.6945 (EMA200 on the 4-hour chart, March, April highs) will return the downward dynamics to the pair NZD / USD.

The targets will be the levels of 0.6885 (March lows), 0.6860 (the Fibonacci level of 23.6% of the upward correction to the global wave of decline of the pair from the level of 0.8800, which began in July 2014, the low of December 2016), 0.6818 (May minima and the bottom line of the downward channel on Day chart).

In case of breakdown of the support level of 0.6818, the global downtrend of the NZD / USD pair, which began in July 2014, will resume. The minima of the wave of this trend are close to the level of 0.6260, which were reached in September 2015, and from which the current upward correction began.

Support levels: 0.7000, 0.6945, 0.6900, 0.6885, 0.6860, 0.6818, 0.6800, 0.6680

Resistance levels: 0.7030, 0.7070

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics